After years of increasing costs for video programming, the disadvantages of not being large enough to qualify for lucrative volume discounts, and a declining customer base, a Montana cooperative says it is calling it quits on cable television service later this year to focus on its broadband business.

After years of increasing costs for video programming, the disadvantages of not being large enough to qualify for lucrative volume discounts, and a declining customer base, a Montana cooperative says it is calling it quits on cable television service later this year to focus on its broadband business.

3 Rivers Communications, a rural telecommunications cooperative based in Fairfield, Mont., this week announced it was discontinuing television service on Oct. 31, 2019, inviting its members to choose a streaming TV provider (DirecTV Now, YouTube TV, etc.) instead.

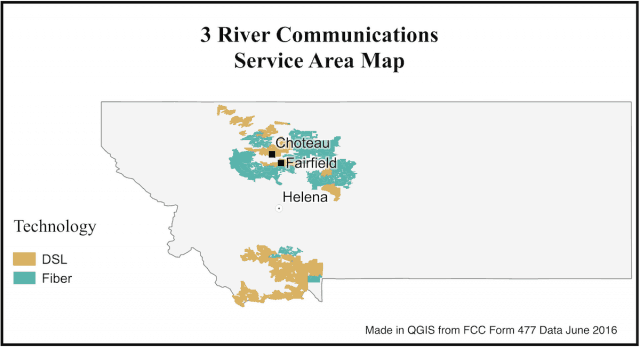

The co-op serves 15,000 customers across two significant service areas in Montana. Only 1,800 still subscribe to cable television service — a number that has dropped steadily since the introduction of streaming TV alternatives. Most cable networks and local stations charge a sliding scale fee to carry their programming, with substantial volume discounts offered exclusively to large providers like Comcast, Charter, AT&T, DirecTV and Dish Networks. Small, independent companies are at a disadvantage because they must charge substantially more to cover their higher wholesale costs. Many have attempted to mitigate these high fees by pooling resources and buying programming through a national cooperative, but even that arrangement cannot keep costs low enough to prevent subscribers from canceling service after each rate increase.

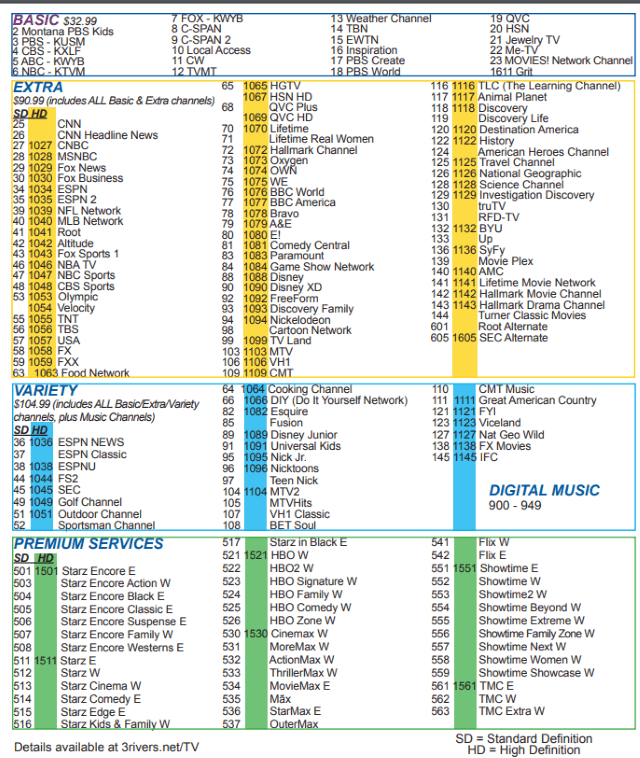

Local TV station rate inflation, along with sports programming price hikes, have made offering cable television untenable for a growing number of small cable operators. As an example, 3 Rivers customers in Big Sky pay $32.99 for a basic cable TV package of 23 channels, including C-SPAN, Local Access, three religious networks, three home shopping channels, and around a half-dozen digital multicast TV networks. A comprehensive digital cable TV package costs $104.99 a month, just for television.

The 3 Rivers Communications television lineup for Big Sky, Mont.

In the last ten years, 3 Rivers has been focused on expanding its fiber to the home network, now reaching 65% of its customers. But the costs to provide service in rural Montana remain high, and internet packages remain costly. A 10 Mbps unlimited internet account costs $74.95/mo, 20 Mbps costs $94.95/mo, and 30 Mbps costs $114.95 (add around $10/mo for voice service). Offering television service originally boosted the average revenue received from each subscriber, but now that costs have skyrocketed, 3 Rivers now feels it should focus its investments on better broadband service.

“With all the new streaming options available, [including] Netflix and Hulu and Amazon Prime, in addition to traditional satellite providers like Dish and DirecTV, we just can’t really compete anymore,” 3 Rivers marketing director Don Serido told KRTV News. “We’re getting out of the TV business and we’re really going to focus on providing the best broadband we can to all of our cooperative members. That’s really what people want and need.”

“With all the new streaming options available, [including] Netflix and Hulu and Amazon Prime, in addition to traditional satellite providers like Dish and DirecTV, we just can’t really compete anymore,” 3 Rivers marketing director Don Serido told KRTV News. “We’re getting out of the TV business and we’re really going to focus on providing the best broadband we can to all of our cooperative members. That’s really what people want and need.”

Serido also said the company’s lack of support for pay-per-view and on demand programming also hurt its TV business. As a convenience to members, 3 Rivers is waiving all early termination fees and will continue to honor its promotional agreements until service is ended on Oct. 31.

The biggest impact will likely be felt by Montana TV stations that will lose retransmission consent revenue from 3 Rivers. Only a handful of streaming providers offer TV stations from the Great Falls market, forcing many cord-cutters to depend on on-demand viewing from services like Hulu and over-the-air antennas to pick up local stations.

As a member-owned cooperative, 3 Rivers returns all of its profits to members through capital credits. At the end of each fiscal year, the cooperative allocates a percentage of the margins to each patron on a pro-rata basis according to the total amount paid or produced for services. These allocations to patrons are known as capital credits. Upon approval of the Board of Trustees, these allocations are refunded to cooperative patrons. As a result, 3 Rivers has no incentive to overcharge its customers. Instead, it often invests its funds in improving service for its customers. When the cooperative was formed in 1953, it was the only provider of telephone service in north-central Montana. It has offered internet service for the last 20 years, with television only becoming a part of its menu of offerings a decade ago.

3 Rivers Communications will get out of the cable television business this fall, reports KRTV News in Great Falls, Mont. (1:05)

Subscribe

Subscribe WASHINGTON (Reuters) – The U.S. Supreme Court on Monday agreed to hear cable television operator Comcast Corp’s bid to throw out comedian and producer Byron Allen’s racial bias lawsuit accusing the company of discriminating against black-owned channels.

WASHINGTON (Reuters) – The U.S. Supreme Court on Monday agreed to hear cable television operator Comcast Corp’s bid to throw out comedian and producer Byron Allen’s racial bias lawsuit accusing the company of discriminating against black-owned channels.

The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.

The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.

Comcast has begun gradually rolling out

Comcast has begun gradually rolling out