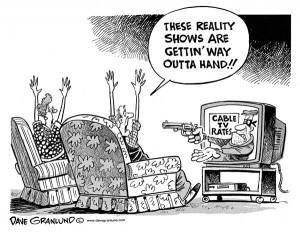

Time Warner Cable believes it has room to raise broadband prices and get away with it without much customer backlash.

Time Warner Cable believes it has room to raise broadband prices and get away with it without much customer backlash.

The cable company’s chief financial officer, Arthur Minson, raised the prospect of more price hikes at Tuesday’s Goldman Sachs 22nd Annual Communacopia Conference.

“Look, the modem [fee] was really just a form of a High Speed Data rate increase,” Minson said, referring to the company’s introduction of a $4 cable modem rental fee last fall and a later increase to around $6 a month introduced this summer. “I do see an ability for us to continue to have ARPU increases on that product.”

“ARPU” refers to the Average Revenue Per User — a term that reflects what companies earn in revenue divided by the number of customers. In most cases, an ARPU increase comes from price hikes or customers subscribing to additional value-added services.

Minson

Minson suggested that the company’s gradual rollout of optional usage-based pricing tiers provides an alternative for price-sensitive customers that cannot afford rate increases on flat-rate service or are seeking a price reduction.

“I think we’re very pleased with where we are in the usage-based pricing front and I think that’s something we will continue,” Minson concluded. “I think over time it will be interesting to see how many people ultimately take the usage-based pricing, or will people say I just want to have unlimited and I think the market will speak on that.”

Time Warner Cable has focused investment on several fronts this year, and plans continued investments to expand offerings in these key areas:

- Business broadband expansion. Some of the company’s biggest investments target wiring businesses and office parks for cable service, primarily to expand commercial broadband. “Commercial services is success-based capital that we see real meaningful returns on,” Minson said.

- Wi-Fi expansion. Time Warner Cable will continue expanding Wi-Fi hotspots in select cities. Customers with Standard (15/1Mbps) service or above can use the service for free. Minson said that the company was very happy to offer customers subscribed to unlimited use tiers free access to Wi-Fi. Not so for those choosing usage-based pricing plans. They will have to upgrade to an unlimited plan to get free access. “That’s a real incentive to drive people into the higher tiers,” Minson noted.

- DOCSIS 3.1. Time Warner plans to adopt and invest in DOCSIS 3.1 cable modem technology when it is officially released. DOCSIS 3.1 will offer more efficient broadband transport and will let companies offer even faster speeds. Minson noted that broadband is increasingly the company’s anchor product, so it will continue investments accordingly.

Customers looking for aggressive pricing won’t find much at Time Warner Cable. Minson noted the company will continue its year-long pullback on low-priced promotions.

“We have a $79 bundle out in the marketplace and you would say okay, that sounds similar to the offer in the marketplace last year,” Minson said. “It may be similar but in terms of what you get for that $79 it is very different from what we gave a year ago and what we have now is the ability to meaningfully up sell the customers from the beacon price.”

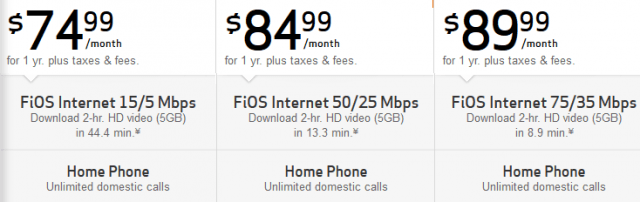

A year ago, Time Warner Cable didn’t have a modem rental fee and typically bundled its Standard tier Internet service in its promotional packages. A traditional triple-play package of phone, cable TV and Internet service starts at $89 today, but only includes 3Mbps broadband, doesn’t bundle DVR service, and doesn’t include a mandatory set-top box which now costs a minimum of $8.99 a month each. Combining the modem fee with the mandatory box charge raises the promotional price to $104.97 a month.

- Upgrading to Standard 15/1Mbps service costs an extra $10 a month.

- Adding a DVR? That costs an additional $21.94 a month.

- The “whole house” DVR package is now priced at $37.47 a month.

- Time Warner Cable has also recently increased the price of premium movie channels to a uniform $15.95 each for HBO, Cinemax, Showtime, and Starz.

Taking into account these popular upsold add-ons, the promotional price of $79-89 might be seen as bait and switch by some customers. The true cost for most choosing a triple play package including cable TV with DVR service, one set-top box, a Time Warner-supplied cable modem, and a speed upgrade to 15/1Mbps service is $127.92 a month before taxes and fees.

Taking into account these popular upsold add-ons, the promotional price of $79-89 might be seen as bait and switch by some customers. The true cost for most choosing a triple play package including cable TV with DVR service, one set-top box, a Time Warner-supplied cable modem, and a speed upgrade to 15/1Mbps service is $127.92 a month before taxes and fees.

Customers unhappy with their cable bill who call to complain are now routed to specially trained retention operators, Minson said.

“We’ve taken about a 1,000 dedicated employees and focused them on retention and even within those centers there are areas of expertise,” Minson said. “For our Spanish language customers we have retention centers set-up to help them when they call in. For people who are coming off a promotional offer, we have dedicated reps who can deal with that group of customers. So it’s having a deeper set of expertise in those areas and the returns so far are well within our expectations and we are really pleased with how it’s going.”

Subscribe

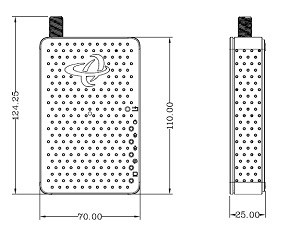

Subscribe As the cable industry seeks new revenue from the adoption of growing cable modem rental fees, one vendor has

As the cable industry seeks new revenue from the adoption of growing cable modem rental fees, one vendor has

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after.

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after. That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies.

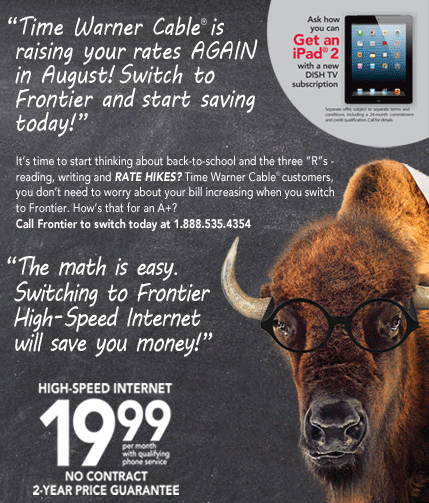

That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies. Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers.

Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers. In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.

In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.