April 18, 2016: This article is retained for archival purposes and is now out of date. Please click here to read the 2016 Guide.

September 29, 2015: Time Warner Cable has apparently changed how they handle customers looking for a better deal. Social media representatives on Twitter and Facebook are no longer authorized to help customers with customer retention plans. Therefore, you will need to negotiate by phone with a customer retention specialist. While less convenient than using social media to negotiate, we will walk you through the steps and let you know what to expect when you call, so you can cut through the nonsense and be confident of securing the best deal for you and your family.

Courtesy: Jacobson

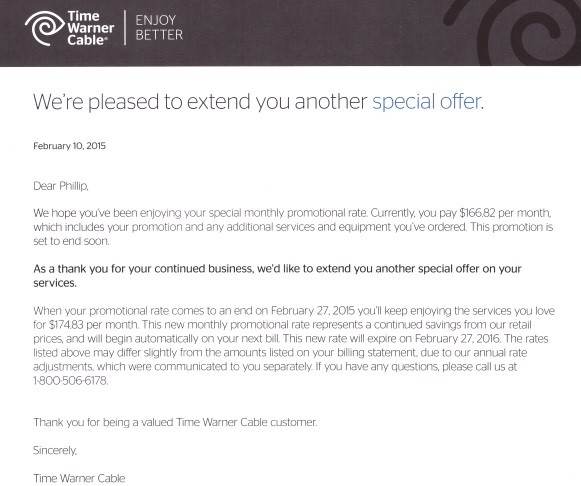

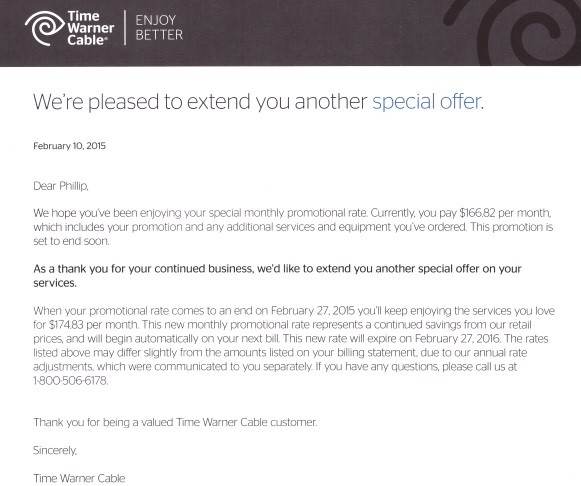

Step One: Read the article below. Most of the information in it is still valid and will be important in the negotiating process. Since this article was first written in March 2015, we have also learned it can be difficult to negotiate a better retention deal if you already have one. But once you receive a rate adjustment letter letting you know your current promotion is expiring, you can reject their “special offer” to extend the promotion at a higher rate and may even win an extension of the promotion you started with.

Step Two: Instead of using social media, you will call 1-800-892-4357 and say “cancel service” when the automated system asks what you are calling about. From there, your call will be forwarded to a customer retention call center.

Step Three: You will be asked why you are canceling service. You want to emphasize “it costs too much” and you have “found a better deal” elsewhere. You should expect the representative to start negotiations by attempting to downgrade your current service to save money. Do not play this game. Politely tell the representative you are not interested in a reduction in your services because you can get the same or better from the competition… at a lower price. Keep reminding them your concern is over the cost of the service, nothing else. Don’t get sidetracked talking about service problems or poor customer service. Address those issues at the end of the call.

Next, the representative is likely to first pitch a minor promotional offer with minimal savings. If you read the article below, you already know what you want is a deal comparable to what new customers receive. The key phrase to use is, “is this the best you can do for me?” Remind them that the phone company is ready to sign you up with a new customer promotion very similar to what Time Warner Cable offers their new customers. You want something closer to that. They will remind you their website promotions typically do not include equipment, which is why their offer will usually be higher than what is on the website. You can let them know you understand that, but the competitor’s deal is still cheaper. Up the urgency by letting them know you have already scheduled an installation with their competitor, but your spouse convinced you to give Time Warner one last chance to save your business. If they can find you a good deal, you will stay with Time Warner.

