Verizon workers attend a mass rally at Verizon headquarters on July 25, 2015. (Image: CWA)

If Verizon management and its unionized workforce cannot come to terms on a new contract by this Saturday, up to 39,000 Verizon landline workers from Massachusetts to Virginia will begin a strike industry observers predict could last for weeks.

Verizon Communications has increasingly shifted attention and investment away from its wireline networks, which include copper landline service and its FiOS fiber to the home network. The workforce of line technicians, installers, and engineers that are trying to keep Verizon’s wired networks running well are under pressure to accept concessions the company says reflect the reality of a dwindling number of landline customers and competition for its FiOS network.

As of Monday, representatives for the Communications Workers of America District 1, the International Brotherhood of Electrical Workers (IBEW) Local 2213 and IBEW New England Regional committees continued to call out Verizon for insisting on a list of benefit and job security reductions:

- Eliminating protections against layoffs and mandatory transfers/temporary reassignment to different Verizon service areas, including those in other states;

- No Cost of Living increases;

- Adding Sunday as part of the basic work week;

- Possible elimination of corporate profit-sharing;

- Eliminating caps on overtime and limiting payouts to 1.5x regular pay;

- Reduce the notice given to workers if Verizon has plans for any major technological change (ie. getting rid of rural landlines, selling FiOS, moving customers to wireless, etc.);

- Reductions in medical benefits including higher deductibles, co-pays, premiums, and co-insurance;

- Eliminating the union’s ability to negotiate retiree health care benefits, often at risk in other companies;

- Eliminate the lump sum pension option and introducing new restrictions on pensions and new fees on 401K plans;

- Eliminate accidental disability coverage;

- Eliminate family care leave.

Verizon spokesman Rick Young countered that Verizon has offered workers a straight 4% wage increase but admitted many existing contract provisions are decades old and no longer reflect current business reality. Young added Verizon union network technicians are paid $160,000 a year on average in total compensation, including salary, pension and health care. But Verizon management is insistent on cutting back the company’s health care costs, noting Verizon successfully reduced the cost of covering nonunionized workers to about $16,700 per family while union workers still receive coverage worth $20,000-24,000 a year per family.

Verizon spokesman Rick Young countered that Verizon has offered workers a straight 4% wage increase but admitted many existing contract provisions are decades old and no longer reflect current business reality. Young added Verizon union network technicians are paid $160,000 a year on average in total compensation, including salary, pension and health care. But Verizon management is insistent on cutting back the company’s health care costs, noting Verizon successfully reduced the cost of covering nonunionized workers to about $16,700 per family while union workers still receive coverage worth $20,000-24,000 a year per family.

Union officials counter Verizon was able to manage that by slashing non-union employee benefits and forcing workers into high deductible medical plans that offer lower levels of coverage. In 2011, Verizon fought its unions over the same issues, including a company demand workers accept health care plans with a $5000 out-of-pocket deductible before medical coverage kicked in. That led to a contentious two-week strike.

“Negotiations are going poorly,” Communication Workers of America’s Bob Master told CBS News this week. “We are far apart.”

With 86 percent of union members voting to strike if negotiations fail, it seems an almost certainty workers will be on the picket lines by next week if negotiations remain unsuccessful. Workers believe Verizon’s profits have been shared mostly at the top through executive bonuses and ever-increasing compensation packages while ordinary workers are asked to forego benefits and job security.

With 86 percent of union members voting to strike if negotiations fail, it seems an almost certainty workers will be on the picket lines by next week if negotiations remain unsuccessful. Workers believe Verizon’s profits have been shared mostly at the top through executive bonuses and ever-increasing compensation packages while ordinary workers are asked to forego benefits and job security.

In solidarity with Verizon customers, the unions are also fighting to force Verizon to further build out its FiOS fiber network to more customers and stop allowing its copper network to deteriorate to the point of unusability.

“On the one hand, Verizon refuses to build its high-speed FiOS network in lower-income areas and on the other, they are systemically ignoring maintenance needs on their landline network,” said Ed Mooney, vice president for CWA District 2-13, which covers Pennsylvania to Virginia. “This leaves customers at the mercy of a cable monopoly or stuck with deteriorating service while Verizon executives and shareholders rake in billions.”

