March was a big month for lobbyists visiting the Federal Communications Commission, which opened the doors to wireless special interest groups for “ex parte” meetings with agency staffers that, in turn, brief the three Republicans and two Democrats that serve as FCC commissioners.

March was a big month for lobbyists visiting the Federal Communications Commission, which opened the doors to wireless special interest groups for “ex parte” meetings with agency staffers that, in turn, brief the three Republicans and two Democrats that serve as FCC commissioners.

Last month’s ex parte filings reveal strong evidence of a coordinated, well-financed campaign by America’s wireless operators and cable companies to get the FCC to ease off regulations governing forthcoming 5G networks, particularly with respect to where tens of thousands of “small cell” antennas will be installed to deliver the service.

Four industry trade groups and companies are part of the concerted campaign to scale back third party control over where 5G infrastructure will end up. Some want to strip local governments of their power to oversee where 5G infrastructure will be placed, while others seek the elimination of laws and regulations that give everyone from historical societies to Native American tribes a say where next generation wireless infrastructure will go. The one point all four interests agree on — favoring pro-industry policies that give wireless companies the power to flood local communities with wireless infrastructure applications that come with automatic approval unless denied for “good cause” within a short window of time, regardless of how overwhelmed local governments are by the blizzard of paperwork.

Here are the big players:

The Competitive Carriers Association (CCA)

The Competitive Carriers Association (CCA)

The CCA is primarily comprised of rural, independent, and smaller wireless companies. In short, a large percentage of wireless companies not named AT&T or Verizon Wireless are members of CCA. The CCA’s chief goal is to protect the interests of their members, who lack the finances and political pull of the top two wireless companies in the U.S. CCA lobbyists met ex parte with the FCC multiple times, submitting seven filings about their March meetings.

CCA’s top priority is to get rid of what they consider burdensome regulations about where members can place cell towers and antennas. They also want a big reduction in costly environmental, tribal, and historic reviews that are often required as part of a wireless buildout application. CCA lobbyists argue that multiple interests have their hands on CCA member applications, and fees can become “exorbitant” even before some basic reviews are completed. The CCA claims there have been standoffs between competing interests creating delays and confusion.

Costs are a relevant factor for most CCA members, which operate regional or local wireless networks often in rural areas. Getting a return on capital investment in rural wireless infrastructure can  be challenging, and CCA claims unnecessary costs are curtailing additional rural expansion.

be challenging, and CCA claims unnecessary costs are curtailing additional rural expansion.

NCTA – The Internet & Television Association

The large cable industry lobbyist managed to submit eight ex parte filings with the FCC in March alone, making the NCTA one of the most prolific frequent visitors to the FCC’s headquarters in Washington.

The NCTA was there to discuss the Citizens Broadband Radio Service (CBRS) band, which is of particular interest to cable companies like Charter Communications, which wants to get into the wireless business on its own terms. Cable lobbyists, under the pretext of trying to avoid harmful interference, want to secure a large percentage of the CBRS band for their licensed use, at the expense of unlicensed consumers and their wireless industry competitors.

The cable industry wants CBRS spectrum to be wide, spacious, and contiguous for its cable industry members, which should open the door to faster speeds. The lobbyists want to make life difficult for unlicensed use of the band, potentially requiring cumbersome use regulations or costly equipment to verify a lack of interference to licensed users. They also want their traffic protected from other licensed users’ interference.

CTIA – The Wireless Association

CTIA – The Wireless Association

The wireless industry’s largest lobbying group made multiple visits to the FCC in March and filed 10 ex parte communications looking for a dramatic reduction in local zoning and placement laws for the next generation of small cells and 5G networks.

The CTIA has been arguing with tribal interests recently. Tribes want the right to review cell tower placement and the environmental impacts of new equipment and construction. The CTIA wants a sped-up process for reviewing cell tower and site applications with a strict 30-day time limit, preferably with automatic approval for any unconsidered applications after the clock runs out. Although not explicitly stated, there have been grumblings in the past that tribal interests are inserting themselves into the review process in hopes of collecting application and review fees as a new revenue source. Wireless companies frequently question whether tribal review is even appropriate for some applications.

Sprint has had frequent run-ins with tribal interests demanding several thousand dollars for each application’s review under the National Historic Preservation Act (NHPA), which is supposed to protect heritage and historical sites.

In Houston, Sprint deployed small cells around the NRG Stadium, but found itself paying fees to at least a dozen Indian Tribal Nations as part of the NHPA. The NHPA opens the door to a lot of Native Americans interests because of how the law is written. Any Tribal Nation can express an interest in a project, even when it is to be placed on public or private property that is not considered to be tribal land. In Houston, Sprint found itself paying $6,850 per small cell site, not including processing fees, which raised the cost to $7,535 per antenna location. Those fees only covered tribal reviews, not the cost of installation or equipment. Some tribes offered better deals than others. The Tonkawa Tribe has 611 remaining members, mostly in Oklahoma. But they sought and got $200 in review fees for the 23 small cell sites deployed around the stadium. The Kiowa Indian Tribe of Oklahoma, not Texas, charged $1,500 for the 23 applications it reviewed.

