Comcast premium subscribers began seeing Cinemax dropped from their lineup this morning, replaced with Comcast’s own premium movie network Hitz.

Comcast premium subscribers began seeing Cinemax dropped from their lineup this morning, replaced with Comcast’s own premium movie network Hitz.

The cable company announced back in May it was replacing AT&T/WarnerMedia-owned Cinemax with its own movie channel beginning this summer. Summer has arrived.

Hitz will save Comcast an undisclosed amount of money over what AT&T was charging the cable operator for the lesser-watched cousin of HBO. Cinemax was launched in 1980 to focus on movies, and so will Hitz. Comcast says its new movie channel will feature at least 200 major movie titles, all available on-demand, with fewer HBO also-rans. Linear TV viewers will see at least three versions of Hitz on their lineup, replacing five Cinemax networks. They are dubbed Hitz, Hitz2 and Hitz3. The new movie channel is included in XFINITY Premier, Super and certain other TV packages.

Cinemax fans who want the channel back will still be able to subscribe, but only on an a-la-carte basis for $12/month.

Comcast offers this FAQ:

What is Hitz?

Hitz is a new on-demand movie service that includes more than 200 titles from a variety of top studios. This selection will rotate over time.Where can I find Hitz?

The easiest way to find Hitz is by saying “Hitz” into your X1 Voice Remote. Hitz can also be found in the Networks section of the On Demand menu. You can also see current Hitz movies in the On-Screen Guide – frequently near other movie services.Why are you doing this?

Most of the movies on Cinemax also air on HBO. By offering Hitz instead, we’re delivering customers a better variety of content.How can I watch Cinemax original content?

While Cinemax is no longer included in the adjusted packages, it is still available to purchase on its own for $12 per month.Should I pay a different price now that I am no longer receiving Cinemax?

While Cinemax is no longer included in these packages, we believe the new lineup offers a better value. Most of the movies on Cinemax have also aired on HBO. By offering Hitz instead, we’re delivering a better variety of content.

Subscribe

Subscribe

But critics contend the FCC’s decision to disallow required shared use of wiring will likely deter new competitors from entering existing buildings, because of the cost of installing redundant wiring. Others object to the FCC regulating the use of wiring owned and installed independently by building owners, not telecom companies. FCC Commissioner Jessica Rosenworcel, a Democrat who voted against the pre-emption, was unimpressed.

But critics contend the FCC’s decision to disallow required shared use of wiring will likely deter new competitors from entering existing buildings, because of the cost of installing redundant wiring. Others object to the FCC regulating the use of wiring owned and installed independently by building owners, not telecom companies. FCC Commissioner Jessica Rosenworcel, a Democrat who voted against the pre-emption, was unimpressed.

Industry trade association NCTA reports that Comcast, Charter, Cox, Mediacom, Midco, Rogers (Canada), Shaw Communications (Canada), Vodafone (Europe), Taiwan Broadband Communications, Telecom Argentina, Liberty Global (Europe/Latin America) are all implementing the industry’s 10G initiative, with lab trials already underway, and field trials beginning in 2020. DOCSIS 4.0 will ultimately be a part of that project.

Industry trade association NCTA reports that Comcast, Charter, Cox, Mediacom, Midco, Rogers (Canada), Shaw Communications (Canada), Vodafone (Europe), Taiwan Broadband Communications, Telecom Argentina, Liberty Global (Europe/Latin America) are all implementing the industry’s 10G initiative, with lab trials already underway, and field trials beginning in 2020. DOCSIS 4.0 will ultimately be a part of that project. (Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

(Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

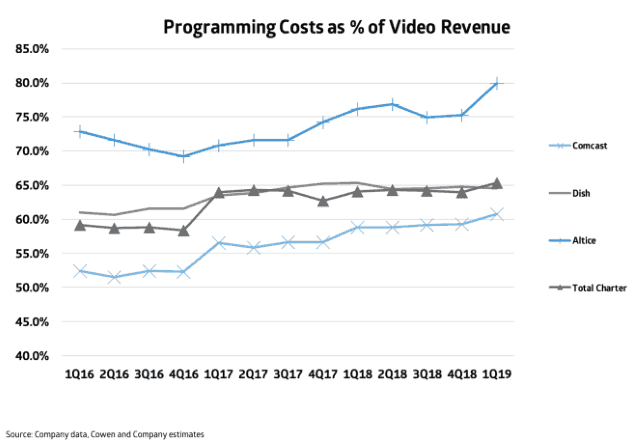

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station.

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station.