A well-placed source in Washington, D.C. with knowledge of the matter tells Stop the Cap! the Federal Communications Commission is prepared to take a hard look at the issue of Internet data caps and usage-based billing if a major cable operator like Comcast imposes usage allowances on its broadband customers nationwide.

A well-placed source in Washington, D.C. with knowledge of the matter tells Stop the Cap! the Federal Communications Commission is prepared to take a hard look at the issue of Internet data caps and usage-based billing if a major cable operator like Comcast imposes usage allowances on its broadband customers nationwide.

Comcast introduced its usage cap market trial in Nashville, Tenn. in 2012 but gradually expanded it to include Huntsville and Mobile, Alabama; Atlanta, Augusta and Savannah, Georgia; Central Kentucky; Maine; Jackson, Mississippi; Knoxville and Memphis, Tennessee; Charleston, South Carolina; and Tucson, Arizona.

“Two and a half-years is exceptionally long for a ‘market trial,’ and we expected Comcast would avoid creating an issue for regulators by drawing attention to the data cap issue during its attempted merger with Time Warner Cable,” said our source. “Now that the merger is off, there is growing expectation Comcast will make a decision about its ‘data usage plans’ soon.”

In most test markets, Comcast is limiting residential customers to 300GB of usage per month, after which an overlimit fee of $10 per 50GB applies. Despite that, Comcast’s forthcoming premium gigabit speed plans are exempt from usage caps, the company announced.

Comcast sustomers in market test cities have not been happy with the usage caps, some confronted with inaccurate usage measurement tools or “bill shock” after claiming to find surprise charges on their cable bill. One federal employee offered his own story of bill shock — $200 in overlimit fees on his April Comcast bill. The customer spent $70 a month on broadcast basic cable television and Comcast Internet service. As an almost cord-cutter, he could instead rely on one of several alternative online video providers like Netflix or Hulu, but watching video that did not come from Comcast’s cable TV package contributed to eating his monthly usage allowance and subjected him to hundreds of dollars in extra fees.

“I’ve reviewed [the] account to see and can confirm the charges are valid,” responded a Comcast representative who defended the company’s usage cap trials. “Please understand that we are not here to take advantage of customers. We are here to provide a great customer service experience. After researching [the] account, at this time no matter what level of service you obtain, the Internet usage [allowance] will remain the same.”

“I’ve reviewed [the] account to see and can confirm the charges are valid,” responded a Comcast representative who defended the company’s usage cap trials. “Please understand that we are not here to take advantage of customers. We are here to provide a great customer service experience. After researching [the] account, at this time no matter what level of service you obtain, the Internet usage [allowance] will remain the same.”

To date, the Federal Communications Commission has left the issue of data caps and usage-based billing on the back burner, despite a Government Accounting Office report that found little justification for usage limits or compulsory usage allowances on broadband.

In 2012, former FCC chairman Julius Genachowski defended the practice, claiming it would bring lower prices to light users, spur “innovation” and enable consumer choice. But Comcast customers have found little, if any savings from Comcast’s so-called “data usage plans.” The only savings comes from enrollment in Comcast’s Flexible Data Option, which offers a $5 discount if a customer keeps usage under 5GB a month on just one plan — Comcast’s 3Mbps $39.95/mo Economy Plus tier.

“We don’t see much innovation coming from Comcast’s usage limit trials because Internet pricing continues to rise and the plans have the side effect of discouraging customers from using competing video providers, which can consume a lot of a customer’s usage allowance,” our source adds.

You are over our arbitrary usage limit!

As far as enabling consumer choice, Comcast’s own representative put the kibosh on that, unless a customer wants to pay higher Internet bills.

Net Neutrality and issues surrounding Title II have consumed much of the FCC’s attention in the residential broadband business during the first half of the Obama Administration’s second term. Usage billing and data caps are likely to become bigger issues during the second half if there is a decisive move towards compulsory usage limits and consumption billing by large operators.

“An operator the size of Comcast absolutely will draw scrutiny,” said our source. “If Comcast decides to impose its currently tested market trial plans on Comcast customers nationwide, the FCC will take a closer look. Under Title II, the agency is empowered to watch for attempts to circumvent Net Neutrality policies. Usage caps and charging additional fees to customers looking for an alternative to the cable television package will qualify, especially if Comcast continues to try to exempt itself.”

