President Donald Trump took credit on Friday for Charter Communications’ commitment to hire 20,000 new employees and invest $25 billion on improving cable and broadband service, despite the fact Charter promised to hire those workers more than a year before Trump won the election and its spending commitment may actually represent a reduction in spending.

Today, I was thrilled to announce a commitment of $25 BILLION & 20K AMERICAN JOBS over the next 4 years. THANK YOU Charter Communications! pic.twitter.com/PLxUmXVl0h

— Donald J. Trump (@realDonaldTrump) March 24, 2017

“We are really in the process of announcements and you’re going to see thousands and thousands and thousands of jobs and companies and everything coming back into our country,” Trump told reporters in the Oval Office after meeting with Charter CEO Thomas Rutledge and Texas Gov. Greg Abbott. “They’re coming in far faster than even I had projected.”

Rutledge claimed the company’s promise to spend $25 billion over the next four years was because of Trump’s commitment to cut corporate taxes and further deregulate the cable industry. Rutledge added that he was excited that the time was right in the “regulatory climate and the right tax climate to make major infrastructure investments.”

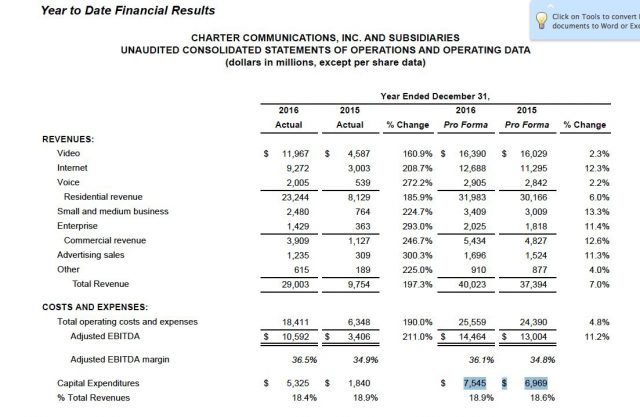

Unfortunately for both the president and Charter’s CEO, public filings required by the Securities and Exchange Commission show Rutledge’s spending commitment to the president actually could represent a $4 billion reduction in spending over the next four years.

In 2015, Charter, Time Warner Cable, and Bright House collectively spent a combined $7 billion as Charter continued its speed improvements and Time Warner Cable invested in its Time Warner Cable Maxx upgrade initiative. That spending increased in 2016 to $7.1 billion (a figure that excludes merger-related expenses), an amount confirmed in last month’s 4th quarter 2016 financial results:

“Capital expenditures totaled $1.89 billion in the fourth quarter, including $187 million of transition spend,” reported Christopher Winfrey, chief financial officer of Charter Communications. “Excluding transition CapEx, fourth quarter CapEx declined by $81 million year-over-year or 4.5% with tradeoffs between all-digital in the fourth quarter of 2015 in Spectrum pricing and packaging box placement in Q4 2016. For the full-year 2016, our capital expenditures totaled $7.5 billion or $7.1 billion when excluding transition spending.”

Hal Singer, a principal at Economists, Inc., noted Rutledge’s new $25 billion spending commitment could represent a net decrease in spending. That’s because “New Charter” would have spent $28.4 billion over the next four years if it kept combined spending in line with the figures the three companies independently reported in 2015 and 2016.

Charter officials told Ars Technica the spending commitment announced Friday was “specific to broadband infrastructure and technology investment” and claimed it was different from the total capital expenditure figure. Charter claimed spending related to infrastructure and technology was $5.3 billion in annual spending over the last three years, but Charter declined to provide numbers for 2016. It also wouldn’t provide a breakdown adequate to determine if Rutledge’s commitment would result in a spending increase or decrease.

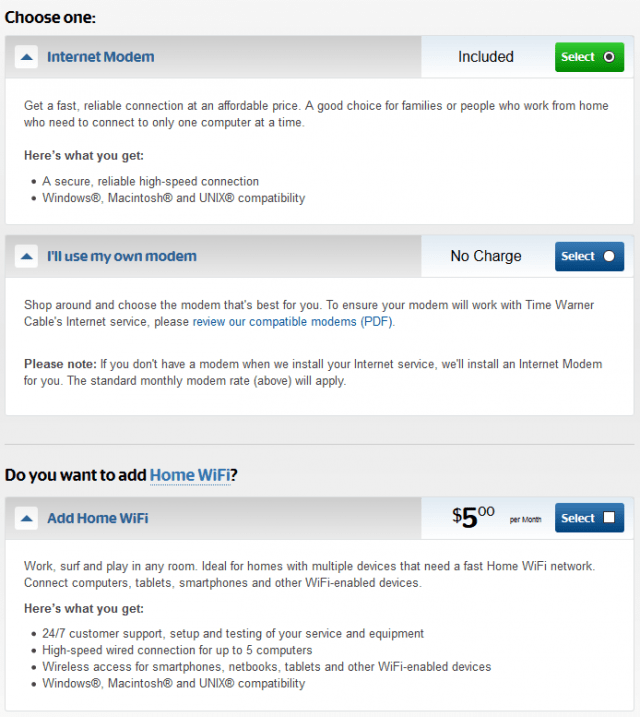

CFO Winfrey told investors in February that a “bigger portion of CapEx” spending in 2017 won’t be for broadband enhancements and expansion, as Mr. Rutledge seemed to tell President Trump. Instead, Charter will spend the money on set-top boxes, cable modems, and network gateways Charter will place in customer homes as a result of an ongoing digital transition, expected to last until 2020.

