Before regulators, the media, and elected officials, Comcast’s executive vice president David Cohen has repeatedly told all who can hear that there are no usage caps on Comcast’s broadband service.

Before regulators, the media, and elected officials, Comcast’s executive vice president David Cohen has repeatedly told all who can hear that there are no usage caps on Comcast’s broadband service.

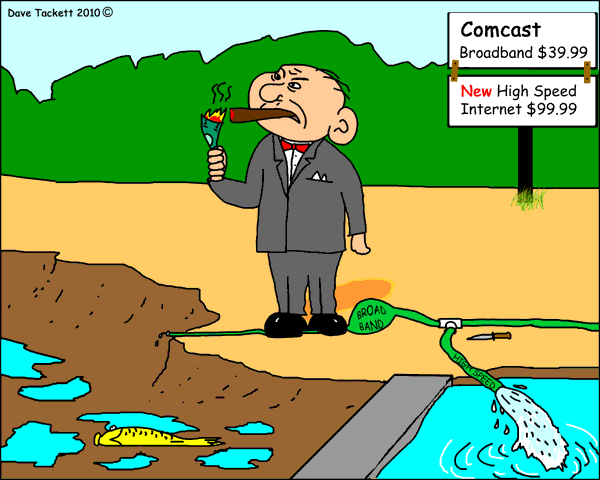

“There isn’t a cap anymore. We’re out of the cap business,” Cohen began saying in May 2012 after the cable company dropped its nationwide 250GB usage cap. But in several markets, mostly in the southern and western United States, Comcast snuck the caps back on residential Internet customers, only this time they claim it isn’t a usage cap at all.

“We effectively offer unlimited usage of our services because customers will have the ability to buy as much data as they want,” says the cable company these days.

But if the “usage caps” are actually gone, why is Comcast issuing executive-level memos to its customer service representatives and supervisors that repeatedly state the company does, in fact, have “data caps” in about a dozen cities across the country — part of an ongoing market trial that suggests Comcast is considering extending a new 300GB usage allowance nationwide.

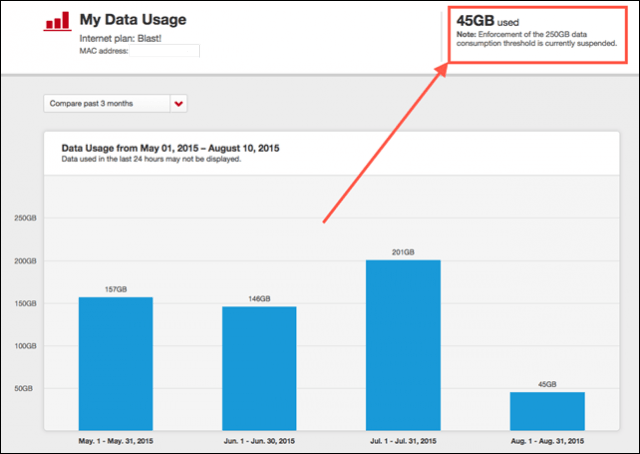

Stop the Cap! reader Joe, an AT&T U-verse customer in Woodstock, Ga. — 30 miles north of downtown Atlanta — was offered a deal to switch to Comcast for 75Mbps Internet service at an attractive price. All Comcast had to do was convince Joe he would never have to deal with Comcast’s 300GB cap that is being tested in Atlanta. Joe, like many Internet customers, will not sign up with a company that imposes usage allowances on its wired broadband customers. He isn’t interested in checking a usage meter and considers broadband usage overlimit fees a deal-breaker.

So Joe called Comcast to get some straight answers. Does Comcast impose its usage cap on customers in Woodstock, which is part of Comcast’s greater Atlanta service area? Current Comcast broadband customers in Woodstock tell Stop the Cap! the company absolutely does impose a 300GB usage cap on Internet service, and some have the overlimit fees to prove it. But Comcast’s customer service representative insisted it just was not true. To back her up, not one but two Comcast supervisors also swore Woodstock is not affected by “data caps.”

