For years, cable operators have denied they have a problem.

But new evidence suggests Americans are cutting back on their cable television habit as prices continue to rise and alternatives become available.

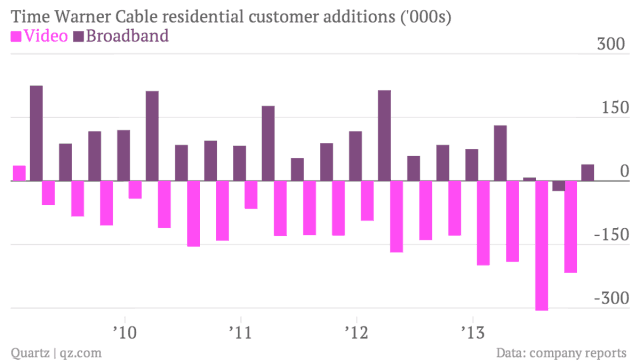

One of the worst affected by cable cord cutters is Time Warner Cable, which has been consistently losing video customers month after month since 2009:

Disputes with programmers and competition from satellite and telephone companies may not be enough to explain away the trend of subscriber losses. It also does not explain why Americans under 35 are increasingly unlikely to sign up for cable television at all.

Cable cord cutting — fact or fiction?

Nonsense, replies Bloomberg opinion columnist Matthew C. Klein:

It is tempting to think that the declining number of subscribers at the U.S.’s biggest cable-television companies is a symptom of the industry’s malaise as it slowly slides into obsolescence. Don’t buy it. The losses are accounted for in the gains by smaller and nimbler rivals.

[…] The customers who have been abandoning Comcast and Time Warner Cable in droves haven’t given up on paid TV content, however. Focusing on the travails of the biggest cable companies obscures the reality that, according to Bloomberg Industries, the total number of pay-TV subscribers is slightly higher now than it was at the end of 2008 and that there were probably more people paying for television subscriptions at the end of 2013 than at the end of 2012.

To the extent that individual company results tell us anything, it could be about where Americans are moving, or the relative quality of service offered by the various companies. In the 12 months ended Dec. 31, AT&T Inc. added 924,000 subscribers to its U-verse TV service, while Verizon Communications Inc. added 536,000 subscribers to its FiOS TV service. Since the end of 2008, the two companies best known for their wireless services have added about 8 million pay-TV subscribers — far more than Time Warner Cable and Comcast have lost.

Klein’s views mirror those of many cable industry executives who blame the economy for deteriorating cable television subscriber numbers. Many suggest multi-generational households are responsible — stay at home kids and older parents are sharing a single cable television subscription. Others claim discretionary income is squeezing some to downgrade, but not cancel, cable television service.

Klein’s accounting does not tell the entire story. Competition from telephone companies, especially AT&T’s U-verse, is not as pervasive against Time Warner Cable and Comcast as Klein suggests. In fact, Charter Communications is among the cable companies facing the biggest onslaught of competition from AT&T. U-verse has picked up many of its newest subscribers not because of a sudden urge to switch, but rather because the service has only just become available in several new markets as a result of AT&T’s expansion effort. Verizon FiOS is still slowly expanding within its current franchise areas as well. Neither Comcast or Time Warner Cable consider either service much of a serious competitive threat.

AT&T U-verse, the larger of the two telephone company services, has a TV penetration rate of just 21 percent of customer locations. FiOS, which serves a smaller customer base, has a 35 percent penetration rate for television. Cable remains dominant for now, even as it loses subscribers and market share.

Another way to measure cord cutting is to look at the subscriber numbers of major basic cable networks that are most likely to be a part of any channel lineup. ESPN, for example, lost around 1.5 million subscribers between September 2011 and September 2013. Most of that loss came from cord cutting or downgrades to tiers like “Broadcast Basic,” consisting mostly of local television stations. ESPN’s numbers include all pay television platforms — satellite, telco TV, and cable.

In spite of the subscriber losses, cable industry profits remain healthy. Revenue growth these days comes from broadband service and rate increases.

Subscribe

Subscribe

Montana is among the bottom three states for Internet broadband performance and the state can partly blame Charter Communications for its poor service.

Montana is among the bottom three states for Internet broadband performance and the state can partly blame Charter Communications for its poor service. “The future is a ring, a community ring connecting around the community that allows data to be transmitted both internally and externally,” said Fontenot.

“The future is a ring, a community ring connecting around the community that allows data to be transmitted both internally and externally,” said Fontenot. Comcast Corporation and Charter Communications are actively working on a deal to let Comcast acquire Time Warner Cable subscribers in New York, New England, and North Carolina, according to sources

Comcast Corporation and Charter Communications are actively working on a deal to let Comcast acquire Time Warner Cable subscribers in New York, New England, and North Carolina, according to sources  Comcast’s involvement in the deal could inject much-needed cash into a takeover bid financed largely by debt. It might also prompt Charter to sweeten its offer for TWC.

Comcast’s involvement in the deal could inject much-needed cash into a takeover bid financed largely by debt. It might also prompt Charter to sweeten its offer for TWC.