Despite years of arguments from telecom companies that residential customers don’t need or want super-fast broadband speeds, the people of Kansas City think otherwise.

Despite years of arguments from telecom companies that residential customers don’t need or want super-fast broadband speeds, the people of Kansas City think otherwise.

A survey by Wall Street analyst Bernstein Research discovered Google Fiber has signed up almost 75% of homes offered the gigabit fiber-to-the-home service.

“[Customer] penetration measured by our survey was much higher than we had expected,” said Berstein Research analyst Carlos Kirjner.

Haynes and Company conducted a door-to-door survey of more than 200 homes within Google Fiber’s service area in Kansas City, visiting wealthy, middle-income, and challenged urban areas. Despite claims from cable and phone companies that Google is only interested in choosing to offer fiber service in affluent areas, Bernstein Research found Google was doing very well in every neighborhood.

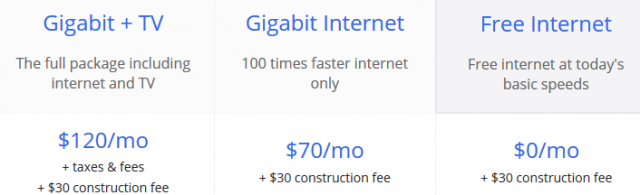

In the poorest neighborhoods, Google is still winning a 30% market share — way above estimates, with customers attracted to Google’s free 5/1Mbps broadband service (customers must pay a recently lowered $30 construction fee). Customer penetration rates in urban areas could grow even higher if Google allowed customers with free Internet service access to its $50 cable television package, now only available to gigabit broadband customers.

Google’s service plans

In middle and upper income neighborhoods, Google has decisively captured a 75% market share — clearly a major problem for incumbent competitors AT&T and Time Warner Cable, which could lose well over half their customers.

Even more worrying for the cable and phone companies, Google is grabbing customers primarily on word-of-mouth testimonials from satisfied customers. At least 98% of Kansas City residents surveyed were aware of Google’s fiber offering. At least 52% said they would “definitely or probably” buy Google Fiber, 25% said they might or might not purchase the service, and only 19% said they definitely or probably wouldn’t buy it.

“Our survey suggests that Google Fiber has gained a significant foothold in its early Kansas City fiberhoods. Consumers are highly satisfied with Google Fiber service, suggesting its share gains are likely not done yet,” Kirjner added.

Bernstein believes Google can grab an even larger share of the Kansas City market by returning to mature fiberhoods in the future with aggressive marketing campaigns that could easily win even more customers.

If Bernstein’s research holds true in other markets, Google Fiber could eventually become a serious competitive threat to both cable and telephone companies, depending on how quickly they expand. Google Fiber is also likely to become a profitable service for the search engine giant, despite the high initial expense of wiring communities for fiber optics.

If Bernstein’s research holds true in other markets, Google Fiber could eventually become a serious competitive threat to both cable and telephone companies, depending on how quickly they expand. Google Fiber is also likely to become a profitable service for the search engine giant, despite the high initial expense of wiring communities for fiber optics.

Bernstein predicts that Google Fiber is positioned to capture a minimum of 50% of the Kansas City market within four years, knocking Time Warner Cable’s out of first place for the first time and posing a serious financial threat for AT&T’s less-capable U-verse platform, which has only attracted a minority share of the market. At least 40% of customers seeking a broadband and cable television package will choose Google Fiber, Bernstein Research predicts.

In almost every market, the traditional cable operator still maintains the largest share of customers. Telephone company competitors usually don’t win more than 20-30% of a market, although Verizon FiOS’ fiber network does better than most. Satellite providers only compete for television customers, which is increasingly less profitable than broadband service.

These kinds of results underline Bernstein Research’s conviction Google Fiber is not an experiment or publicity stunt that the cable industry often claims it to be. Nor does the research firm believe Google is only interested in forcing cable and phone companies to raise broadband speeds. Instead, it is becoming increasingly clear Google is prepared to gradually expand its fiber network across the country, at least in areas bypassed by Verizon FiOS or other fiber networks. However, it will take many years for this to happen.

Subscribe

Subscribe Comcast customers in Philadelphia are organizing to stop the cable company from winning a 15-year franchise renewal to continue providing service in the city unless the cable operator changes its ways after years of rate increases and poor customer service.

Comcast customers in Philadelphia are organizing to stop the cable company from winning a 15-year franchise renewal to continue providing service in the city unless the cable operator changes its ways after years of rate increases and poor customer service. Cox Communications Inc., the third-largest U.S. cable company, will offer gigabit broadband to residential customers later this year when it begins deploying DOCSIS 3.1 technology across its footprint.

Cox Communications Inc., the third-largest U.S. cable company, will offer gigabit broadband to residential customers later this year when it begins deploying DOCSIS 3.1 technology across its footprint. The leveling off of video subscriptions has made broadband a critical part of Cox’s ongoing business plan. Esser claims Cox will adapt its business network infrastructure to introduce gigabit service to residential customers in some cities.

The leveling off of video subscriptions has made broadband a critical part of Cox’s ongoing business plan. Esser claims Cox will adapt its business network infrastructure to introduce gigabit service to residential customers in some cities. Mediacom sent Stop the Cap! a press release today indicating it is boosting broadband speeds at no charge for customers starting this June and continuing through the summer months.

Mediacom sent Stop the Cap! a press release today indicating it is boosting broadband speeds at no charge for customers starting this June and continuing through the summer months. A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.

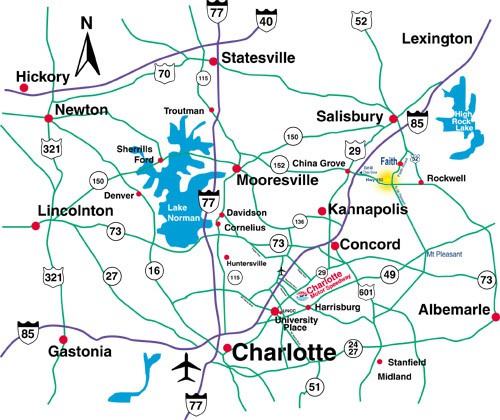

A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.