Next, the representative is likely to first pitch a minor promotional offer with minimal savings. If you read the article below, you already know what you want is a deal comparable to what new customers receive. The key phrase to use is, “is this the best you can do for me?” Remind them that the phone company is ready to sign you up with a new customer promotion very similar to what Time Warner Cable offers their new customers. You want something closer to that. They will remind you their website promotions typically do not include equipment, which is why their offer will usually be higher than what is on the website. You can let them know you understand that, but the competitor’s deal is still cheaper. Up the urgency by letting them know you have already scheduled an installation with their competitor, but your spouse convinced you to give Time Warner one last chance to save your business. If they can find you a good deal, you will stay with Time Warner.

In the end, these days expect a good deal to be at or less than $100 for a double play package and at or less than $130 for a triple play package, after all taxes and fees. These prices assume you subscribe to cable television, have upgraded Turbo, Extreme, or Ultimate speed Internet, have one DVR box in the home with no premium movie channels, and you own your own cable modem. The variability in cost usually has to do with the Internet speed you choose and how much equipment you have in your home. The less of both, the cheaper the price. If your offer is in this ballpark, it’s probably a good one.

Equipment is usually extra.

The customer retention representatives have a list of valid promotions they can pitch current customers, but it is important to remember they usually cannot customize a specific deal to precisely fit your existing service. Do not insist on this — you will limit your potential savings. If you are friendly and willing to be flexible, there may be a great double-play or triple-play deal that upgrades your broadband service or includes a phone line, whether you need the service or not, for a very attractive price. Remember that you can also negotiate for a faster Internet plan, a better DVR, or discounted movie channels, if those things interest you. If your number and theirs is pretty close, you can also propose a one-time credit to split the difference and seal the deal. Time Warner is likely to be more amenable offering you a better deal that also upgrades your service.

Broadband-only customers have the least negotiating power and you should expect to pay no less than the prevailing new customer rate, which may or may not be extended when the promotion expires. Your best option if an extension is not available is to flip to Earthlink on Time Warner Cable, which offers identical quality service (no Time Warner e-mail address, however) at promotional prices usually the same or lower than what Time Warner offers its customers. The switch can be done over the phone. When the Earthlink promotion expires, you qualify to return to Time Warner broadband at the new customer price.

If you find you are dealing with a difficult or intransigent representative, thank them for their time, hang up and call back in a few hours and try again. Expect to spend about 30 minutes before calling reviewing your current bill, cross-matching it with the closest new customer promotion on Time Warner’s website, and reviewing what the phone company is currently selling that most closely matches your existing service. Expect the call to Time Warner will take up to 30 minutes, including hold time. The dreaded negotiation over price should take less than 10 minutes. The rest of the time will be spent looking up your account and reviewing what kinds of offers are available to you. Have your bill and the new customer offers from TWC and the phone company in front of you while you talk, so you can refer back to them if necessary. You never have to commit to a deal immediately. If you want to think about it, ask for the representative to note your account with the offer he or she made and ask their name so you can refer back to that conversation when you call back.

The original article follows below…

In 2012, Stop the Cap! helped thousands of readers slash their Time Warner cable bills by more than $50 a month with less than 10 minutes of effort. This year, it will take you longer to read this article than it will to get a better deal from Time Warner Cable.

Many of our readers have contacted us to let us know their promotional rate has expired and have sought help scoring more savings from Time Warner Cable. This year, we decided to enlist the help of Stop the Cap! volunteers who are also Time Warner Cable customers to see what kind of savings we could negotiate from the cable company that dominates much of the northeast, Texas, southern California, and parts of the midwest. We’re happy to report even greater savings (more than $700 annually for some) are there for the asking. Even better, it took some of us less than five minutes to win a better deal and by using social media, we never had to argue with anyone — great news if you don’t like negotiating on the phone.

