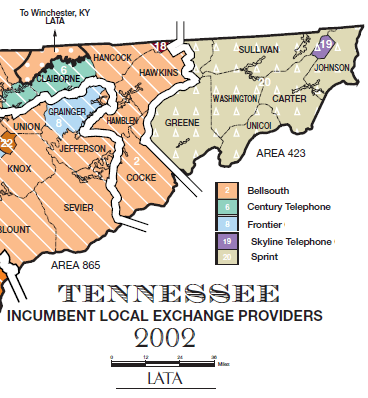

Cable One is unique among America’s top-10 large cable system owners for its nearly incomprehensible broadband usage policies, only fully disclosed to customers after they sign up for service.

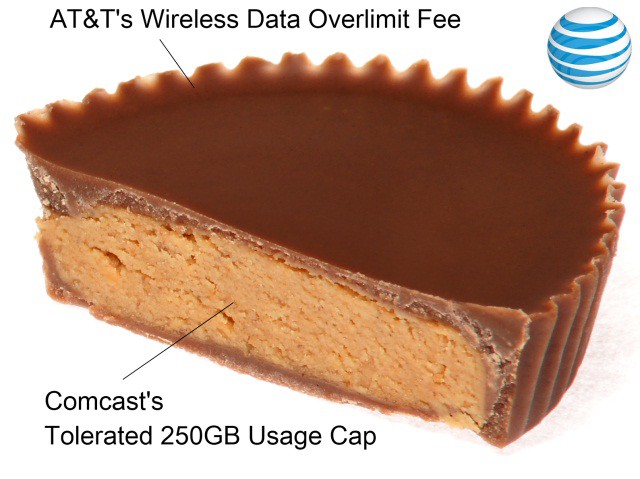

The cable company, owned by the owners of the Washington Post, have been tinkering with their broadband pricing and Internet Overcharging schemes as they embark on upgrades to DOCSIS 3 broadband service. The result: faster broadband service priced like a cell phone plan.

Currently, Cable One controls usage of their customers with a daily usage ration coupled with a speed throttle. For customers, it means keeping track of usage, time of day, and whether you are in the over-usage doghouse with speeds cut in half.

Stop the Cap! went through the sign-up procedure offered online at the Cable One website, suggesting we were new customers in the Anniston, Alabama area. While the company is quick to disclose speeds and plan features, it takes some deep wading through an Acceptable Use Policy for new customers to unearth the company’s extensive and complicated limits on broadband usage. The company doesn’t even like to disclose they are throttling your speeds in half as a punishment. Instead they refer to them as ‘Standard Speeds’:

Standard & Extended Speeds: Residential

| Plan Speeds | Download | 1.5 Mb | 3.0 Mb | 5.0 Mb | 8.0 Mb | 10.0 Mb | 12.0 Mb |

| Upload | 150 Kb | 300 Kb | 500 Kb | 500 Kb | 1000 Kb | 1500 Kb | |

| Standard Speeds | Download Speed (+/-) | 1500 kbps | 1500 kbps | 2500 kbps | 4000 kbps | 5000 kbps | 6000 kbps |

| Upload Speed (+/-) | 150 kbps | 150 kbps | 250 kbps | 250 kbps | 500 kbps | 750 kbps | |

| Extended Speeds | Download Speed (+/-) | 1500 kbps | 3000 kbps | 5000 kbps | 8000 kbps | 10000 kbps | 12000 kbps |

| Upload Speed (+/-) | 150 kbps | 300 kbps | 500 kbps | 500 kbps | 1000 kbps | 1500 kbps |

Standard & Extended Speeds: Business

| Plan Speeds | Download | 5.0 Mb | 10.0 Mb | 12.0 Mb | 15.0 Mb | 20.0 Mb |

| Upload | 1.0 Mb | 1.0 Mb | 1.5 Mb | 2.0 Mb | 2.5 Mb | |

| Standard Speeds | Download Speed (+/-) | 2500 kbps | 5000 kbps | 6000 kbps | 7500 kbps | 10000 kbps |

| Upload Speed (+/-) | 500 kbps | 500 kbps | 750 kbps | 1000 kbps | 1250 kbps | |

| Extended Speeds | Download Speed (+/-) | 5000 kbps | 10000 kbps | 12000 kbps | 15000 kbps | 20000 kbps |

| Upload Speed (+/-) | 1000 kbps | 1000 kbps | 1500 kbps | 2000 kbps | 2500 kbps |