Sprint complains it has paid millions in such fees over the last 13 years and no tribe to date has ever asked to meet with Sprint or suggest one of its towers or cell sites would intrude on historic or tribal property.

“Tribal Nations are continuing to demand higher fees and designate larger and larger areas of interest,” says Sprint. “At present, there are no constraints on the amount of fees a Tribal Nation may require or the geographic areas for which it can require payment for review. The tribal historic review process remains in place even in situations—such as utility rights-of-way—where the Commission has exempted state historic review.”

The CTIA wants major changes to the NHPA and other regulations regarding cell tower and antenna placement before the stampede of 5G construction begins.

Verizon

Verizon

Verizon has been extremely busy visiting with the FCC during the month of March, filing 10 ex parte communications, also complaining about the tribal reviews of wireless infrastructure.

Verizon argues it wants to expand wireless service, not effectively subsidize Native American tribes.

“The draft order’s provisions to streamline tribal reviews for larger wireless broadband facilities will likewise speed broadband deployment and eliminate costs, thus freeing up resources that can, in turn, be used to deploy more facilities,” Verizon argued in one filing.

Verizon has also been carefully protecting its most recent very high frequency spectrum buyouts. It wants the FCC to force existing satellite services to share the 29.1-29.25 GHz band for 5G wireless internet. Verizon has a huge 150 MHz swath of spectrum in this band, allowing for potentially extremely high-speed wireless service, even in somewhat marginal reception areas.

“Verizon assured the commission that even when sharing with other services, we would be able to make use of the 150 MHz of spectrum in this block to provide high-speed broadband service to American consumers,” said one filing.

Subscribe

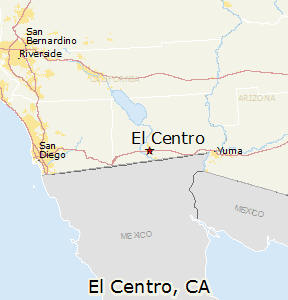

Subscribe Charter Communications is taking the city of El Centro, Calif., to federal court for interfering in a dispute between Spectrum and a local TV station owner that has resulted in two stations being blacked out on the local cable system for nearly three months.

Charter Communications is taking the city of El Centro, Calif., to federal court for interfering in a dispute between Spectrum and a local TV station owner that has resulted in two stations being blacked out on the local cable system for nearly three months. “Northwest’s pulling its authorization for Charter to carry its broadcast signals is not a ‘service interruption’ within the meaning of the City Code provisions in question,” Charter argued in its lawsuit. “Even if it were, while El Centro demands that Charter ‘cure’ its alleged violations, the only means for Charter to do so is to finalize a retransmission agreement with Northwest. The City’s citations are thus intended to pressure Charter to accept Northwest’s unreasonable terms by imposing fines and intentionally damaging Charter’s reputation and harming its goodwill and relationships with its existing and prospective customers.”

“Northwest’s pulling its authorization for Charter to carry its broadcast signals is not a ‘service interruption’ within the meaning of the City Code provisions in question,” Charter argued in its lawsuit. “Even if it were, while El Centro demands that Charter ‘cure’ its alleged violations, the only means for Charter to do so is to finalize a retransmission agreement with Northwest. The City’s citations are thus intended to pressure Charter to accept Northwest’s unreasonable terms by imposing fines and intentionally damaging Charter’s reputation and harming its goodwill and relationships with its existing and prospective customers.” “Rather than negotiating in good faith like all other parties would do and what the law requires, Charter has taken a ‘take it or leave it’ approach,” added Brady. “In an effort this week to get this back on track, Northwest submitted a new proposal to Spectrum. Spectrum’s representative communicated that they really wanted to get this resolved, but would not counter Northwest’s proposal and would not respond at all in writing. Odd behavior for a company that claims to be negotiating in good faith. It appears that Charter would rather bully a small municipality than to engage in a good faith negotiation.”

“Rather than negotiating in good faith like all other parties would do and what the law requires, Charter has taken a ‘take it or leave it’ approach,” added Brady. “In an effort this week to get this back on track, Northwest submitted a new proposal to Spectrum. Spectrum’s representative communicated that they really wanted to get this resolved, but would not counter Northwest’s proposal and would not respond at all in writing. Odd behavior for a company that claims to be negotiating in good faith. It appears that Charter would rather bully a small municipality than to engage in a good faith negotiation.” “Despite the fact the fee is itemized and justified as a pass-through, Charter did not eliminate or reduce that fee, even though it was no longer incurring costs associated with carriage of … at least two network affiliates,” Crescent City officials told the FCC.

