Mark Lowenstein was a vice president of strategy at Verizon Wireless, where helped set pricing for the carrier.

The key to turning America into a haven for Internet Overcharging schemes is Re-educating customers to accept that unlimited ‘isn’t fair,’ especially in wireless mobile broadband.

Mark Lowenstein, an industry analyst and commentator, has given his prescription to Internet providers just itching to slap usage limits and overlimit fees on consumers enjoying unlimited broadband service: you have to Re-educate consumers to accept Internet Overcharging schemes as a “positive” rather than a “punitive” development.

Fierce Wireless, where Lowenstein’s ideas were published, left out the fact he was also a senior executive at Verizon Wireless.

Despite the billions in profits earned from today’s broadband marketplace, some in the industry want to banish “unlimited” from subscribers’ lexicons. Sure it’s true that many companies’ investments in broadband expansion and upgrades have actually declined in the last few years, right along with the costs to provide the service. But in a world where revenues in other parts of the business are drying up, someone has to make up the difference — you.

For AT&T, the decision was easy. If you want the raging-popular iPhone, you’re going to need a two-year service contract and a data plan limited to 2 GB of usage per month. Exceed that at your financial peril (or use a Wi-Fi hotspot and stay off our 3G network). Don’t like it? Too bad for you. Where else will you find a subsidized iPhone?

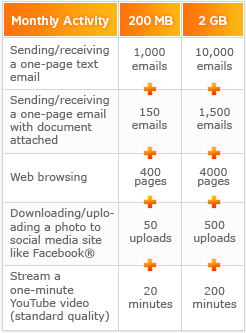

Now that AT&T has thrown down the smartphone cap gauntlet, Lowenstein is ready to offer carriers advice on how to make their abusive pricing schemes go down better with consumers. He wants everyone to take a crash course in computer science. Grandparents everywhere will come to understand the meaning of megabyte and get into the habit of contemplating how many of those will be eaten from usage allowances everytime they use their phones.

A key part of the transition to usage-based pricing is going to be educating users and the app development community about what a “megabyte” is, as well as developing more advanced tools and the right early warning systems to ensure wireless operators don’t end up testifying before Congress for Bill Shock, Part 2. U.S. consumers are accustomed to flat-rate pricing in all other aspects of their connected life: landline phone, wireless voice (increasingly), cable, broadband and so on.

Lowenstein considers AT&T Usage Estimator to be “nifty,” missing the irony of his own declaration that AT&T’s nasty cap means “moderate usage of anything multimedia gets you to 2 GB pretty fast.” AT&T, he notes, also helpfully notifies customers they are about to bust through AT&T’s subjective definition of an appropriate usage allowance.

He concedes there are some “gray areas” — mere minutiae in AT&T’s greater scheme for fatter profits:

- New generation multitasking smartphones can run apps and other bandwidth-consuming features in the background, sometimes simultaneously, leading to exponential increases in data usage;

- The model of the “constant connection” means apps in the background exchanging data over the mobile network 24/7 could consume plenty of data, or perhaps not. Few know for sure;

- Consumers are forced to pay for spam, advertising, unwanted file transfers and attachments, and other data not specifically requested;

- Family plan users now need to track something else on AT&T’s website — how much data their kids are using. Remember the wars over cell phone voice calling plan overages and text messaging? Wait.

In Lowenstein’s world-view, this all represents opportunity.

In Lowenstein’s world-view, this all represents opportunity.

Among his suggestions:

- Add special ratings to apps that are highly consumptive of content.

- Provide notification before certain content downloads or heavy usage apps.

- Provide a view into other family plan users.

- Provide the option for sponsored content and value exchange.

That last one may prove to be the most controversial at all. It assumes the Kindle model — where the content producer builds in the price of network consumption. That would make AT&T’s day — forcing content producers to cough up money to deliver content over the same network AT&T already charges customers to access. Who would turn down being paid twice for the same thing? Lowenstein’s model allows for advertisers to defray part of the costs:

An advertiser or sponsor could pick up some of the network cost. Or the content publisher could bundle the price of data into the app. Users are comfortable with the “choice” model in the TV world: view it for free on broadcast or Hulu, with commercials; pay a monthly fee for the DVR service and skip the ads; or pay a premium to view that content on-demand, commercial-free.

That suggestion benefits AT&T enormously, but does nothing for content producers who can’t even sustain themselves with advertising. Lowenstein suggests they should now seek out advertisers to remunerate AT&T? The implications of wireless carriers deciding who gets the usage-cap-exempt content deal and who doesn’t opens a whole new Pandora’s Box. It effectively allows a handful of companies to pick the winners and losers in the mobile broadband marketplace. After all, if AT&T offered free videos on its own video portal but didn’t exempt other websites with the same video content, guess where users will choose to watch.

Lowenstein believes taking these kinds of steps will somehow insulate the wireless industry from charges it’s barely competitive, restricts too much, and charges even more. Yet usage limits like AT&T’s, coming even as carriers enrich themselves with gotcha add-on plans and extra fees will speak far louder than AT&T providing customers a guide on how to be abused by the wireless carrier just a little less.

I also think how usage-based pricing is handled in wireless will be closely watched in the wired broadband world. Consumers have become accustomed to flat-rate pricing for unlimited data from their broadband provider. But with the exponential growth of video consumption, and the notion of more TV and movie programming being downloaded from or streamed via the Internet, usage-based pricing for certain types of content or highly consumptive customers might be coming to a broadband neighborhood near you.

The “unlimited” ride might be coming to an end, but there’s an opportunity to implement it in a positive, rather than a punitive, manner.

In spite of Lowenstein’s love of telecom industry talking points (hardly a surprise considering he works for that industry), his notions that consumers will accept increasing broadband bills even as the level of service provided is reduced makes him not only wrong, but hopelessly out of touch.

Oklahoma residents — your state government needs you… to test your broadband speeds.

Oklahoma residents — your state government needs you… to test your broadband speeds.

Subscribe

Subscribe