When your Time Warner Cable promotion expires, expect to receive a letter like this in the mail, gradually increasing your rates.

Our volunteers for this effort came from Rochester, N.Y. (myself), Greensboro, N.C., Flower Mound, Tex., Los Angeles, Calif., and Portland, Maine. Two of us are triple play customers with 50/5Mbps broadband, Preferred TV (the 200+ channel package), and Time Warner home phone service. Two others are double play customers with Preferred TV and 30/5Mbps service, and our volunteer in Portland is a broadband-only customer.

We used three methods to contact Time Warner to discuss our current bills:

- Calling Time Warner Cable’s office and asking for a lower rate or to cancel service;

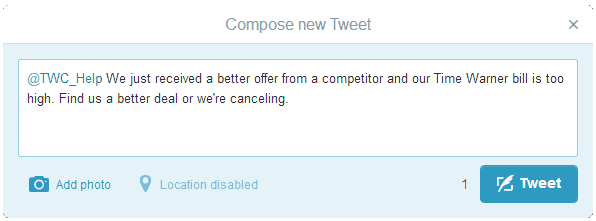

- Tweeting a message to Time Warner threatening to change providers;

- Posting a complaint about our cable bill on the company’s Facebook page.

Dealing with customer churn – the rate of customers coming and going – is always a concern at cable companies. New customer promotions are costly and often include a cash rebate. It is much less expensive for Time Warner to lower the bills of current customers than trying to win back wayward ex-customers with promotions later on. The company maintains several specialized customer retention call centers around the country that pay employees around $14 an hour + a bonus for each customer they keep. Employees are trained to deal with hostile callers and pleas for lower bills by escalating unresolved service problems to technical specialists, issuing service credits, and cutting rates.

But telephone retention specialists also have an incentive to cut back on your package before they cut the price. Just as we found three years ago, the two volunteers that phoned for a better deal were significantly less happy with the outcome than those who relied on social media.

But telephone retention specialists also have an incentive to cut back on your package before they cut the price. Just as we found three years ago, the two volunteers that phoned for a better deal were significantly less happy with the outcome than those who relied on social media.

“Their ‘review’ of my package quickly turned into an interrogation about whether I needed this movie channel or that Internet speed,” said Stop the Cap! volunteer Denise, who insisted on a better deal or her next phone call would be to sign up for service from Verizon. “Before they talk price, they want you to cut back on services.”

Cerise, a broadband-only customer in Portland had the same experience.

“I wanted a better deal than the $60 I am paying them for 15Mbps Internet-only service and they wanted to cut my speed to 6Mbps before we would even talk price,” Cerise said. “They knew my only other choice was DSL from FairPoint.”

My experience with Twitter was even easier than it was three years ago. Time Warner acceded to my request for a better deal in a message left on my voicemail: a rate cut of $63 a month with no change in service. I never had to speak with anyone and the new rate has already been applied to my account.

Sam, a triple play customer in Los Angeles took a phone call from Time Warner after his wife blasted the company on its Facebook page about a “new special promotional rate” that was “neither special or promotional” in her eyes.

“Their letter in the mail makes it sound like they are doing you a favor, but it’s really just the dead-end road back to paying normal prices.”

Time Warner Cable promotions run typically 12 or 24 months, after which the company mails a letter inviting you to experience a new “promotional rate” reset to a higher price, but not one that will usually deliver bill shock. A year after that less generous promotion expires, in most cases rates reset to regular pricing.

How to Negotiate

Because our experiences consistently found that interacting with Time Warner’s social media team is more effective at winning the best possible deal, we again strongly recommend you do not call Time Warner looking for a better deal. Instead, engage them through Twitter or Facebook. But before that happens, get organized:

