Comcast’s chief lobbyist stalled plans to unveil cheaper Internet service for the financially disadvantaged to use as bait to win regulator approval of its 2009 merger with NBC-Universal.

The Washington Post today reports David Cohen’s influence at the cable operator as its chief of lobbying has helped the cable company achieve its status as America’s largest cable operator and entertainment conglomerate.

Cohen has friends in high places thanks to his status as a Democratic Party money bundler. A self-styled “consigliere” to the Roberts family that controls the company, Cohen has overseen a transformation of Comcast from one cable operator among many into a high-powered force not to reckoned with in Washington or Silicon Valley.

Comcast’s growth into a mega-corporation with $58 billion in annual revenues came, in part, from dealmaking that won regulator approval in D.C. Maintaining good relations with those regulators is a Cohen specialty. It did not take the Post too long to find former FCC officials giving Cohen high praise:

- “Every meeting with David is incredibly substantive,” Eddie Lazarus, former chief of staff to the FCC told the newspaper. “He always comes with a willingness to find solutions.”

- “David loves politics, he loves government and he has incredible situational awareness — a 360-degree view of business,” said Blair Levin, a former senior adviser to FCC Chairman Julius Genachowski. “He’s just so good at what he does.”

Under Cohen’s leadership, Comcast has spent lavishly on its corporate lobbying and legal team. Today, 20 full time lobbyists work under Cohen’s direction, with dozens of others available on retainer. The company spent $8.3 million of its subscribers’ money solely on lobbying. The Post reports that makes Comcast the ninth biggest K Street spender, above Verizon.

The poor and disadvantaged had to wait for Comcast to seal the deal on their $30 billion acquisition of NBC-Universal before affordable Internet could become reality for them.

In 2009, Comcast insiders were hard at work on a discount program for the disadvantaged who could not afford Comcast’s regular prices for broadband service. But the program was stalled at the direction of Cohen, who wanted it to be a chip with regulators to win approval of its acquisition of NBC-Universal. The program, sure to be popular among advocates of the digitally disadvantaged, was a key part of approving the $30 billion deal.

“I held back because I knew it may be the type of voluntary commitment that would be attractive to the chairman [of the FCC],” Cohen said in a recent interview.

Regulators promoted Comcast’s “concession” to offer the discounted Internet service as a win for consumers as part of the final approval of the deal. In reality, Comcast was planning to offer the service anyway and finally introduced it in 2011 — two years after first being proposed inside the company.

That fact is a slight embarrassment to current FCC chairman Julius Genachowski, who has told audiences the discounted Internet program was partly to his credit.

“This particular program came from our reviewing of the Comcast NBC-U transaction,” Genachowski said in a speech. “Comcast embraced it as good for the country, as well as good for business. And I’m fine with that.”

Cohen defends Comcast’s lobbying expense as part of the company’s effort to combat scrutiny and challenges to its all-or-nothing video business model, denying customers access to a-la-carte programming.

Comcast’s scope has now grown so large, it has become a force few companies are willing to challenge, and those that try are quick to run into a blockade of Comcast lawyers, lobbyists, and carefully constructed contracts that protect the company’s bottom line from would-be competitors.

Comcast’s scope has now grown so large, it has become a force few companies are willing to challenge, and those that try are quick to run into a blockade of Comcast lawyers, lobbyists, and carefully constructed contracts that protect the company’s bottom line from would-be competitors.

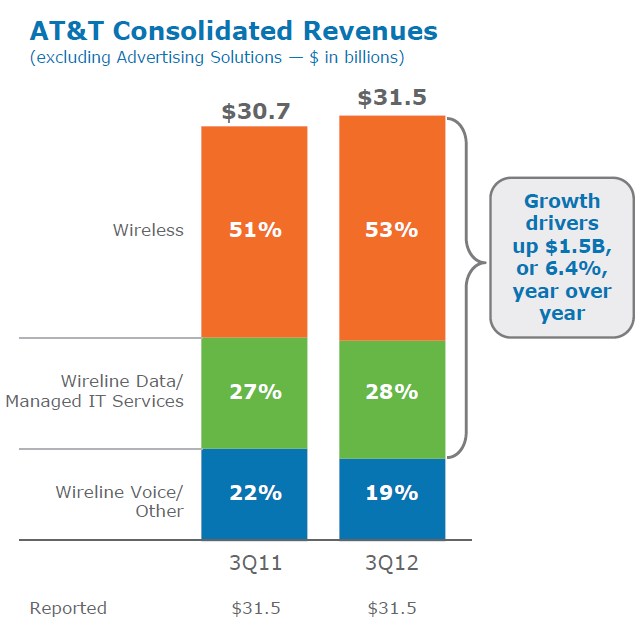

Deep pockets like Verizon, Apple, Netflix and Google have all tried… and failed to recast the cable television experience with on-demand programming, a-la-carte channels, and cord-cutting technology.

In response, Comcast has kept competitors tied down to the same cable packages that require subscribers to pay for everything, even if they seek only a few channels. Comcast leverages its broadband network with usage limits that effectively curtail cord-cutting among consumers looking to skip the TV package. Anyone seeking a place in today’s entertainment industry ends up dealing with Comcast sooner or later.

“They are hugely important because they can singlehandedly sink or swim multiple businesses that rely on the Internet ecosystem by virtue of controlling the dissemination of information through their pipes and now by supplying so much of the content,” said Joel Kelsey, a policy director at consumer interest group Free Press. “So many companies have come to us and ask we fight their battles for them because they are afraid of retribution.”

Cohen is well-compensated for his effectiveness. His latest three-year contract makes him one of the highest paid corporate lobbyists in Washington, with a $15 million annual compensation package and $3 million in bonuses, not including his ample stock holdings in Comcast.

His influence extends to the highest levels of the Obama Administration. Last summer, the family hosted a $1.2 million campaign fundraiser for President Obama, and the Cohens have separately contributed $877,000 to various campaigns. Comcast itself has spent $3.3 million in campaign contributions so far this year.

Subscribe

Subscribe