“When we do an install under Spectrum pricing and packaging, there’s a higher number of devices that we’re placing in the home because of our two-way set-top box strategy as well as our strategy not to charge for modem rental and to have reasonable router fees, which means that you’re going to put more capital into the home on an average transaction and we expect to have [more transactions as a result of increased sales],” Winfrey told investors last month.

Rutledge himself told investors on February’s investor conference call that predicting Charter’s CapEx spending in the future represented an “artificial target.”

“On CapEx, we are not providing CapEx guidance just because we approved a budget internally, which is what we want to operationally deploy this year,” Rutledge explained. “It could be less than that just because of what practically can be done or could be in a position to accelerate. But from our perspective, it doesn’t make sense to release such an artificial target and have the tail try to wag the dog for what’s ultimately right.”

Rutledge agreed with Winfrey’s assessment about what Charter’s spending priorities will be this year: installing more cable boxes and converting customers to all-digital television service. In all, there will be no significant boost in CapEx spending.

“If you think back to what I said, in 2017 we will be spending more on Spectrum pricing and packaging through that higher [cable equipment] placement or connect,” Rutledge said. “We will restart all-digital. We will be insourcing. But offsetting some of that increase will be the benefit of synergies. So without giving specific guidance, 2017 is probably a bit higher in terms of absolute dollars than what we were performing in 2016, but it shouldn’t be a dramatic change in terms of capital intensity or CapEx as a percentage of revenue.”

As for Trump claiming credit for Charter’s commitment to hire 20,000 additional employees, that has been part of Charter’s list of claimed “deal benefits” to win approval of its acquisition of Time Warner Cable and Bright House Networks for at least a year before the election, as Fortune reminds us:

The 20,000 jobs, at least, have been in the works for more than a year. Charter CEO Tom Rutledge said in 2015 that Charter would need to bring on 20,000 additional workers if the company’s merger with Time Warner Cable and acquisition of Bright House Networks went through. A Charter spokesman reiterated the claim in April 2016. The FCC approved the deal last May, and Charter CEO Tom Rutledge said in January that the company had plans to hire 20,000 new employees within three years.

Subscribe

Subscribe

The FCC order approving the merger deal was hardly onerous, requiring Charter to compete head-to-head for customers in places the company can choose itself. Lawmakers eliminated exclusive cable franchise agreements years ago, but established major cable operators like Charter have gone out of their way to avoid competing in areas that already receive cable service. While Wheeler may have hoped some of that competition would be directed against fellow cable companies, Charter CEO Thomas Rutledge quickly made clear to investors and the FCC Charter would continue to avoid direct cable competition, instead promising to expand service into non-cable areas that already get DSL service from the phone company or no broadband at all.

The FCC order approving the merger deal was hardly onerous, requiring Charter to compete head-to-head for customers in places the company can choose itself. Lawmakers eliminated exclusive cable franchise agreements years ago, but established major cable operators like Charter have gone out of their way to avoid competing in areas that already receive cable service. While Wheeler may have hoped some of that competition would be directed against fellow cable companies, Charter CEO Thomas Rutledge quickly made clear to investors and the FCC Charter would continue to avoid direct cable competition, instead promising to expand service into non-cable areas that already get DSL service from the phone company or no broadband at all. The real goal here is to minimize direct competition at all costs. The FCC’s deal conditions already included the need for more rural broadband expansion. Wheeler’s second goal was to introduce a new model — cable company competing against cable company — fighting for new customers by offering consumers better service and pricing. The existence of such competition would belie the industry’s claim that cable overbuilds and head-to-head competition is uneconomical. Wildly profitable, perhaps not, but certainly possible. Historically, the traditional way cable operators dealt with the few instances of direct cable competition was to buy them out to put them out of business. Rutledge was certainly thinking along those lines when he complained that the FCC’s order to compete did not include permission to eventually devour its competitor, effectively making competition go away.

The real goal here is to minimize direct competition at all costs. The FCC’s deal conditions already included the need for more rural broadband expansion. Wheeler’s second goal was to introduce a new model — cable company competing against cable company — fighting for new customers by offering consumers better service and pricing. The existence of such competition would belie the industry’s claim that cable overbuilds and head-to-head competition is uneconomical. Wildly profitable, perhaps not, but certainly possible. Historically, the traditional way cable operators dealt with the few instances of direct cable competition was to buy them out to put them out of business. Rutledge was certainly thinking along those lines when he complained that the FCC’s order to compete did not include permission to eventually devour its competitor, effectively making competition go away.