ABCom is Albania’s largest ISP.

Albanians no longer have to watch usage meters while browsing the Internet and downloading movies and music. The country’s largest ISP – ABCom – has eliminated data caps on all but its cheapest broadband plans (4Mbps service with a 2GB cap: $4.81 for 15 days or 4Mbps service with a 5GB cap: $9.69 for 30 days). Now residents of Tirana, Durrës, Shkodër, Elbasan, Vlorë, and Gjirokastër can browse the Internet at self-selected speeds between 1-100Mbps with no usage-based billing or fixed caps.

It is remarkable progress for Europe’s poorest country. For much of the 20th century, Albania was infamous for its oppressive Communist dictatorship under the leadership of Enver Hoxha, a man who felt Stalin was the Soviet Union’s last true Communist leader and who courted and later cut ties with both the U.S.S.R. and the People’s Republic of China over what he called their “revisionist Marxist-Leninist” policies that betrayed true socialism. Hoxha’s idea of a worker’s paradise was to force huge numbers of both blue and white color workers into the fields every summer to help harvest the country’s strawberry crop.

During Hoxha’s 40 years in power, telecommunications for most Albanians consisted of a portable radio (and occasionally an imported television). Only 1.4 out of 100 had basic telephone service. If more wanted it, they could not get it. A long waiting list guaranteed an installation date years in the future. Albania began its transformation into a democracy with just 42,000 telephone lines, despite a population of nearly three million.

After the Communist government fell in 1991, life changed little in rural Albania. Peasants found initiatives to improve rural telephone service so irrelevant they knocked out service to about 1,000 villages after commandeering telephone wire to build fences to keep their sheep herds from straying. Even in the capital city Tirana, telecommunications infrastructure was decrepit at best. Even the wealthiest Albanians had to contend with rotary dial telephones produced in a forgotten factory in Bulgaria or Romania. Many preferred refurbished telephones rebuilt with scrap parts obtained from Italy.

Today, like many other countries lacking wired infrastructure, Albanians depend mostly on their cell phones to communicate. In 2012, there were 312,000 landlines in use, but 3.5 million cell phones were active. More than a half million wireless users rely entirely on their phones for Internet access.

“Are you ready for unlimited Internet with guaranteed 100Mbps speed?”

In 1998, ABCom launched its Internet Service Provider business, initially selling DSL and wireless broadband. With Albania’s economy always in difficulty, the country chose the cheaper path followed by North America — adopting Hybrid Fiber-Coax (HFC) network technology instead of fiber to the home, common elsewhere in southern Europe. HFC Internet access is better known by most of us as broadband from our local cable company. Expansion of wired broadband has been very slow in Albania. The concept of delivering television, broadband, and phone service over ABCom’s cable system in a triple play package only began in 2009.

The biggest attractions to wired broadband include no data caps and more reliable fixed broadband speeds the country’s wireless providers cannot deliver. Because of wide income disparity, ABCom offers a large range of speed plans for different budgets: 1, 2, 4, 8, 12, 30, and 100Mbps.

In response, competition from wireless providers has stepped up recently. Vodafone Albania is offering five mobile Internet options for users of its 3G network. Customers can opt to pay for daily, weekly or monthly bundles. The 40MB daily bundle costs $0.58; the 250MB weekly bundle costs $2.91; the 500MB monthly bundle costs $4.85, and the 1GB monthly bundle costs $7.76. The speeds are much slower than the plans offered by ABCom, however.

[flv]http://www.phillipdampier.com/video/ABCom Mesazh Promocional nga ABCom March 2013.mp4[/flv]

ABCom produced this television ad introducing its new triple play TV, broadband, and telephone package for Albanian customers. (Albanian) (0:31)

Subscribe

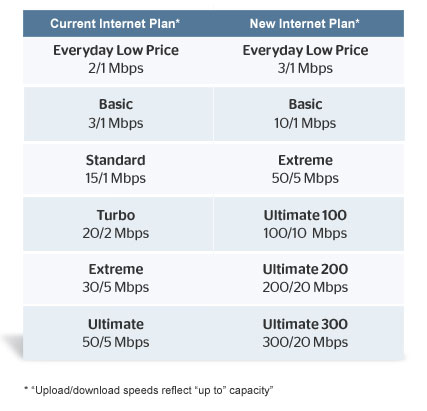

Subscribe CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

The town of Hollis, N.H., population 7.600, is the first community in New Hampshire to receive gigabit broadband, courtesy of the local telephone company.

The town of Hollis, N.H., population 7.600, is the first community in New Hampshire to receive gigabit broadband, courtesy of the local telephone company.