Time Warner Cable today relaunched usage-based billing, offering customers a $5 monthly discount off Internet access when they confine their usage to a maximum of 5GB per month.

Stop the Cap! was at the forefront of protesting Time Warner’s last Internet Overcharging experiment in 2009, which would have allowed unlimited access for $150 a month — a major rate increase to be sure. Other customers had usage allowances that originally would have ranged from 40-60GB per month, with overlimit fees of $1/GB or more.

Time Warner Cable’s Jeff Simmermon, director of digital communications, admitted the 2009 experiment attempted in Beaumont, San Antonio, and Austin, Texas, Greensboro/Triad, N.C., and Rochester, N.Y. was unsuccessful.

“Yes, we did try this before, a few years ago,” Simmermon said. “And yes, pretty much everyone agrees that it didn’t go so well. So we listened to customer complaints. A lot.”

The cable company is trying again in southern Texas, including the cities of San Antonio, Laredo, Corpus Christi, the Rio Grande Valley and the Border Corridor.

This time Simmermon says the usage-based pricing program for Time Warner Cable customers will be optional. He also promised Time Warner Cable customers will always have access to unlimited broadband at a flat monthly rate.

This is a major change for the cable company, because earlier statements from both CEO Glenn Britt and the chief financial officer Irene Esteves called usage based billing inevitable.

Simmermon admitted Time Warner Cable is making plenty of money selling unlimited access to customers today.

“We profit from unlimited consumption, and a free, open Internet is the sort of Internet that has gotten us this far,” Simmermon wrote on the company’s blog.

“All participation in the Essentials plan is opt-in, with the opportunity to save a few dollars each month,” Simmermon said. “It’s not going to be for everybody, and that’s fine — all Time Warner Cable customers will still have the option of selection an unlimited broadband plan.”

The details:

1) Up to 5GB/month of data transmission for a $5/month discount from one’s current monthly bill. All Standard, Basic and Lite broadband customers will be eligible. Turbo, Extreme and Wideband customers will continue as always, with access to unlimited broadband and no optional tiered plan or discounts.

2) The ability to opt-in and opt-out of a tiered package at any time.

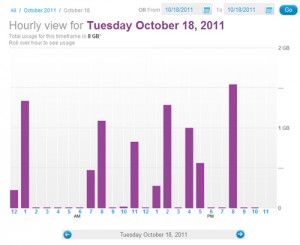

3) A “meter” that tracks usage on a daily, monthly, weekly or even hourly basis, enabling customers to accurately gauge usage.

3) A 60 day/2 billing-cycle grace period to allow customers to adjust usage patterns. During this time the company will notify customers of overages but won’t charge for them.

4) Overages will cost $1 per GB, not to exceed a maximum of $25/month.

This presents the opportunity to save $5/month from a monthly broadband bill.

Time Warner already has the TV Essentials plan for $39.99/month that offers low-income households to have access to cable, in a stripped down package. Simmermon says this is meant to be the broadband equivalent.

[Stop the Cap! will publish our own views on this development in a separate editorial.]

Subscribe

Subscribe