A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.

A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.

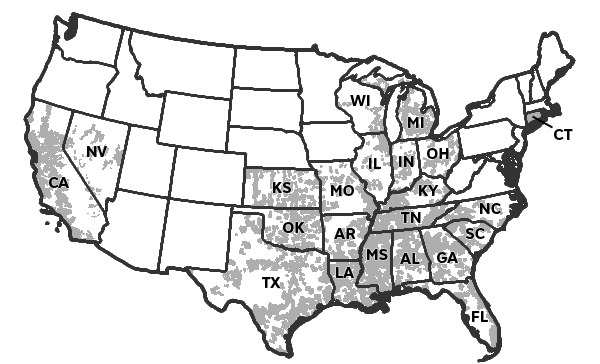

North Carolina is dominated by Time Warner Cable, AT&T and CenturyLink. Google and AT&T recently expressed interest in bringing their fiber networks to the home in several cities in the state, but neither have put a shovel in the ground.

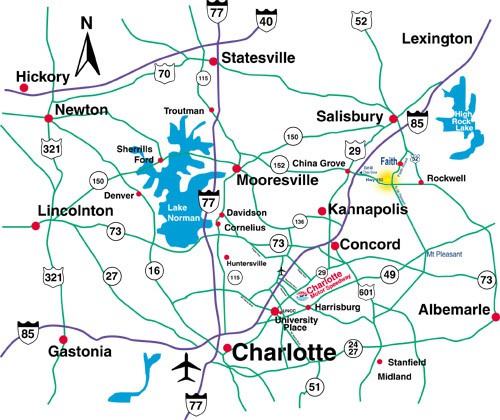

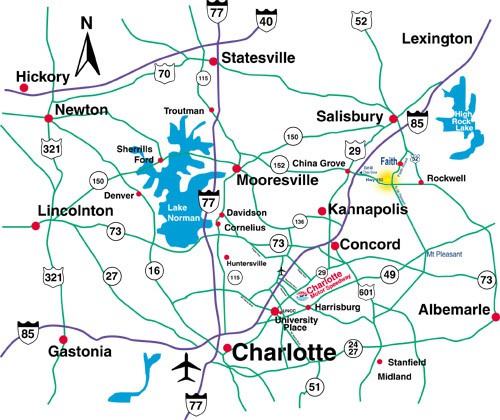

Fibrant, a community owned broadband provider in Salisbury, northeast of Charlotte, not only laid 250 miles of fiber optics, it has been open for business since November 2010. It was just in time for the publicly owned venture, joining a growing number of community providers like Wilson’s Greenlight and Mooresville, Davidson and Cornelius’ MI-Connection. Time Warner Cable’s lobbyists spent several years pushing for legislation restricting the development of these new competitors and when Republicans took control of the General Assembly in 2011, they finally succeeded. Today, launching or expanding community broadband networks in North Carolina has been made nearly impossible by the law, modeled after a bill developed by the American Legislative Exchange Council (ALEC).

With fiber fever gripping the state, Fibrant has gotten a lot of attention from Charlotte media because it provides the type of service other providers are only talking about. Fibrant offers residents cable television, phone, and broadband and competes directly with Time Warner Cable and AT&T. Although not the cheapest option in town, Fibrant is certainly the fastest and local residents are gradually taking their business to the community alternative.

Charlotte, N.C. is surrounded by community providers like Fibrant in Salisbury and MI-Connection in the Mooresville area.

“A lot faster Internet speeds, a lot clearer phone calls,” said Sidewalk Deli owner Rick Anderson-McCombs, who switched to Fibrant after 15 years with another provider. His mother, Anganetta Dover told WSOC-TV, “I think we save about $30 to $40 a month with Fibrant and the advantages of having the speed is so much better.”

Julianne Goodman cut cable’s cord, dropping Time Warner Cable TV service in favor of Netflix. To support her online streaming habit, she switched to Fibrant, which offers faster Internet speeds than the cable company.

Commercial customers are also switching, predominately away from AT&T in favor of Fibrant.

“Businesses love us because we don’t restrict them on uploads,” one Fibrant worker told WCNC-TV. “So when they want to send files, it’s practically instantaneous.”

Fibrant offers synchronous broadband speeds, which mean the download and upload speeds are the same. Cable broadband technology always favors download speeds over upload, and Time Warner Cable’s fastest upstream speed remains stuck at 5Mbps in North Carolina.

AT&T offers a mix of DSL and U-verse fiber to the neighborhood service in North Carolina. Maximum download speed for most customers is around 24Mbps. AT&T has made a vague commitment to increase those speeds, but customers report difficulty qualifying for upgrades.

Time Warner Cable is a big player in the largest city in North Carolina, evident as soon as you spot the Time Warner Cable Arena on East Trade Street in downtown Charlotte.

Taxpayer dollars are also funneled to the cable company.

Time Warner Cable’s $82 million data center won the company a $2.9 million Job Development Investment Grant. Charlotte’s News & Observer noted the nation’s second largest cable company also received $3 million in state incentives.

When communities like Salisbury approached providers about improving broadband speeds, they were shown the door.

