Despite happy talk from Charter Communications about a “new day” with Spectrum packages and pricing, some former Time Warner Cable customers are voting with their feet and canceling service when their promotional pricing packages end and rates have nowhere to go but up.

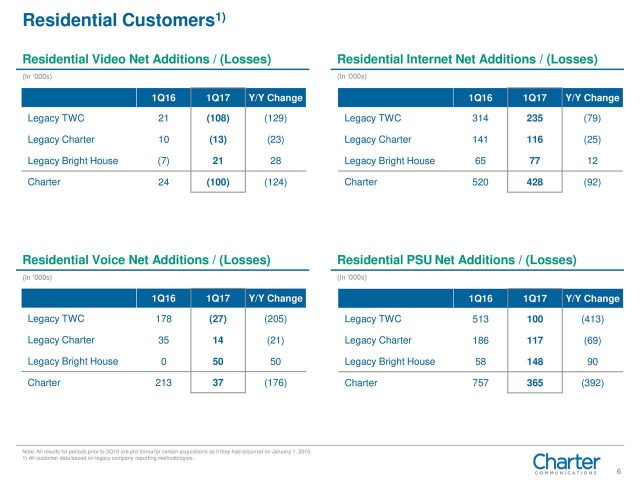

More than 100,000 video customers left Charter during the first quarter of 2017, the majority former TWC customers facing repricing and package changes as their bundle pricing and promotions expired. At that point, rates spike dramatically and customers have to choose a Spectrum package many don’t like or leave.

With only 17% of Time Warner Cable and Bright House Networks customers nationwide having switched to Spectrum plans and pricing, Charter has a long way to go and a lot of customers to lose because of the company’s unwillingness to negotiate.

“As we’ve implemented consistent retention policies nationwide, we’re managing through higher churn at TWC in the short term,” noted Charter’s chief financial officer Christopher Winfrey. “As we migrate and replace the legacy base through a disciplined approach, legacy TWC churn will improve.”

In plain English, Charter has dramatically curtailed promotional customer retention offers and has refused to negotiate with customers that have been on promotional packages for years. Hardest hit are Time Warner Cable customers, and Charter is willing to let them walk instead of extending lower prices.

“The TWC churn, somebody was given a $10 unlimited video basic package, where can you move them?” asked Winfrey. “And they have an exploding offer. It was promotional offer. Where can you move them that’s a satisfactory place relative to what they were given before.”

CEO Thomas Rutledge has been harshly critical of Time Warner Cable’s penchant to reach for promotional pricing to keep customers happy. He has instituted “discipline” to get customers away from the idea they can get a lower cable bill just by asking. Rutledge understands most of his customers don’t have a great alternative and are effectively captive to limited competitive options. For Rutledge, by taking away discounted options, customers can be retrained to accept higher prices as a fact of life.

So far, many former Time Warner Cable customers are not willing to be led to a higher bill and as their legacy promotions expire, families are having conversations about dropping service(s) as a result of price and Charter’s intransigence about lowering it.

First quarter results show the first, and widely expected victim of Charter’s “repricing” is Time Warner Cable’s home phone product, which has been offered in bundles for $9.99 a month over at least the last four years. Charter discontinued Time Warner Cable’s popular international calling feature which offered free calling to the European Union, parts of Latin America and Asia. It also raised the promotional price to $19.99 a month, and now limits free long distance calling to the U.S., Canada, Mexico, Puerto Rico, Guam, U.S. Virgin Islands, and the Northern Marianas.

As customers transition to Spectrum plans, they are leaving their voice lines largely behind as a result. During the first quarter of 2017, Charter only picked up 37,000 new Spectrum phone customers signing up for a Spectrum package versus 213,000 last year. Price was the only factor mentioned for the decline.

Decisions about cord-cutting are also being made at many former Time Warner Cable and Bright House Networks homes when Spectrum’s new cable television offer is presented to customers. Cindy Sims of Apopka, Fla., summed it up this way: “They are raising prices and doing nothing different.”

Sims is former Bright House Networks customer who saw her bill jump from $150 to $175 a month after Charter Communications took over. Since she is a “new customer” of Charter Communications, she hoped to get an introductory offer from the company but Charter no longer considers its acquired customers “new customers,” so she was forced into Spectrum’s regular pricing, which is higher than what she paid before. She is not alone. Charter executives admit customer cancellation/retention call center contacts from former Time Warner Cable customers are 50-60% higher than those of legacy Charter customers that have been with the company for several years.

The last straw for many is the fact customers often find they have to upgrade to the most expensive TV package to keep the channels they had before.

“They are kicking the old customers in the butt,” she added, noting that some Charter representatives handling customers threatening to leave have gotten downright nasty and rude on the phone.

Given no good alternative, some customers decide the time is right to cut cable-TV for good, and TWC’s video net loss was 129,000 worse than last year. The company claims over 90% of the losses were from budget-priced, limited-basic TV disconnects. Charter prefers to sell customers large bundles of channels for considerably more, while Time Warner Cable offered local channels and a small selection of cable networks for as little as $10 a month to certain internet-only customers.

The customer losses are expected to continue for up to a year as the other 83% of customers still on a legacy Time Warner Cable or Bright House Networks package see their prices jump as promotions end. For now, Charter won’t force customers to move to a Spectrum package, but by refusing to negotiate lower prices for legacy packages, the rate increases that happen after regular rates return are enough to push many customers to make a decision to switch or cancel service.

How much of a rate jump? Consider one Time Warner Cable triple-play package with Whole House DVR service, phone and 50/5Mbps internet access reset from $129 a month to $180 after the year-long promotion expired. A comparable package from Spectrum is still $30-40 higher than what Time Warner Cable used to charge.

The impact of the transition to Charter’s Spectrum plans and pricing is also dragging down growth of its internet service. Customers signed up for less expensive and slower tiers with Time Warner Cable are being priced out of the market by Charter’s single-advertised offer – 60 or 100Mbps for approximately $65 a month ($45 for new customers), depending on the area. Higher speed tiers are available if customers call in, if only to give them the bad news a $199 upgrade fee typically also applies.

As a result, residential internet growth among customers signing up for a Spectrum plan was 428,000 during the quarter versus 520,000 last year.

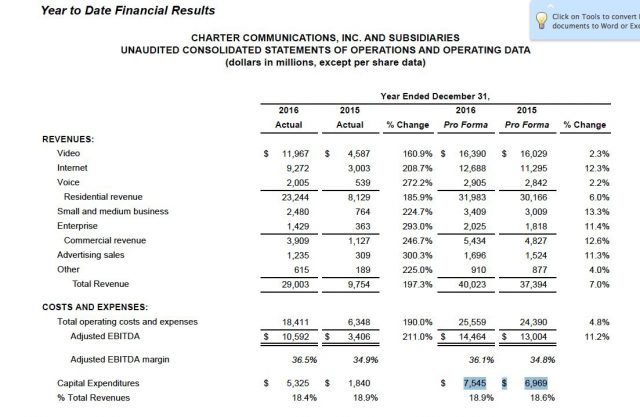

Despite the concerning numbers, Rutledge declared victory and claimed Charter would continue full-speed ahead.

“As we near the first anniversary of the close of our transformative transactions in May of last year, the execution of our integration and operating plan remains on track,” Rutledge said in a statement. “We have now launched our Spectrum pricing and packaging to nearly all of the homes we pass in our new footprint. We are already seeing the benefits of our customer-focused strategy in those markets, including greater connect volumes and the sales of higher quality products, all of which will lead to higher customer satisfaction, lower churn, and faster customer and financial growth in future quarters.”

Subscribe

Subscribe