Trainor

A highly critical audit of Verizon’s FiOS rollout in New York City found that Verizon failed to meet its promise to deliver high-speed fiber optic Internet and television to everyone in the city who wanted it, claims the union. During its negotiations for a city franchise, Verizon promised the entire city would be wired with fiber optic cables by June 2014 and everyone who wanted FiOS would get it within six months to a year. The audit found that despite claiming it had wired the city by November 2014, Verizon systematically continues to refuse orders for service. The audit also found Verizon stonewalled the audit process.

The CWA also contends rates for basic telephone service have increased in recent years, even as Verizon has refused to expand their broadband services into many cities and rural communities, and service quality has greatly deteriorated. Verizon’s declining service quality especially impacts customers who cannot afford more advanced cable services, or who live in areas with few options for cable or wireless services.

But the company is not hurting for money, argues union officials.

“Verizon made $9.6 billion in profits in 2014 and reported $4.4 billion in profits just in the 2015 second quarter alone,” said Dennis Trainer, vice president of CWA District One in a statement.

“In 2012, during a time of great economic stress, the company came to the union and after 15 months of bargaining, including mediation, reached an agreement that the company said they had to have to survive,” wrote an official updating workers represented by CWA District 2-13 (Mid-Atlantic region) in a bargaining update. “Since then, every year they have made billions of dollars in profits and not one executive officer at Verizon has made a single sacrifice like they told us they needed us to do. The latest insult being [Verizon CEO] Lowell McAdam getting a 16% raise in one year while we have paid more in healthcare, lost pensions for new hires, froze pensions for current members, made significant changes in incidental absence payments and made other changes to our contract that have resulted in stressful working conditions and excessive discipline to our members.”

CWA officials in District 1, representing New York and New England workers, were more blunt in responding to an unsolicited email sent to every worker signed by Marc Reed, Verizon’s executive vice president and chief administrative officer.

“Reed suggests in his e-mail that he has a concern for you and your family,” wrote one official. “Ask yourself, if he really gave a shit about you and your family why is he proposing to gut the contract that provides for you and your family.”

Subscribe

Subscribe

Despite the job shifts, the fact 24,000 workers in the region are already employed in photonics-related jobs may have been a deciding factor in selecting Rochester for the center.

Despite the job shifts, the fact 24,000 workers in the region are already employed in photonics-related jobs may have been a deciding factor in selecting Rochester for the center.

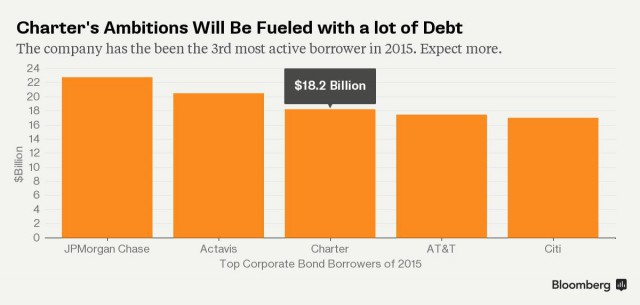

The Marcus-led opposition campaign against Charter gave Comcast just the time it needed to mount a competing bid — all in Comcast stock, then worth around $159 a share. Comcast also offered Marcus an $80 million golden parachute if the deal succeeded.

The Marcus-led opposition campaign against Charter gave Comcast just the time it needed to mount a competing bid — all in Comcast stock, then worth around $159 a share. Comcast also offered Marcus an $80 million golden parachute if the deal succeeded.

The New York State Public Service Commission today

The New York State Public Service Commission today  “The Rochester Business Alliance advocates for an environment that will promote the success of its members and the local economy,” the group writes on its website. “We help our member companies and their employees stay connected to the issues as well as to the people who can make a difference.”

“The Rochester Business Alliance advocates for an environment that will promote the success of its members and the local economy,” the group writes on its website. “We help our member companies and their employees stay connected to the issues as well as to the people who can make a difference.”

“Our view is the incumbent telcos have a market reason to invest in improving their plant through the investment in fiber,” Blais said. “That’s what Canadians expect and because of market conditions they have to do that investment. So we’re quite confident that’s going to happen.”

“Our view is the incumbent telcos have a market reason to invest in improving their plant through the investment in fiber,” Blais said. “That’s what Canadians expect and because of market conditions they have to do that investment. So we’re quite confident that’s going to happen.”