AT&T today announced it was selling off its residential wireline network in Connecticut to Stamford-based Frontier Communications for $2 billion in a deal that includes an expanded license for U-verse TV that could eventually be available to Frontier customers nationwide.

AT&T today announced it was selling off its residential wireline network in Connecticut to Stamford-based Frontier Communications for $2 billion in a deal that includes an expanded license for U-verse TV that could eventually be available to Frontier customers nationwide.

Frontier will assume control of the Southern New England Telephone Co. (SNET), a wholly owned subsidiary of AT&T, and its 2,700 employees and 900,000 telephone lines. Included in the deal is AT&T’s U-verse network in the state and the right to expand U-verse TV into all 27 states where Frontier provides service. The deal comes three years after Frontier paid $8.6 billion in stock and cash to buy landline operations in 14 states from Verizon Communications.

In a Stop the Cap! exclusive story published last year, we reported Frontier was interested in acquiring licensing rights to the U-verse brand to potentially offer its customers a unified product suite of television, broadband, and phone service over a fiber to the neighborhood network. Maggie Wilderotter, CEO of Frontier Communications, told the Wall Street Journal the deal between AT&T and Frontier had been on the table for years waiting to be finalized. With today’s announcement, AT&T New England president Patricia Jacobs acknowledged Frontier will use the U-verse name at a secondary brand for video service. Frontier now relies on satellite reseller agreements to bundle video service into its packages for consumers.

Frontier’s acquisition will give the company hands-on experience with AT&T’s U-verse network in Connecticut and offer a path to bring improved service to Frontier customers elsewhere. Company officials also acknowledged a key reason for the transaction was boosting Frontier’s lagging dividend, a critical part of its share price. By taking on nearly 1,000,000 new customers, Frontier will boost its cash flow, returning some of that new revenue in a higher dividend payout to shareholders. But the company will take on an extra $2 billion in debt to manage higher dividend payouts.

Frontier’s acquisition will give the company hands-on experience with AT&T’s U-verse network in Connecticut and offer a path to bring improved service to Frontier customers elsewhere. Company officials also acknowledged a key reason for the transaction was boosting Frontier’s lagging dividend, a critical part of its share price. By taking on nearly 1,000,000 new customers, Frontier will boost its cash flow, returning some of that new revenue in a higher dividend payout to shareholders. But the company will take on an extra $2 billion in debt to manage higher dividend payouts.

JPMorgan Chase & Co. arranged the financing for the acquisition and Frontier will likely raise about $1.9 billion from debt markets by selling bonds. Frontier already has $8.13 billion in debt on the books, much of it acquiring landlines originally owned by Verizon.

AT&T’s departure from Connecticut was no surprise to analysts. AT&T operates most of its landline network in the midwest, south, and in the state of California. The company has focused primarily on serving business customers and its wireless network in the northeast, not residential landlines. Frontier described the deal as a perfect fit for Connecticut residents, because Frontier specializes in residential phone and broadband service.

“AT&T has been trying to sell its rural wireline businesses for some time,” Gerard Hallaren, an analyst with Janco Partners Inc., told Bloomberg News. “It looks to me like Frontier cherry-picked a nice asset at a nice price from AT&T.”