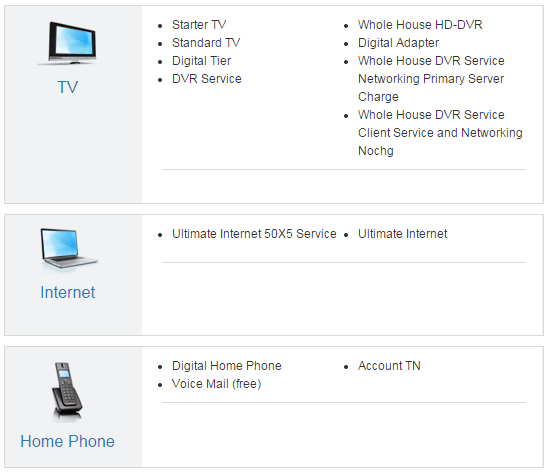

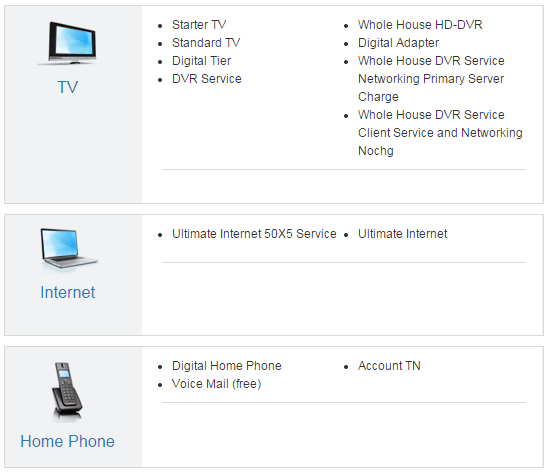

1. Visit Time Warner Cable’s current plans and promotions web page. Your goal is to note the current promotions available and find the package that most closely resembles the services you have now. You can get a current copy of your Time Warner bill from the My Services section of Time Warner’s website.

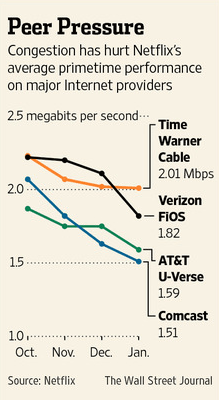

Second, visit the competition. Check your phone company for any promotional offers for services like U-verse or FiOS, or satellite television promotions many telephone companies bundle with DSL. Familiarize yourself with the packages you would consider signing up for and jot down the prices.

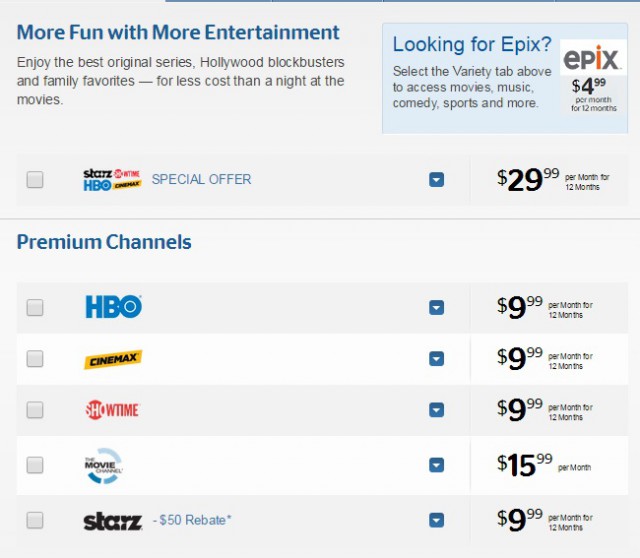

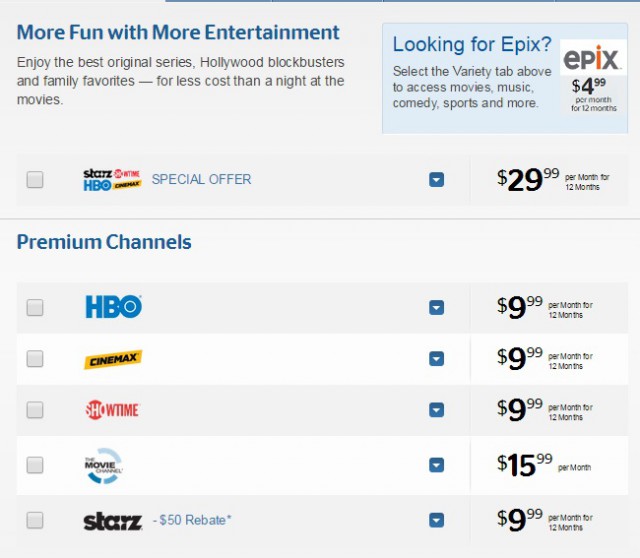

Are you overpaying for premium movie channels? If you are paying more than this, you are.