“Despite the fact the fee is itemized and justified as a pass-through, Charter did not eliminate or reduce that fee, even though it was no longer incurring costs associated with carriage of … at least two network affiliates,” Crescent City officials told the FCC. A company is testing a solution to video subscription password abuse that will register each device authorized to access streaming video, while giving customers a Forever Login, ending the need to regularly re-enter usernames and passwords to watch.

A company is testing a solution to video subscription password abuse that will register each device authorized to access streaming video, while giving customers a Forever Login, ending the need to regularly re-enter usernames and passwords to watch. Under the new system, a customer will be permitted to register a limited number of “trusted devices” allowed access to streamed video content. A cable company, for example, could limit subscribers to two smartphones, one tablet, and one smart/internet-enabled TV or Roku box. Even if the subscriber has other devices, they would have to unregister an existing device before being allowed to register a new one. Additionally, a cable operator could limit concurrent streams to two or three, either per network or per account, regardless of what networks are being watched. That would mean, in one example, a family of four would designate a maximum of five “trusted devices” and be allowed to watch up to three concurrent streams per account. “Bill” could watch ESPN on the bedroom television, “Mary” could watch a murder-mystery on the Hallmark Channel on her tablet on the patio, and “Dylan” could watch a movie on HBO on his phone at the same time. But if “Sara” decided to watch a show on Lifetime on her phone, the system would block the request.

Under the new system, a customer will be permitted to register a limited number of “trusted devices” allowed access to streamed video content. A cable company, for example, could limit subscribers to two smartphones, one tablet, and one smart/internet-enabled TV or Roku box. Even if the subscriber has other devices, they would have to unregister an existing device before being allowed to register a new one. Additionally, a cable operator could limit concurrent streams to two or three, either per network or per account, regardless of what networks are being watched. That would mean, in one example, a family of four would designate a maximum of five “trusted devices” and be allowed to watch up to three concurrent streams per account. “Bill” could watch ESPN on the bedroom television, “Mary” could watch a murder-mystery on the Hallmark Channel on her tablet on the patio, and “Dylan” could watch a movie on HBO on his phone at the same time. But if “Sara” decided to watch a show on Lifetime on her phone, the system would block the request. But many subscribers, especially those with larger families, are likely to balk at the new restrictions, especially if cable operators offer to ease them in return for additional fees. The process of registering devices is also likely to be seen as cumbersome by those not technically proficient, as well as those who own a large assortment of electronic devices.

But many subscribers, especially those with larger families, are likely to balk at the new restrictions, especially if cable operators offer to ease them in return for additional fees. The process of registering devices is also likely to be seen as cumbersome by those not technically proficient, as well as those who own a large assortment of electronic devices.

The loss was devastating to residents, especially at the nursing home.

The loss was devastating to residents, especially at the nursing home.

Of the 64 properties he manages, Scally told Habitat fewer than a dozen have signed up for a bulk rate, and those deals were signed years ago.

Of the 64 properties he manages, Scally told Habitat fewer than a dozen have signed up for a bulk rate, and those deals were signed years ago.

Spectrum ignores her complaints, she claims, transferring her from call center to call center in search of a solution. She finally took her complaint to the FCC, something she does not think should be required after paying the company $1,600 a month for cable television.

Spectrum ignores her complaints, she claims, transferring her from call center to call center in search of a solution. She finally took her complaint to the FCC, something she does not think should be required after paying the company $1,600 a month for cable television. Charter Communications is raising rates for its dwindling number of Earthlink customers still subscribed to Earthlink’s legacy internet plans in an effort to avoid Spectrum’s entry-level $65 internet service.

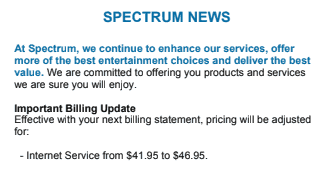

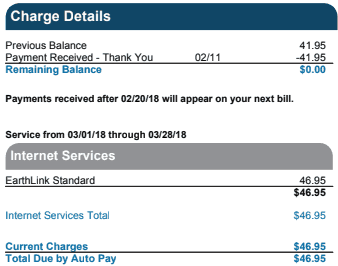

Charter Communications is raising rates for its dwindling number of Earthlink customers still subscribed to Earthlink’s legacy internet plans in an effort to avoid Spectrum’s entry-level $65 internet service. This last loophole allowed some customers to avoid switching to Spectrum’s more costly $65 entry-level 100/10 Mbps plan (200 Mbps in select areas). But now Spectrum is gradually taking away Earthlink’s price advantage. The new rate is $46.95 a month, and is likely to continue increasing in similar increments at least twice a year, until its price reaches about $60.

This last loophole allowed some customers to avoid switching to Spectrum’s more costly $65 entry-level 100/10 Mbps plan (200 Mbps in select areas). But now Spectrum is gradually taking away Earthlink’s price advantage. The new rate is $46.95 a month, and is likely to continue increasing in similar increments at least twice a year, until its price reaches about $60.