Cable industry officials have also become aware of the buzz surrounding usage caps and growing regulator concern. Some reportedly discussed the possibility of FCC intervention behind closed doors at the recent cable industry conference in Chicago. Multichannel News reported (sub. req.) cable industry executives increasingly fear federal officials will ban usage pricing for wired broadband service on competitive grounds. Online video competitors rely on large cable and phone companies to reach prospective customers, many that may think twice if usage allowances are imposed on consumer broadband accounts.

Subscribe

Subscribe Verizon Communications this morning announced it will

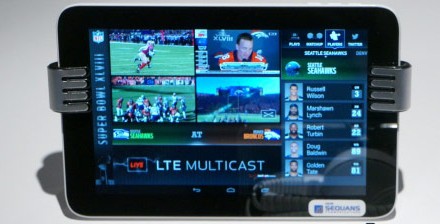

Verizon Communications this morning announced it will  All signs point to the AOL acquisition as more evidence Verizon management is shifting priorities to its mobile business, Verizon Wireless. In 2014, Verizon acquired the assets of Intel Media, which was planning an Internet TV service called OnCue. Verizon’s acquisition will help it develop an alternative television platform and many analysts expect it will primarily reach Verizon Wireless customers.

All signs point to the AOL acquisition as more evidence Verizon management is shifting priorities to its mobile business, Verizon Wireless. In 2014, Verizon acquired the assets of Intel Media, which was planning an Internet TV service called OnCue. Verizon’s acquisition will help it develop an alternative television platform and many analysts expect it will primarily reach Verizon Wireless customers.

Cable’s bad reputation has come home to roost, allowing everyone to assume the worst and see a need to erect protective fences like Net Neutrality to keep cable companies from capitalizing on new fees for Internet usage.

Cable’s bad reputation has come home to roost, allowing everyone to assume the worst and see a need to erect protective fences like Net Neutrality to keep cable companies from capitalizing on new fees for Internet usage. A Florida utility company has told federal regulators it is certain Verizon has a plan to exit its landline and wired broadband businesses within the next ten years to become an all-wireless service provider.

A Florida utility company has told federal regulators it is certain Verizon has a plan to exit its landline and wired broadband businesses within the next ten years to become an all-wireless service provider. “Verizon has not increased its efforts to deploy wireline broadband in the last three years; and there is no evidence that Verizon has used the capital saved on joint use rates for the expansion of wireline broadband,” FP&L officials write. “Indeed, all of the evidence shows that Verizon is abandoning its efforts to build out wireline broadband.”

“Verizon has not increased its efforts to deploy wireline broadband in the last three years; and there is no evidence that Verizon has used the capital saved on joint use rates for the expansion of wireline broadband,” FP&L officials write. “Indeed, all of the evidence shows that Verizon is abandoning its efforts to build out wireline broadband.” If you are a long time Optimum customer, the CEO, management, and shareholders of Cablevision would like to thank you for driving average monthly cable revenue per customer 4.8% higher from a year ago to $155.34 a month.

If you are a long time Optimum customer, the CEO, management, and shareholders of Cablevision would like to thank you for driving average monthly cable revenue per customer 4.8% higher from a year ago to $155.34 a month. “The main drivers of our increased revenue per customer came from a combination of rate increases, but also lower proportion of subscribers on promotion,” said Brian G. Sweeney, chief financial officer. “We had a number of fixed rate increases January 1 of this year related to cable box fees, an increase in our sports and broadcast TV surcharge, as well as the pass-through of PEG fees to certain customers.”

“The main drivers of our increased revenue per customer came from a combination of rate increases, but also lower proportion of subscribers on promotion,” said Brian G. Sweeney, chief financial officer. “We had a number of fixed rate increases January 1 of this year related to cable box fees, an increase in our sports and broadcast TV surcharge, as well as the pass-through of PEG fees to certain customers.”

To further combat promotion-bouncing, Cablevision is embracing its broadband product line and marketing new cord-cutting packages to customers that offer reduced-size cable television packages and free over the air antennas for local stations. The cable company also recently announced it would offer cable customers Hulu subscriptions. Jim Dolan, Cablevision CEO, believes broadband is where the money is and customers are willing to pay higher prices to get Internet access even when video package pricing has its limits.

To further combat promotion-bouncing, Cablevision is embracing its broadband product line and marketing new cord-cutting packages to customers that offer reduced-size cable television packages and free over the air antennas for local stations. The cable company also recently announced it would offer cable customers Hulu subscriptions. Jim Dolan, Cablevision CEO, believes broadband is where the money is and customers are willing to pay higher prices to get Internet access even when video package pricing has its limits.