In a move that clearly signals cord-cutting is taking a toll on Spectrum cable television, Charter Communications today unveiled a new streaming TV service priced to compete with “over the top (OTT)” streaming services like YouTube TV and DirecTV Now.

In a move that clearly signals cord-cutting is taking a toll on Spectrum cable television, Charter Communications today unveiled a new streaming TV service priced to compete with “over the top (OTT)” streaming services like YouTube TV and DirecTV Now.

“Spectrum TV Essentials” will offer a package of 60 national cable networks for $14.99 a month, when the streaming service debuts in March. The lineup avoids costly cable channels focused on sports and will include no local channels.

“Spectrum TV Essentials is a OTT offering designed to provide Spectrum internet-only customers a new low-price, high-value video option,” said Charter CEO Tom Rutledge. “As we began to assemble the rights for this new video service, we received great enthusiasm and encouragement from these key programming partners, who share our view and embrace creating an innovative video offering we believe will resonate with our internet customers.”

Remarkably, one of Charter’s first programming partners for the newest slimmed-down cable TV package is Viacom, notorious for its bouquet of high-priced cable networks. Viacom has been so insistent on regular rate increases and forced bundling of multiple Viacom-owned cable networks, some cable systems like Cable One dropped all Viacom networks from their lineups just a few years ago.

A management change at Viacom apparently included a new willingness to combat cord-cutting.

A management change at Viacom apparently included a new willingness to combat cord-cutting.

“Viacom shared its strong belief and research that suggests there is a large untapped opportunity for a low-priced, entertainment-only bundle unencumbered by the high cost of broadcast retransmission consent fees and expensive sports programming,” Rutledge noted.

The 60-channel lineup is heavy on content from Discovery Networks, Viacom, Hallmark, and AMC. News junkies will be unhappy to find CNN, MSNBC, and Fox News are not on the lineup, although lesser-watched BBC World News, Bloomberg, and NewsmaxTV are there.

The full lineup:

The full lineup:

A&E, AMC, American Heroes Channel, Animal Planet, AXS TV, BBC America, BBC World News, BET, BET Her, BET Jams, BET Soul, Bloomberg, Cheddar, CLEO TV, CMT, CMT Music, Comedy Central, Cooking Channel, Destination America, Discovery, Discovery Family, Discovery Life, DIY, Food Network, FYI, Game Show Network, Hallmark Channel, Hallmark Drama, Hallmark Movies & Mysteries, HDNet Movies, HGTV, HISTORY, IFC, Investigation Discovery, Lifetime, Lifetime Movie Network, Logo, MotorTrend Network, MTV, MTV2, MTV Classic, MTV Live, MTVU, NewsmaxTV, Newsy, Nickelodeon, Nick Jr., Nick Music, NickToons, Outdoor Channel, OWN, Paramount Network, Science Channel, Sundance TV, Teen Nick, TLC, Travel Channel, TV Land, VH1, Viceland, The Weather Channel and WEtv.

There will be no DVR option at launch, but Charter is reportedly testing cloud DVR technology for introduction later.

“We’re thrilled to expand and deepen our relationship with Charter. They share both our commitment to the evolution of the the Pay TV ecosystem as well as our understanding of the changing needs of consumers,” said Bob Bakish, Viacom CEO. “As the video marketplace continues to segment across price points and offerings, we believe a high quality, lower priced option for internet-only subscribers is very important. We’re excited to have our global brands as part of Spectrum TV Essentials at launch.”

Access will initially be available on the desktop through SpectrumTV.com and Spectrum’s Roku app. The service will also be available on iOS and Android phones and tablets, Apple TV, Xbox One, Amazon Kindle Fire, and Samsung Smart TVs.

Subscribe

Subscribe YouTube TV customers attracted by unlimited storage DVR service are now discovering their recorded shows have been temporarily replaced with an on-demand version loaded with unskippable advertising.

YouTube TV customers attracted by unlimited storage DVR service are now discovering their recorded shows have been temporarily replaced with an on-demand version loaded with unskippable advertising.

But in reality, because of YouTube’s own desire to increase advertising revenue and thanks to agreements with certain programmers, DVR service is becoming more restricted on current shows, and a growing number of older titles airing on cable networks are likely to see mandatory ads creep in as well as YouTube starts selling ad time itself.

But in reality, because of YouTube’s own desire to increase advertising revenue and thanks to agreements with certain programmers, DVR service is becoming more restricted on current shows, and a growing number of older titles airing on cable networks are likely to see mandatory ads creep in as well as YouTube starts selling ad time itself.

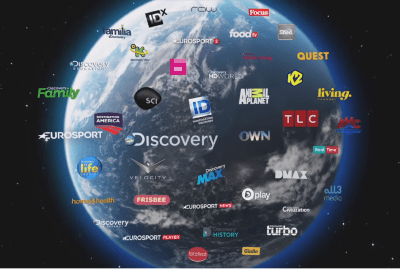

As Discovery Communications completes its $11.9 billion acquisition of Scripps Networks Interactive Inc., the newly supersized basic cable network powerhouse will lay the foundation to launch

As Discovery Communications completes its $11.9 billion acquisition of Scripps Networks Interactive Inc., the newly supersized basic cable network powerhouse will lay the foundation to launch  Fox Networks will cut advertising to just two minutes per hour by the year 2020, according to its ad sales chief.

Fox Networks will cut advertising to just two minutes per hour by the year 2020, according to its ad sales chief.