Threshold Limits: Residential

| Plan Speeds | 1.5 Mb Download | 3.0 Mb Download | 5.0 Mb Download | 8.0 Mb Download | 10.0 Mb Download | 12.0 Mb Download |

| 150 Kb Upload | 300 Kb Upload | 500 Kb Upload | 500 Kb Upload | 1000 Kb Upload | 1500 Kb Upload | |

| Period of Measurement | No Measurement | 12 p.m. – 12 a.m. (Noon to Midnight) |

12 p.m. – 12 a.m. (Noon to Midnight) |

12 p.m. – 12 a.m. (Noon to Midnight) |

12 p.m. – 12 a.m. (Noon to Midnight) |

12 p.m. – 12 a.m. (Noon to Midnight) |

| Max Threshold Bytes Downstream During Period of Measurement |

N/A | 1,400 MB | 2,250 MB | 3,600 MB | 4,500 MB | 11,000 MB |

| Max Threshold Bytes Upstream During Period of Measurement |

N/A | 140 MB | 225 MB | 225 MB | 450 MB | 1,380 MB |

| Period at Standard Speed | N/A | 4 p.m to Midnight | 4 p.m to Midnight | 4 p.m to Midnight | 4 p.m to Midnight | 4 p.m to Midnight |

Threshold Limits: Business

| Plan Speeds | 5.0 Mb Download | 10.0 Mb Download | 12.0 Mb Download | 15.0 Mb Download | 20.0 Mb Download |

| 1.0 Mb Upload | 1.0 Mb Upload | 1.5 Mb Upload | 2.0 Mb Upload | 2.5 Mb Upload | |

| Period of Measurement | 2 p.m. – 12 a.m. (midnight) |

2 p.m. – 12 a.m. (midnight) |

2 p.m. – 12 a.m. (midnight) |

2 p.m. – 12 a.m. (midnight) |

2 p.m. – 12 a.m. (midnight) |

| Max Threshold Bytes Downstream During Period of Measurement |

2,300 MB | 6,900 MB | 11,000 MB | 20,700 MB | 27,600 MB |

| Max Threshold Bytes Upstream During Period of Measurement |

460 MB | 460 MB | 1,380 MB | 3,680 MB | 4,600 MB |

| Period at Standard Speed | 5 p.m. to Midnight | 5 p.m. to Midnight | 5 p.m. to Midnight | 5 p.m. to Midnight | 5 p.m. to Midnight |

Company officials have been telling Cable One customers some of these complicated usage formulas are about to be relaxed as they introduce their new 50Mbps DOCSIS 3 broadband service. With Cable One delivering service primarily in small cities and rural areas, the arrival of 50Mbps broadband has generated considerable excitement, until customers learned the cable company has decided to market it like a cell phone plan.

“The new 50Mbps plan is downright bizarre here in Fargo, N.D.,” writes Stop the Cap! reader Paul. “It actually costs less than their 10Mbps plan — I was quoted $45 a month for the broadband-only option, $35 if I signed a two year contract. That actually saves me money as I currently spend just over $50 a month for their 10Mbps plan.”

But Paul learned the super fast broadband plan comes with some major strings attached.

“It is limited to 50GB of usage per month on what they are calling their ‘data plan,'” Paul shares. “The customer service representative said it was like ordering a data plan with your wireless phone.”

Currently, the 50GB limit is the only data plan on offer, and the usage cap does not apply to usage overnight from midnight until noon the following day. But those exceeding it at other times face a $0.50/GB overlimit fee.

Paul also says Cable One appears to be ready to dispense with the complicated speed throttle it uses on its mainstream 3-12Mbps broadband plans. Cable One traditionally gave customers a daily usage allowance ranging from 1-11GB, after which accounts were subject to throttled speeds for the next 24 hours.

“Customers have complained about the slow speeds, throttles, and usage limits for years, if only because they couldn’t navigate all of them and Cable One’s usage measurement tool is often offline or inaccurate,” Paul writes.

“I first learned about Stop the Cap! when Cable One tried to charge some of our local residents $1,000 for cable equipment lost in a fire,” Paul says. “Cable One has been so bad my wife was hoping Mediacom… Mediacom, would deliver us from them with a buyout.”

Cable One is an example of a cable company that has gone all out with Internet Overcharging, delivering customers an expensive and speed throttled broadband experience.

“Even though the lower price for the 50Mbps plan looks nice, it’s not if you start going over the limit,” Paul says. “Sorry, broadband is not cell phone service.”

He is sticking with his current 10/1Mbps service plan.

Cable One representatives argue very few customers exceed any of the company’s plan limits, less than 1 percent exceeding them consistently.

Subscribe

Subscribe