How accurate is the map?

The biggest story you know nothing about is taking place at the Federal Communications Commission in Washington, where regulators are trying to figure out what to do with $185 million in leftover broadband expansion funds Internet Service Providers either could not qualify for or did not want. The FCC is on the verge of making a decision, one that will rely on broadband map data that service providers are now calling grossly inaccurate.

During the first phase of the Connect America program to fund broadband expansion in rural areas, the Commission offered up to $300 million to providers willing to wire consumers and businesses deemed too unprofitable to serve.

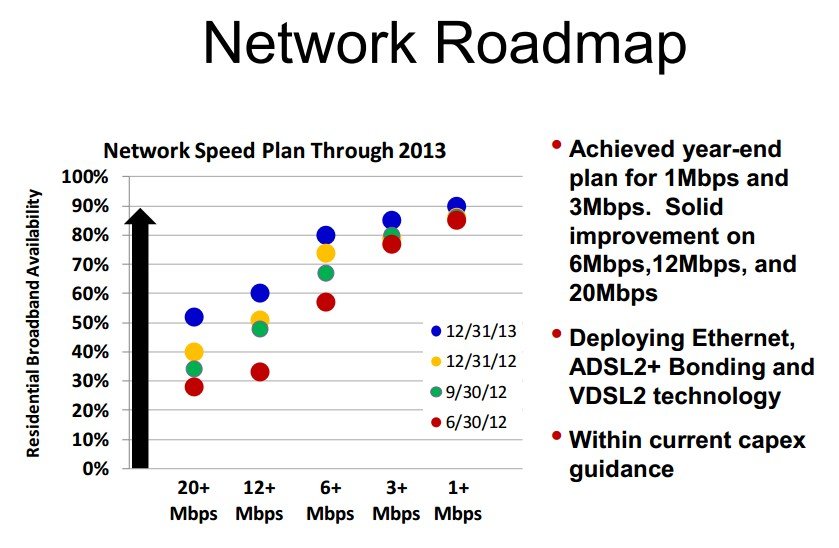

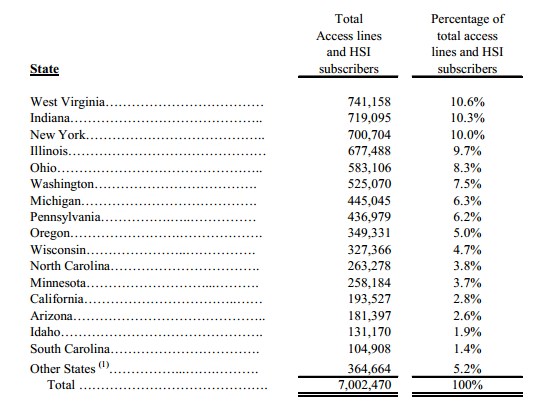

The rules largely favored phone companies, and although some including Frontier Communications gratefully accepted the funding to expand their DSL service, both of America’s largest phone companies expressed little interest. Many others, including CenturyLink and Windstream, petitioned to change the rules.

In the end, less than half of the available funding — $115 million — was actually spent, none in areas served by AT&T and Verizon.

The initial guidelines for participation were not exactly a high bar to cross. Under the program’s original rules, providers are required to deploy broadband within three years to certain locations that receive less than 768kbps downstream and 200kbps upstream (or no service at all). That “means test” set the bar far below the minimum speed providers can even call “broadband” under the FCC’s own current definition: 4/1Mbps.

Anyone served by 1-3Mbps DSL “broadband” was instantly ineligible because the FCC effectively deemed those speeds ‘good enough for now.’ The FCC argued it wanted to first target funds to those without any service at all, not those who had inadequate service.

Participating carriers receive compensation up to $775 per home to defray connection costs, bringing expenses closer to the Return on Investment-test that decides whether your rural home will have broadband service or not. Large phone companies complained the subsidy was not nearly enough and did not bother applying. Some others said even with the subsidy, it was still too unprofitable to wire rural homes in their service areas.

This not-so-auspicious start of the Connect America project has driven the FCC to propose modifying the rules to increase participation by disinterested providers. In an opaque “Further Notice of Proposed Rulemaking,” the Commission proposes new rules that will “further accelerate the deployment of broadband facilities to consumers who lack access to robust broadband.”

Under the new guidelines, providers could be able to apply for funding if the areas they propose to serve are not already getting at least 4/1Mbps service. But in a surprising footnote, the FCC announced they will “use 3Mbps downstream and 768kbps upstream as a proxy for 4/1Mbps service.” In other words, the FCC is ignoring its own standard definition of broadband and settling for something less. That will leave customers waiting for something better than 3Mbps service up the creek, excluded from Connect America funding.