Joe knew enough to record the call. Because if he did sign up for service and maintained his current usage, often in excess of 400GB a month, that “good deal” offered by Comcast would be replaced by nightmarish overlimit fees of $10 for each 50GB increment he exceeded his allowance.

Stop the Cap! reader Joe recorded his Aug. 22, 2015 conversation with Comcast — a company that really, really, really wants to convince potential customers in Georgia there are no Internet data caps on its broadband service outside of the city of Atlanta. Except there are, including in Joe’s city of Woodstock, Ga.

Comcast executives repeatedly claim Comcast doesn’t have “usage caps” on its Internet service anywhere, but you will quickly lose count adding up the number of times Comcast’s representative specifically refers to Comcast’s “data caps” and its official “data cap document.”

(This recording has been edited for brevity and clarity. Tones indicate where significant edits were made, during the time Joe was left on hold and as the representative moves towards a last ditch sales pitch. At the end of the clip, Joe shares his first impressions after he hung up with Comcast. (8:28)

You must remain on this page to hear the clip, or you can download the clip and listen later.

“What makes me laugh is the fact she is so uncertain. Obviously Comcast doesn’t properly train their employees,” Joe writes. “Comcast reps spreading bad information like this is negligent [when they tell] unsuspecting customers that there is no data cap. I honestly cannot tell if this woman was flat-out lying, or was just poorly trained.”

Joe isn’t the only one being misinformed by Comcast.

Joe isn’t the only one being misinformed by Comcast.

“I’ve been lied to so many times about this,” Jamil Duder wrote. “Sometimes I will get in touch with their online support just to see what they will tell me this time for my own amusement. I’ve been told everything. It has been removed, it never existed, it’s actually 600GB not 300GB, etc.”

In fact, Comcast’s enforcement of its data cap has spread well beyond the city limits of Atlanta. Despite claims from Comcast to the contrary, customers around the state report they are now limited to 300GB of usage before overlimit fees kick in.

“Absolutely unacceptable, and you wonder why they have the reputation as the worst company in America,” Joe writes.

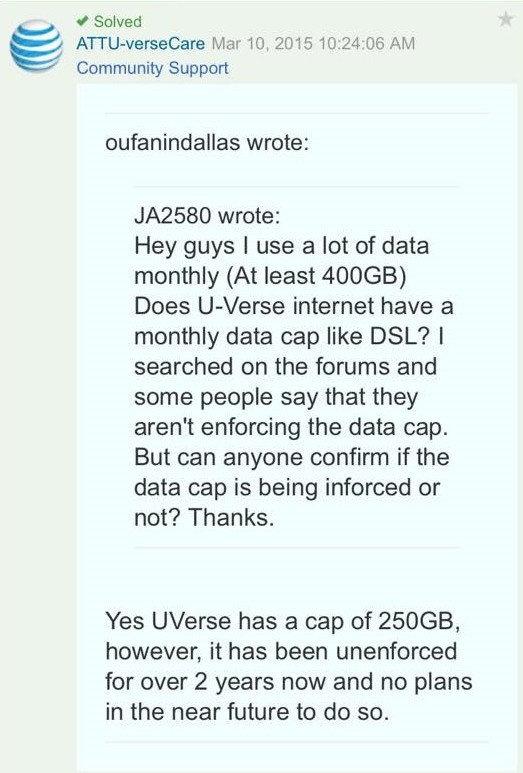

So why would Comcast blatantly misinform customers about usage caps. The company is in an unenviable position in several of the cities where they are testing their caps. Most of Comcast’s competition in the usage cap trial markets comes from AT&T U-verse, which itself claims a 250GB usage cap — one that customers also know isn’t being enforced.

For Joe, sticking with AT&T’s slower Internet speeds in return for peace of mind his usage is not being limited is a better prospect.

Eric Ravenscraft suspects Comcast isn’t too happy with complaints it is getting about data caps from its customers either. He recently received a call from Comcast seeking feedback on what customers would like to see changed about the caps. But in typical Comcast fashion, getting rid of the caps does not seem to be an option. Instead, the representative claimed “obviously, the plans are outdated,” which suggests Comcast will adjust your allowance, not get rid of it.

