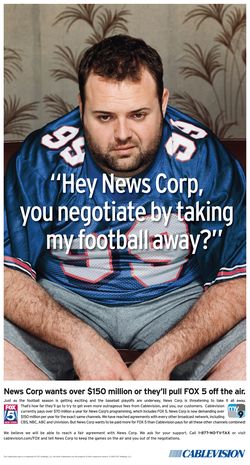

Cablevision and Fox finally settled their two week programming dispute Saturday when two local Fox-owned broadcasters and an assortment of cable channels returned to suburban New York area-television screens. Cablevision ultimately capitulated to Fox’s increased programming fees and grumbled it was stuck paying an “unfair price” for the programming.

“In the absence of any meaningful action from the FCC, Cablevision has agreed to pay Fox an unfair price for multiple channels of its programming including many in which our customers have little or no interest,” Cablevision said, adding that it “conceded because it does not think its customers should any longer be denied the Fox programs they wish to see.”

But in reality, Cablevision subscribers who suffered through the two week outage will ultimately pay the price for Fox-owned programming in the next round of cable company rate increases.

While Cablevision subscribers can now watch the remaining games of the World Series from home, the cable-broadband industry post-game wrap-up show is now underway, surveying the winners and losers.

Let’s take a look:

WINNER: Fox Networks

Fox got everything it wanted, and then some, from Cablevision. Consumers never take the side of the cable companies that have overcharged them for years. All most know is that when their favorite channels are not on the cable system that charges them more than $50 a month for service, it’s the cable company’s fault. While the terms of the final deal were not disclosed, it’s a safe bet Cablevision is paying rates even higher than those charged to New York’s other cable company Time Warner Cable. The cave-in by Cablevision means Time Warner and other cable systems will likely also see higher rates for Fox programming now set as a precedent by Cablevision. So will telco and satellite TV providers. That’s money Fox will take to the bank.

LOSER: Cablevision

Not only did they alienate their customers, at one point telling them to watch Fox programming on third party websites, they are now facing a $450 million class action lawsuit from subscribers (filed by an attorney with prior connections to Fox parent company News Corporation.) It is difficult to feel sympathy for a cable company deprived of Fox programming that still charged subscribers full price for channels they could not watch. One industry executive praised Cablevision for “taking one for the team,” a phrase consumers have heard before to defend corporate pickpocketing.

WINNER: ivi Networks

Stop the Cap! reported on upstart ivi several weeks back. The service carries all of metropolitan New York’s broadcast stations and Cablevision ended up recommending its blacked-out subscribers buy an ivi subscription to watch Fox-owned broadcast channels no longer on the cable lineup. The new online cable system, which started in September, added New York subscribers in droves, annoying Fox to the point of sending a cease-and-desist letter to Cablevision CEO James Dolan to get cable company representatives to stop recommending the service, which Fox claims is “illegal, and perhaps criminal.”

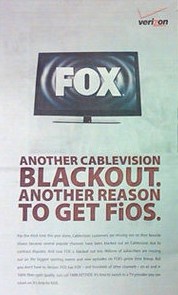

WINNER: Verizon & Satellite Dish Companies

Many subscribers fleeing Cablevision for competitors have probably left for good, especially if they scored substantial discounts and promotions during their first year or two of service. Verizon FiOS always faced resistance from customers not wanting to devote the time needed to install the service, and when customers have been with a cable company for 20 or more years, change does not come easy. But die-hard sports fans already inconvenienced by earlier channel interruptions pulled the trigger just to get away from the endless programming disputes.

LOSER: Comcast-NBC Merger

Lawmakers set to either applaud or introduce roadblocks to the proposed merger between Comcast and NBC saw first hand what can happen when big media companies duel it out over money — millions of customers can be left in the middle with nothing to show for it. Bloomberg reports the dispute could force significant concessions to prevent or limit such disputes in the future. U.S. Representative Maxine Waters, a California Democrat, said the Fox-Cablevision spat made her “increasingly concerned with the potential harm” if a dispute arose between an enlarged Comcast and competing video provider. In a letter to FCC Chairman Julius Genachowski last week, she called for “substantive and enforceable conditions” to preserve competition.

WINNER: NFL Networks – Where is Our Binding Arbitration?

Cablevision’s demands for binding arbitration to settle their disputes with Fox rang hollow, if not hypocritical, for NFL Network officials, who have been calling on Cablevision for the same binding arbitration the cable operator demanded of Fox. The NY Post quoted an unnamed executive at the cable network: “Cablevision has been urging Fox to agree to binding arbitration — the same strategy we’ve been offering Cablevision — but we continue to get sacked.”

LOSER: The Federal Communications Commission

Despite demands from most consumer groups and Cablevision to intervene in the programming disputes, the FCC delivered a rebuke telling all sides to stop with the stunts and start with serious negotiations. Beyond that, the agency did what it has done best under the Obama Administration: sit on its hands.

THE BIGGEST LOSER: You

With the grandstanding by both sides finally over Saturday — the shouting and expensive publicity campaigns wrapped up and put away for next time (KeepFoxOn.com now renders a blank page) — the person left standing with the bill in hand was you. Fox wrapped the costs of its expensive publicity campaign into the rate increase Cablevision finally conceded to paying. The bags of money to be handed from the Dolan family that owns Cablevision over to Rupert Murdoch will be filled from your pockets. And there is no end in sight to future disputes raising programming costs even higher than ever.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Bloomberg Cablevision Fox Dispute 11-1-10.flv[/flv]

Bloomberg News delivers three reports detailing the impact of increased programming costs on cable bills, inaction by the FCC, and whether Americans are fleeing cable TV for online video instead. (10 minutes)

Subscribe

Subscribe