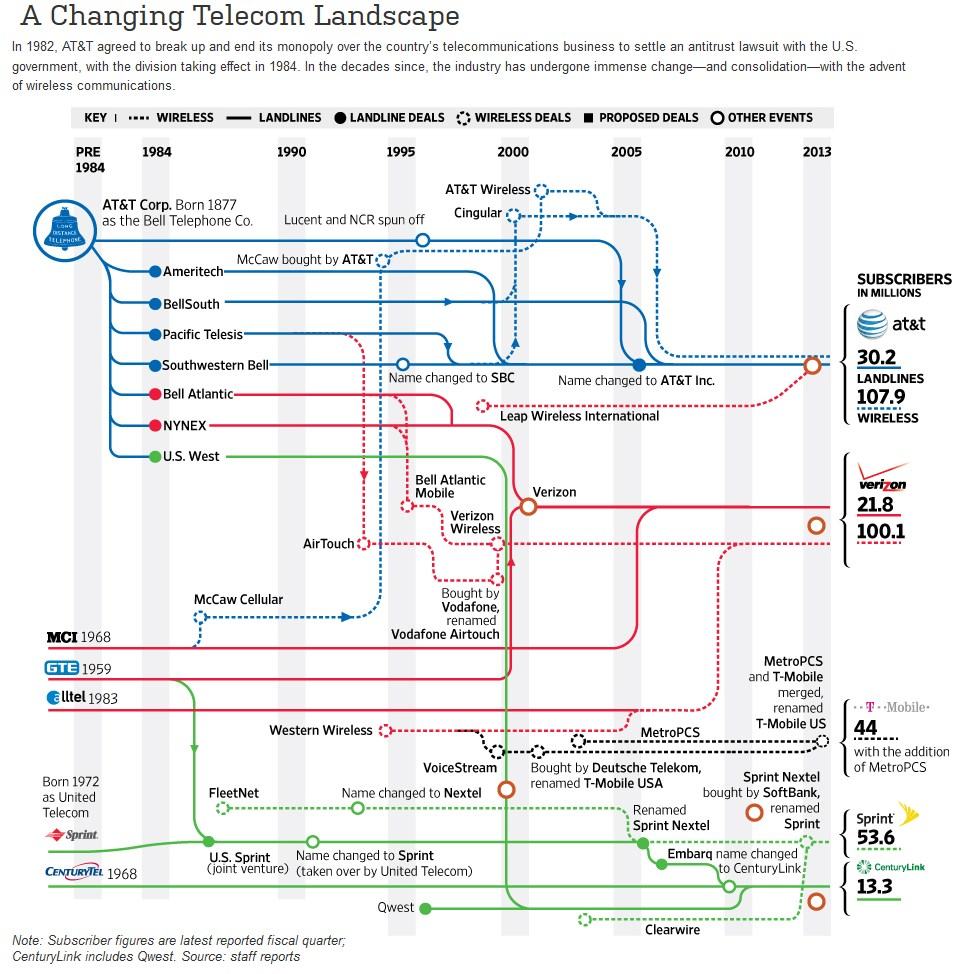

SNET began operations in 1878 as the District Telephone Company of New Haven and pre-dated the Bell System. The company founded the first exchange and printed the world’s first telephone directory. It remained independent of Bell System ownership until 1998, when SBC Communications (formerly Southwestern Bell) acquired the company. In late 2005, SBC purchased AT&T and AT&T Connecticut was born.

SNET began operations in 1878 as the District Telephone Company of New Haven and pre-dated the Bell System. The company founded the first exchange and printed the world’s first telephone directory. It remained independent of Bell System ownership until 1998, when SBC Communications (formerly Southwestern Bell) acquired the company. In late 2005, SBC purchased AT&T and AT&T Connecticut was born.

Over the past seven years, AT&T has watched customers decline from more than two million customers to fewer than one million. AT&T introduced U-verse to improve its position in the market to mixed results. The company’s investments in fiber upgrades have not been as profitable as its wireless network, likely leading to today’s sale.

AT&T says it is not leaving Connecticut altogether. The company plans to keep business and wireless customers in the state.

Much of the proceeds from the deal will be invested by AT&T in its wireless network, mostly to help pay for 4G LTE upgrades. The rest will be spent bringing U-verse to more customers in the midwest and southern U.S.

The acquisition faces regulator approval from both the Federal Communications Commission and Department of Justice, likely to be forthcoming in the first half of 2014.

Frontier executives promised shareholders the deal will result in $125 million in cost savings over the next three years — code language for layoffs. Some of them are likely to be among the 2,400 workers represented by the Communications Workers of America, which has had a contentious relationship with AT&T Connecticut over job cuts in the past.

Subscribe

Subscribe If “follow the money” is a maxim in business, then it should come as no surprise Verizon favors the making the bulk of its investments and expansion in its enormously profitable wireless business.

If “follow the money” is a maxim in business, then it should come as no surprise Verizon favors the making the bulk of its investments and expansion in its enormously profitable wireless business.