[flv]http://www.phillipdampier.com/video/WCNC Charlotte Fibrant Already Provides Fiber 3-5-14.mp4[/flv]

WCNC-TV reports that with Google expressing an interest in providing fiber service in Charlotte, Salisbury’s Fibrant has been offering service since 2010. (2:57)

“Our citizens asked for high-speed Internet,” says Doug Paris, Salisbury’s city manager. “We met with the incumbent providers [like Time Warner and AT&T, and that did not fit within their business plans.”

Salisbury and Wilson, among others, elected to build their own networks. The decision to enter the broadband business came under immediate attack from incumbent providers and a range of conservative astroturf and sock puppet political groups often secretly funded by the phone and cable companies.

Rep. Avila, a ban proponent, meets with Marc Trathen, Time Warner Cable’s top lobbyist (right) (Photo: Bob Sepe)

Critics of Fibrant launched an attack website against the venture (it stopped updating in March, 2012), suggesting the fiber venture would bankrupt the city. One brochure even calls Stop the Cap! part of a high-priced consultant cabal of “Judas goats for big fiber” (for the record, Stop the Cap! was not/is not paid a penny to advocate for Fibrant or any other provider).

Opponents also characterize Fibrant as communism in action and have distributed editorial cartoons depicting Fibrant service technicians in Soviet military uniforms guarding Salisbury’s broadband gulag.

In January of this year, city officials were able to report positive news. Fibrant has begun to turn a profit after generating $2,223,678 in the revenue from July through December, 2013. Fibrant lost $4.1 million during the previous fiscal year. That is an improvement over earlier years when the venture borrowed more than $7 million from the city’s water and sewer capital reserve fund, repaying the loans at 1 percent interest. The city believes the $33 million broadband network will break even this year — just four years after launching.

Fibrant is certainly no Time Warner Cable or AT&T, having fewer than 3,000 customers in the Salisbury city limits. But it does have a market share of 21 percent, comparable to what AT&T U-verse has achieved in many of its markets.

Fibrant also has the highest average revenue per customer among broadband providers in the city — $129 a month vs. $121 for Time Warner Cable. Customers spend more for the faster speeds Fibrant offers.

Some residents wonder if Fibrant will be successful if or when AT&T and Google begin offering fiber service. Both companies have made a splash in Charlotte’s newspapers and television news about their fiber plans, which exist only on paper in the form of press releases. Neither provider has targeted Salisbury for upgrades and nobody can predict whether either will ultimately bring fiber service to the city of Charlotte.

Those clamoring for fiber broadband speeds under the state’s anti-community broadband law will have to move to one of a handful of grandfathered communities in North Carolina where forward-thinking leaders actually built the fiber networks private companies are still only talking about.

[flv]http://www.phillipdampier.com/video/WSOC Charlotte Charlotte could gain from fiber optic network already in place 4-22-14.flv[/flv]

WSOC-TV in Charlotte reports Salisbury customers are happy with Fibrant service and the competition it provides AT&T and Time Warner Cable. (2:12)

Subscribe

Subscribe

The deal, finalized on Sunday, pays $95 per DirecTV share in a combination of stock and cash, about a 10% premium over DirecTV’s closing price on Friday. Including debt, the acquisition is AT&T’s third-largest deal on record, behind the purchase of BellSouth for $83 billion in 2006 and the deal for Ameritech Corp., which closed in 1999, according to data compiled by Bloomberg.

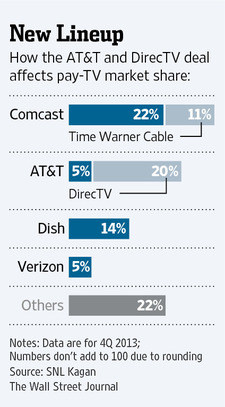

The deal, finalized on Sunday, pays $95 per DirecTV share in a combination of stock and cash, about a 10% premium over DirecTV’s closing price on Friday. Including debt, the acquisition is AT&T’s third-largest deal on record, behind the purchase of BellSouth for $83 billion in 2006 and the deal for Ameritech Corp., which closed in 1999, according to data compiled by Bloomberg. The deal would combine AT&T’s wireless, U-verse, and broadband networks with DirecTV’s television service, creating bundling opportunities for some satellite customers. As broadband becomes the most important component of a package including phone, television, and Internet access, not being able to offer broadband has left satellite TV companies at a competitive disadvantage. AT&T’s U-verse platform – a fiber to the neighborhood network – has given AT&T customers an incremental broadband speed upgrade, but not one that can necessarily compete against fiber to the home or cable broadband.

The deal would combine AT&T’s wireless, U-verse, and broadband networks with DirecTV’s television service, creating bundling opportunities for some satellite customers. As broadband becomes the most important component of a package including phone, television, and Internet access, not being able to offer broadband has left satellite TV companies at a competitive disadvantage. AT&T’s U-verse platform – a fiber to the neighborhood network – has given AT&T customers an incremental broadband speed upgrade, but not one that can necessarily compete against fiber to the home or cable broadband.

A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.

A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.