Third, be flexible. The best promotional deals go to those who sign up for Time Warner Cable’s triple play packages. If you are a double play customer, adding phone service may actually cost you less on certain promotions than the best double play offers, even if you never use the phone line. If you have landline service from the phone company, Time Warner’s triple play offers will certainly save you in the long run, because unlimited long distance and local calling can often be added for as little as $10 a month. You can also consider switching to Ooma, a top-rated landline provider that works over your broadband connection and costs as little as $5 a month.

Fourth, ask about free or discounted upgrades to your existing service. Time Warner Cable has several attractive promotions for services that many customers dismiss as too expensive. Whole House DVR lets you watch DVR recordings on other televisions in the home. Some promotions add this feature for just a few dollars extra a month — less than maintaining two DVRs in the home. Also consider a broadband speed upgrade to 30/5 or 50/5Mbps. Attractive promotions are usually available for these as well.

Fifth, be willing to drop premium movie channels before you start negotiations. Time Warner raised the price of add-on HBO to $16.99 in January and other premium channels typically cost around $13 a month each. You are better off dropping them before negotiating for a better deal. After your new deal is in place, you can visit Time Warner’s website and add back the premiums you want at new promotional prices:

- A 12-month premium promotional package combining HBO, Cinemax, Starz, and Showtime runs $29.99 a month and can be ordered online;

- HBO, Cinemax, Showtime, and Starz can be had a-la-carte for $9.99 a month each for one year (The Movie Channel is inexplicably not included and costs $15.99/mo — you won’t miss it) and you may also qualify for a $50 rebate by adding Starz before March 31, 2015.

Finally, unless you live in a Time Warner Cable Maxx city (New York, Los Angeles, Austin, Kansas City, etc.), it usually doesn’t pay to negotiate over modem rental fees. Time Warner has waived modem fees in certain cases in Los Angeles, but we recommend you invest in buying your own modem and be rid of the modem rental fee for good. If you are not in a Maxx market, we still recommend the Motorola SB6141, which will work at speeds up to 100Mbps on Time Warner’s network. If Maxx is coming to your area and you want even faster speeds, we recommend the ARRIS/Motorola SB6183 ($130+). It is approved to work at 300Mbps speeds in Maxx-upgraded areas.

Now you are ready to reach out!

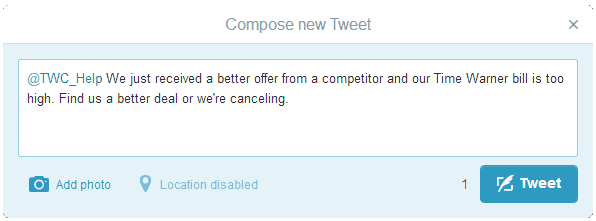

Sign up for a Twitter account.

Once registered and logged in, click the button that appears like a quill pen at the upper right corner of your screen and a new window will appear where you can compose a message of 140 characters or less. You will address your message to @TWC_Help (note the underscore – you can cut and paste that address into your message or use Twitter’s search function – type in TWC and you should be able to find and select it there). Here is a sample Tweet we came up with, but you can compose your own, of course:

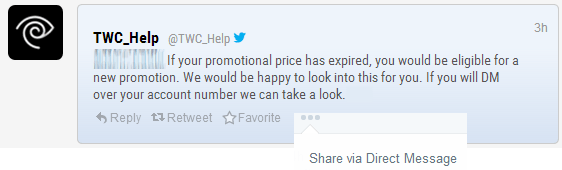

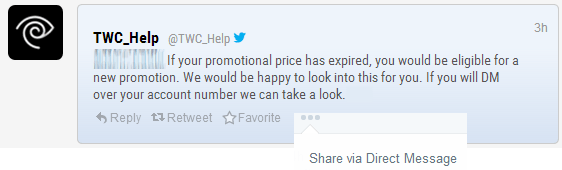

After clicking the Tweet button, your message will be read by Time Warner’s social media team. Sometime later, you will receive a response asking for your contact information and account number. This should be sent in a private “Direct Message,” not as an open Tweet:

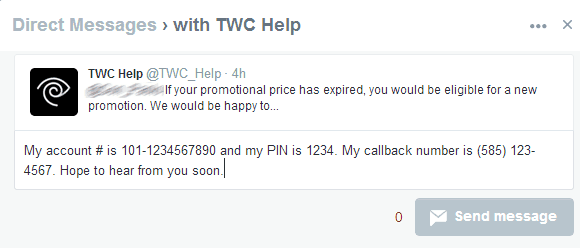

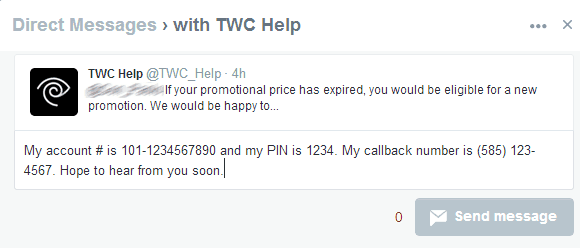

Click the three dots and find the option Share via Direct Message. Click it, add TWC_Help as a recipient and click Next. A conversation window will appear with their message and a space for your private response. Include your Account Number and PIN from your Time Warner Cable bill and a callback number, as shown below.

Time Warner should call you back within the next three days. If you do not receive a reply to your Tweet, send another one during regular business hours. They may have missed your first message.

You can also try Facebook to lodge your rate protest.

You can also try Facebook to lodge your rate protest.

Visit the Time Warner Cable Facebook page and find the box (as shown highlighted below) where you can write a public message on the page.

As with Twitter, you want to get straight to the point and tell Time Warner you are paying too much for cable service and have a better offer from a competitor. Let them know you are willing to consider their counter-offer, if it arrives soon.

They are likely to respond asking for your account information, including the account number and PIN as shown on your monthly bill. Again, send this information privately using the Facebook Messenger. Include your best contact number.

Here is where your write your public complaint about your cable bill and ask for a better deal. You should keep this short and to the point, and do not post your account information here. Wait for their reply and respond in a private message.

Our Results

Was $175. Now $112.

Myself – Rochester, N.Y.: Full package of every cable television channel on offer, no premiums, Whole-House DVR with five cable boxes, 50/5Mbps broadband, Unlimited Home Phone: $112/mo, down from a fading promotional price now resetting to $175 (had been gradually increasing from $110 since 2014)

Tania, Greensboro, N.C.: Double play of all cable television channels, no premiums, DVR and one traditional set-top box with 30/5Mbps broadband: Was paying $156. Offered $99 with free upgrade to 50/5Mbps and Whole House DVR; offered and declined Unlimited Home Phone for extra $10/month. This promotion essentially matched AT&T U-verse introductory pricing for comparable services with slower broadband.

Denise, Flower Mound, Tex.: Started by calling Time Warner to cancel over $175 cable bill covering all cable channels, one premium, DVR with extra set-top boxes, 50/5Mbps broadband. Representative wanted her to cancel HBO and drop Internet speed to a lower 15Mbps tier to bring price to $125 range. She threatened to call Verizon, representative told her to ‘go ahead.’ On the second attempt Denise used Twitter and representative phoned back the next day with a message her bill was instantly cut to $120 and she will receive a one time $30 inconvenience credit for the rudeness she experienced over the phone. She keeps HBO and all of her other services and was offered to call back to discuss free Whole House DVR service.

