Verizon FiOS is the fastest nationwide broadband service available.

Verizon FiOS is the fastest nationwide broadband service available.

That was PC Magazine’s assessment in its ranking of the fastest Internet Service Providers of 2013. It’s not the first time Verizon FiOS has taken top honors. In fact, the fiber to the home broadband service has consistently won excellent rankings not only for its speed, but also for its value for money and quality of service. The worst thing about FiOS is that many Verizon customers cannot buy the service because its expansion was curtailed in early 2010.

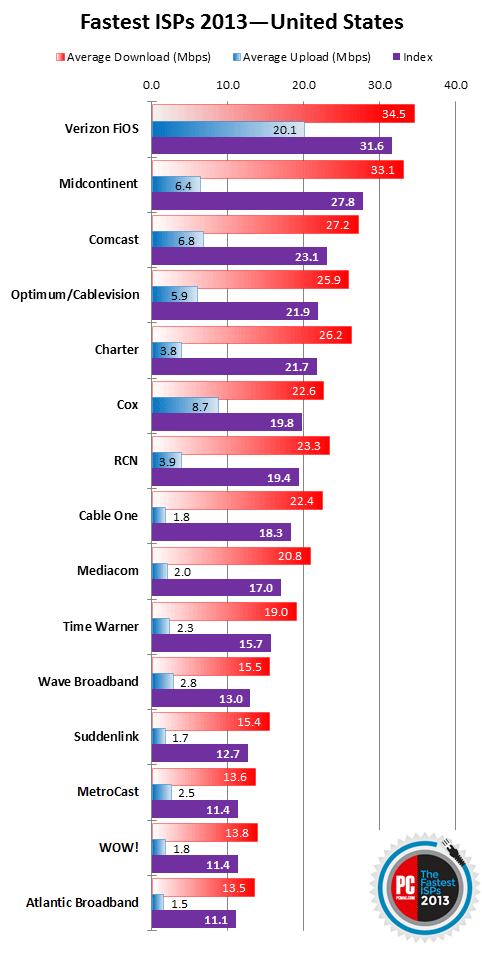

Verizon FiOS has seen its national speed rankings increase this year. In 2012, the provider’s nationwide download speeds averaged 29.4Mbps; this year FiOS average downstream speeds jumped to 34.5Mbps. Upstream speeds are also up from 26.8Mbps to 31.6Mbps. In part, this is because a growing number of customers have moved away from Verizon’s entry-level 15/5Mbps package with a $10 upgrade to Quantum FiOS 50/25Mbps service. FiOS TV customers can upgrade themselves with their remote control.

Frontier Communications made the top five in the Pacific Northwest, thanks to FiOS infrastructure the company inherited from Verizon.

Other high-ranking ISPs included Midcontinent Communications, a small cable provider serving the north-central states. Midco’s DOCSIS 3 upgrade allows the company to offer most customers up to 100Mbps service. The average download speed for Midco customers is 33.1Mbps; average upload speed is 6.4Mpbs.

Where cable operators face head-on competition from Verizon FiOS, the usual competitive response is speed increases. Cablevision is a good example. It came in fourth place nationally with average speeds of 25.9/5.9Mbps. Comcast has also been boosting speeds, especially in the northeast where it faces the most competition from fiber. It came in third place with average speeds of 27.2/6.8Mbps and offers Internet speeds up to 505Mbps in some areas.

There were companies that performed so poorly, they barely made the regional rankings. The most glaring example largely absent from PC Magazine’s awards: Time Warner Cable, which has lagged behind most cable operators in the speed department. It scored poorly for the second largest cable company in the country, beaten by Charter, Mediacom, and CableONE — which all usually perform abysmally in customer ratings. The only regional contest where Time Warner made a showing at all was in the southeast, where it lost to Verizon FiOS, Comcast, and Charter. Only TDS, an independent phone company, scored worse among the top five down south.

Even more embarrassing results turned up for AT&T U-verse, which performed so bad it did not even make the national rankings. AT&T has promised speed upgrades for customers this year, and has implemented them in several cities. Unfortunately for AT&T, its decision to deploy a fiber to the neighborhood system that still depends on copper to the home is turning out to be penny wise-pound foolish, as it continues to fall further behind its cable and fiber competitors. At the rate its competitors are boosting speeds, U-verse broadband could become as relevant as today’s telephone company ADSL service within the next five years.

Other players scoring low include WOW!, a surprising result since Consumer Reports awarded them top honors for service this year. Also stuck in the mud: Atlantic Broadband (acquired by Canada’s Cogeco Cable, which itself is no award winner), Suddenlink, Wave Broadband and Metrocast, which serves smaller communities in New Hampshire, Maine, Pennsylvania, Maryland, Virginia, Connecticut, South Carolina, Mississippi and Alabama.

The magazine also ranked the fastest U.S. cities, with top honors going to the politically important Washington, D.C., and its nearby suburb Silver Spring, Md, which took first and second place. Alexandria, Va., another D.C. suburb, turned up in eighth place. No cable or phone company wants to be caught delivering poor service to the politicians that can make life difficult for them.

Brooklyn, N.Y., took third place because of head-on competition between Cablevision and Verizon FiOS. Time Warner’s dominance in Manhattan and other boroughs dragged New York City’s speed rankings down below the top ten. Among most of the remaining top ten cities, the most common reason those cities made the list was Verizon FiOS. Florida’s Gulf Coast communities of Bradenton (4th place) and Tampa (6th place) have fiber service. So does Plano, Tex. (5th place) and Long Beach, Calif. (7th place). The other contenders: Hollywood, Fla. takes ninth place and Chandler, Ariz. rounds out the top 10.

Subscribe

Subscribe

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey.

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey. Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.

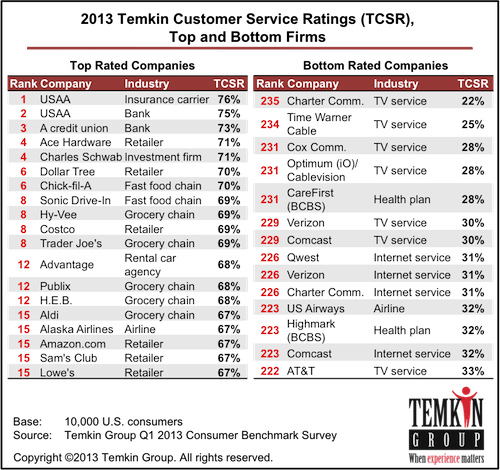

Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming. Nine of the ten lowest ranked firms in America are cable and telephone companies, according to a

Nine of the ten lowest ranked firms in America are cable and telephone companies, according to a

John Malone’s power play for a Charter Communications’ takeover of Time Warner Cable would leave the nation’s second largest cable operator $60 billion in debt and has already cost creditors holding Time Warner Cable bonds $1.8 billion in value as markets react to the rumors of a leveraged buyout.

John Malone’s power play for a Charter Communications’ takeover of Time Warner Cable would leave the nation’s second largest cable operator $60 billion in debt and has already cost creditors holding Time Warner Cable bonds $1.8 billion in value as markets react to the rumors of a leveraged buyout.