The U.S. Telecom Association is a lobbying group dominated by AT&T, Verizon and other phone companies.

The U.S. Telecom Association (USTA), which represents phone companies, was appalled, suggesting this footnote will block funding from approximately one million rural households that receive what most of us would consider substandard broadband.

“This is particularly true for rural areas served by DSL which in most cases has been engineered to provide an upstream speed of 768 Kbps,” the USTA wrote in comments to the FCC. “In such cases, significant and costly network upgrades would be necessary to provide broadband service meeting the 4/1Mbps benchmark. Therefore, rather than relying on evidence of 3/768 service to exclude areas from eligibility, the Commission should use the next speed tier—6/1.5Mbps as a proxy for 4/1 service.”

Windstream, in its own comments, was reduced to educating the FCC about the basic technical facts of DSL:

One Mbps upload speeds are not necessarily available to all customers served by standard ADSL 2+ architecture over a 24 AWG copper pair of 12,000 feet. Rather, delivery of reliable upload speeds of 1 Mbps would require an upgrade, such as two-pair bonded ADSL 2+. Two-pair bonded ADSL2+ essentially doubles last mile deployment cost since the end user modem is two to three times the cost of a normal single pair modem, two cable pairs are used instead of one, and two ADSL2+ ports are required at the DSLAM. Moreover, to achieve 1 Mbps of customer payload throughput would require an upload connection speed of more than 1.2 Mbps, while an upload connection speed of 1 Mbps would produce an actual throughput of about 820 Kbps.

Even where the loop length from the DSLAM to the customer is less than 12,000 feet, a service provider can only deliver service meeting the 4/1 requirement—or more precisely, service at speeds of 6/1.5Mbps, the next-fastest standard service tier—if the DSLAM is ADSL2+ capable and fiber-fed.

Windstream provides a primer on DSL to the FCC.

The resource that will determine who qualifies for broadband funding and who does not is the National Broadband Map, which seeks to describe the broadband options available at hundreds of millions of American addresses. If the map shows an area unserved, it qualifies for funding. If the map shows there is no broadband inadequacy, no funding will be offered.

Unsurprisingly, providers of all kinds are hurrying in comments that declare often considerable inaccuracies in the FCC’s map. This is ironic since much of the collected data on which the map is based was voluntarily supplied by those providers.

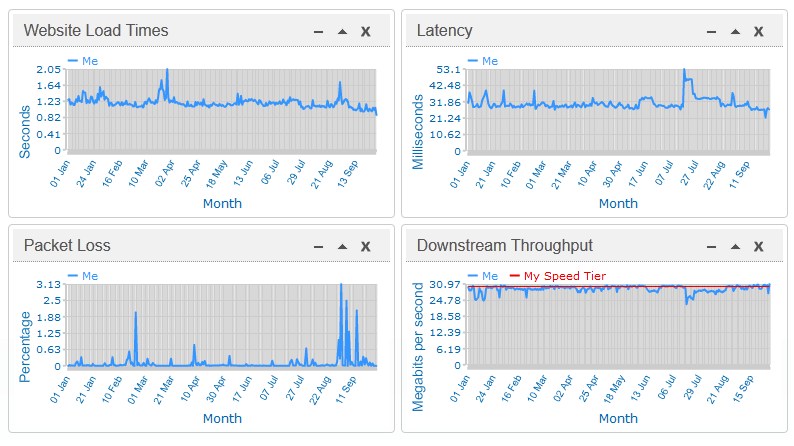

In various submissions filed with the FCC, several ISPs suggest the national map is not to be trusted. Some complain the updated service areas they earlier submitted have never been incorporated into the map, others are discovering inaccuracies for the first time because they can make the difference between winning or not qualifying for rural broadband funding (either for themselves or a competitor). Among other complaints: providers are overestimating their coverage and fibbing about actual speeds, the map’s census tract granularity ends up declaring an area served if even one household manages to get DSL service while others cannot, and providers only serving business customers are treated as if they serve everyone.

Mississippi Gov. Phil Bryant is asking the FCC to clean up the inaccuracies in the Mississippi portion of the National Broadband Map.

The state of Mississippi is the poster child for inaccuracies in the National Broadband Map. All that was required to disqualify most of the state from rural broadband funding was a boastful and inaccurate submission from one cable broadband reseller that claimed they served virtually all of Mississippi. Nobody bothered to question the veracity of their submission or verify it. Now the governor’s office is involved in efforts to scrub the inaccurate broadband map they consider more a fantasy than reality on the ground.