Sam, Los Angeles: Used Facebook to contact Time Warner Cable about his $215 cable bill. Sam appreciated the fact TWC Maxx had arrived in Los Angeles and boosted his broadband speed to around 200Mbps, but didn’t appreciate the $25 a month rate reset that occurred this month as his promotional rate ended. Sam has a full cable television package, three premium movie channels, fast Internet, and Home Phone Unlimited. He also has two DVR boxes, two standard cable boxes, and rented his cable modem. Sam told Time Warner he would rather spend his money with Netflix, Amazon, and Sling’s $20 cable television over the Internet package and he was prepared to cut the cord. Time Warner cut his bill instead. He’s temporarily dropping all of his premium movie channels to score a promotion of $129 a month, drop the second DVR in favor of Whole House DVR service, and he is buying his own modem. He will add back his premiums on the aforementioned $30 a month promotion, which also gives him Starz and a $50 rebate.

Cerise, Portland, Me.: Our broadband-only volunteer, Cerise had the most trouble securing a better deal. Time Warner Cable initially wouldn’t budge beyond offering the same rate new customers get for one year: $34.99/mo + modem rental fee for 15/1Mbps service. Stop the Cap! intervened before Cerise considered her alternative – 6Mbps DSL from FairPoint Communications. After we pointed out Earthlink was selling identical broadband service on Time Warner’s network for $29.95 a month for six months, Time Warner’s “no” turned into “yes” and they agreed to match that price. If they don’t match that price again next year, Cerise can make a phone call and jump ship to Earthlink for their $29.95 promotion and then jump back to Time Warner six months after that. Cerise is also buying her own modem.

Let us know about how your negotiations went in the comment section below.

What will happen in Verizon service areas that are not considered priorities?

What will happen in Verizon service areas that are not considered priorities?

Subscribe

Subscribe

Time Warner (Entertainment): Not affiliated with Time Warner Cable, owning Time Warner (Entertainment) would gain Comcast important cable networks like TNT, HBO, and the Warner Bros. studio.

Time Warner (Entertainment): Not affiliated with Time Warner Cable, owning Time Warner (Entertainment) would gain Comcast important cable networks like TNT, HBO, and the Warner Bros. studio.

Next, the representative is likely to first pitch a minor promotional offer with minimal savings. If you read the article below, you already know what you want is a deal comparable to what new customers receive. The key phrase to use is, “is this the best you can do for me?” Remind them that the phone company is ready to sign you up with a new customer promotion very similar to what Time Warner Cable offers their new customers. You want something closer to that. They will remind you their website promotions typically do not include equipment, which is why their offer will usually be higher than what is on the website. You can let them know you understand that, but the competitor’s deal is still cheaper. Up the urgency by letting them know you have already scheduled an installation with their competitor, but your spouse convinced you to give Time Warner one last chance to save your business. If they can find you a good deal, you will stay with Time Warner.

Next, the representative is likely to first pitch a minor promotional offer with minimal savings. If you read the article below, you already know what you want is a deal comparable to what new customers receive. The key phrase to use is, “is this the best you can do for me?” Remind them that the phone company is ready to sign you up with a new customer promotion very similar to what Time Warner Cable offers their new customers. You want something closer to that. They will remind you their website promotions typically do not include equipment, which is why their offer will usually be higher than what is on the website. You can let them know you understand that, but the competitor’s deal is still cheaper. Up the urgency by letting them know you have already scheduled an installation with their competitor, but your spouse convinced you to give Time Warner one last chance to save your business. If they can find you a good deal, you will stay with Time Warner.

But telephone retention specialists also have an incentive to cut back on your package before they cut the price. Just as we found three years ago, the two volunteers that phoned for a better deal were significantly less happy with the outcome than those who relied on social media.

But telephone retention specialists also have an incentive to cut back on your package before they cut the price. Just as we found three years ago, the two volunteers that phoned for a better deal were significantly less happy with the outcome than those who relied on social media.

You can also try Facebook to lodge your rate protest.

You can also try Facebook to lodge your rate protest.