Eric Ravenscraft suspects Comcast isn’t too happy with complaints it is getting about data caps from its customers either. He recently received a call from Comcast seeking feedback on what customers would like to see changed about the caps. But in typical Comcast fashion, getting rid of the caps does not seem to be an option. Instead, the representative claimed “obviously, the plans are outdated,” which suggests Comcast will adjust your allowance, not get rid of it.

Ravenscraft believes the most effective force to convince Comcast to ditch its caps altogether might be the Federal Communications Commission.

“If you want to do something about it, rope the FCC in. Let them know how you feel about this,” Ravenscraft writes. “Not only does this give the FCC another complaint to add to the pile, Comcast is required to respond to your complaint—by contacting you directly—within 30 days after the FCC forwards your complaint along.”

Several readers are doing exactly that every time they are charged an overlimit fee by Comcast. Within 30-60 days, Comcast has reportedly credited back the overlimit charges to complaining customers.

“I’ve filed 10 complaints with the FCC each time I get an overlimit fee on my bill, and I always get the overlimit fees credited back,” reports Stop the Cap! reader Jeff in Atlanta. “It takes about five minutes to fill out the complaint form — a minor nuisance, but now I effectively don’t have a Comcast usage cap and I am costing them more money dealing with my complaints every month than they would ever get charging me extra in the first place. Imagine if we all did that.”

“Comcast sucks but we might actually have a shot at making things better if we all do this,” Ravenscraft adds. “Most cities aren’t subject to these restrictive data cap trials, but they’ll eventually roll out nationwide if customers here don’t speak up loudly enough. We’ve got a weirdly unique opportunity to actually change how the internet works in the U.S.”

Subscribe

Subscribe

North Carolina residents bypassed by Google Fiber and impatient waiting for AT&T U-verse with GigaPower may still have a chance to get gigabit fiber Internet.

North Carolina residents bypassed by Google Fiber and impatient waiting for AT&T U-verse with GigaPower may still have a chance to get gigabit fiber Internet.

That philosophy may still cost cable companies customers if a fiber competitor doesn’t have to compromise speed and performance and can afford to charge less.

That philosophy may still cost cable companies customers if a fiber competitor doesn’t have to compromise speed and performance and can afford to charge less.

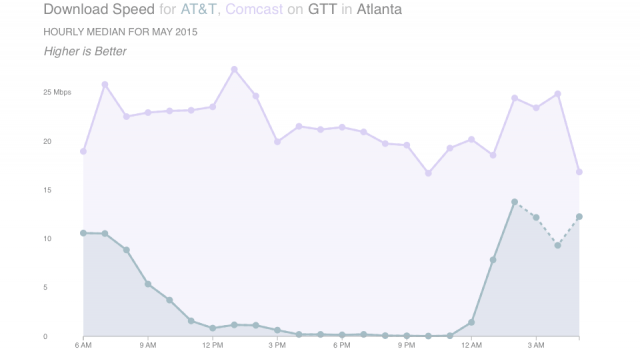

![MLab: "Customers of Comcast, Time Warner Cable, and Verizon all saw degraded performance [in NYC] during peak use hours when connecting across transit ISPs GTT and Tata. These patterns were most dramatic for customers of Comcast and Verizon when connecting to GTT, with a low speed of near 1 Mbps during peak hours in May. None of the three experienced similar problems when connecting with other transit providers, such as Internap and Zayo, and Cablevision did not experience the same extent of problems."](https://stopthecap.com/wp-content/uploads/2015/06/GTT-tata-640x357.png)

Missing from this discussion are AT&T customers directly affected by slowdowns. AT&T’s attitude seems uninterested in the customer experience and the company feels safe stonewalling GTT until it gets a check in the mail. It matters less that AT&T customers have paid $40, 50, even 70 a month for high quality Internet service they are not getting.

Missing from this discussion are AT&T customers directly affected by slowdowns. AT&T’s attitude seems uninterested in the customer experience and the company feels safe stonewalling GTT until it gets a check in the mail. It matters less that AT&T customers have paid $40, 50, even 70 a month for high quality Internet service they are not getting.