With the FCC preparing to launch the second phase of the Connect America Fund with up to $1.8 billion of available funding per year over five years, the money sharks are in the water circling one another.

Cable operators and wireless ISPs are asking the FCC not to hand out money to their competitors and phone companies are returning fire claiming those providers are lying about their coverage areas and have restrictions on service.

Companies ranging from Comcast to small, independent cable operators working with the American Cable Association are filing objections to the existing map. Wireless ISPs, often family-owned, are even more worried what will happen if phone companies like Windstream get federal dollars to upgrade their DSL service while unsubsidized WISPs are left to compete on their own.

In fact, the Competitive Carriers Association argues wireless providers are best positioned to make use of the unspent funds to deploy rural wireless broadband immediately.

“Wireless carriers offer the best opportunity to bring much needed broadband services to unserved and underserved areas, and it only makes sense for the FCC to consider proposals from wireless carriers,” said CCA president Steven K. Berry. “Many of our members are ready and willing to build out these networks, but depend on [financial] support in order to do so. Wireless remains underfunded, and this could be an opportunity for the FCC to provide significant support for the services consumers want most.”

Not if the USTA and Windstream have anything to say about it. Both are on the attack in comments filed with the FCC:

WISPs: “Coverage should be independently verified before such areas are considered ineligible for Connect America funding. Like satellite providers, WISPs often have capacity caps and service quality issues, including unpredictable degradation from third-party interference from common devices such as cordless phones, garage door openers and microwave ovens when WISPs use unlicensed spectrum. The sustained speeds WISPs offer, particularly during busy times, also tend to be slower than those offered by [phone company broadband], and certainly slower than the 4Mbps downstream standard required of future recipients of federal funding.” — U.S. Telecom Association

The USTA also attacks WISPs for their usage caps, which they claim should disqualify them from serious consideration because their networks are technically and realistically inadequate to service today’s broadband consumer.

Cable “Competitors”: Windstream claims the bare existence of a cable operator alone should not disqualify the phone company from funding. Windstream suggests cable companies in its service areas may only serve one or two customers in a census tract, not really offer service at all, or provide sub-standard broadband that is so bad, nobody will do business with them.

Windstream proposes its own competition test: “In many areas […] with an alleged presence of an unsubsidized competitor, Windstream has received no requests in the past two years from customers for telephone number ports that are accompanied by cancellation of the customer’s Windstream broadband service. In other words, despite the alleged presence of a competitor providing service at speeds of at least 3/768 in areas where Windstream itself does not provide service exceeding 3/768, Windstream has not received a single request in two years in an entire area to port a phone number to a competitor and cancel the associated Windstream broadband service. Windstream submits that the lack of such porting requests throughout an entire area over a reasonable historical period is strong evidence that there is no competitor providing 3/768 or better service in that area.”

The independent phone company proposes that alleged unsubsidized competitors offer proof they are actually providing service before the FCC excludes an area from funding consideration.

“Here is our view.” — Phillip Dampier

Consumers are free to share their own views with the FCC on these matters by filing their own comments here. The Proceeding Number you will need is 10-90. It is generally easier to create a .PDF, standard .txt file, or Microsoft Word document and attach it to the submission form. Your comments will be publicly visible and posted to the FCC website.

Stop the Cap! feels the FCC should not renege on its commitment to fund rural providers that will guarantee customers will receive at least 4/1Mbps service. This barely adequate minimum will require phone companies to upgrade their facilities to next generation DSL technology that can support future speed upgrades. Compromising on lower speeds gives phone companies the option to deploy outdated early generation DSL that cannot be upgraded easily. In a positive development, many phone companies seem willing to commit to these upgrades with some financial assistance.

Funding should also be available to the provider that can deliver the best broadband service at the lowest cost. As urban and suburban customers have learned, that service often does not come from the phone company. Cable operators willing to commit to rural broadband upgrades should not be disqualified from funding, nor should community-owned providers who want to build their own networks.

We have also repeatedly complained about broadband mapping that lacks a formal mechanism to clearly verify coverage and speeds independent of the ISP supplying the data. Providers have an incentive to artificially boost or reduce coverage, particularly if it means the difference between qualifying for federal broadband expansion funding or disqualifying a competitor because the provider can falsely claim they already offer the service.

Our thanks to Cassandra Heyne, who dubbed the current situation an FCC ‘maptastrophe.’

Subscribe

Subscribe