U.S. Cellular Monday told investors the company plans to abandon unlimited data service sometime in the next two or three quarters in favor of tiered data plans similar to what is on offer from AT&T and Verizon Wireless.

U.S. Cellular Monday told investors the company plans to abandon unlimited data service sometime in the next two or three quarters in favor of tiered data plans similar to what is on offer from AT&T and Verizon Wireless.

U.S. Cellular president and CEO Mary Dillon told investors the company is changing pricing as a result of “significant changes in pricing strategies” at their larger competitors, who have moved away from unlimited data plans over the last year. Dillon applauded the adoption of tiered data pricing, but noted increasing pricing pressure in the market.

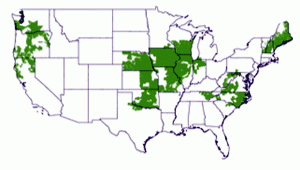

For the nation’s sixth largest wireless carrier, best known in the midwest, northern New England, the Carolinas, and northern California, being a regional provider in an increasingly concentrated wireless marketplace has some on Wall Street concerned about the long term viability of smaller cell phone companies.

Blaming the continuing challenges of “an extremely competitive market and a sluggish economy in which carriers continue to fight for a dwindling pool of new subscribers and the cost of acquiring switchers are significant,” the company reported a net loss of 41,000 customers during the last quarter. Only 226,000 new customers signed up, down from 307,000 in the prior year quarter. Another 17,000 prepaid customers dropped U.S. Cellular last quarter as well. U.S. Cellular now has just under six million customers in all.

Adrian Mill from Eagle Capital noted the customer losses — presumably to larger AT&T or Verizon Wireless, and pondered how long the company can continue to exist on its own in a market increasingly dominated by those two larger carriers:

“I know you guys did a lot of work a couple years ago on whether our regional cellular company could still be relevant and looked at ways in other industries and had some good data from it.

I’m just curious if after the past couple quarters of results where we’ve now seen everybody lose share to AT&T and Verizon if that was something you thought might happen in short term or if it’s been surprising?

If its been surprising, how long would you guys potentially consider losing subs before you do a strategic transaction or consider a sale?”

U.S. Cellular executives didn’t directly answer the question, but acknowledged the wireless carrier does have challenges in the marketplace its larger competitors don’t have. They include:

- Access to coveted smartphones, particularly Apple’s iPhone, which continues to be unavailable from smaller, regional wireless carriers;

- Access to sufficient wireless spectrum to deploy robust data networks to meet customer demand;

- Capital requirements to build and expand the next 4G generation of wireless;

- The downward pressure on smartphone equipment pricing due to competition and expensive equipment subsidies;

- Roaming agreements to ensure nationwide coverage for voice and data services.

Company officials told investors U.S. Cellular intends to continue to compete for new customers, leveraging its top consumer ratings for reliable service and satisfaction with the deployment of its own 4G LTE wireless network. But first it intends to re-align pricing to reduce costs.

Alan Ferber, U.S. Cellular’s executive vice-president, sales operations, notes U.S. Cellular wants to see more of its customers upgrade to smartphones, which guarantee higher revenues per customer from the higher-priced service plans that accompany the phones. The company needs less expensive phones from manufacturers, because consumers typically won’t pay more than $200 for a smartphone that comes with a 2-year service agreement.

Ken Meyers, chief financial officer for the company, has been crunching the numbers on smartphone equipment costs and is grateful for the presence of Android phones in the marketplace, which are starting to drive phone prices downwards.

“[It’s] exciting to me is to see what’s happening with the Android phone cost that will allow carriers to start to recapture some of the economics needed to support LTE [4G] investment and the subsidization of those smartphones, whereas that works on a $200 smartphone but if I’m subsidizing $400 or $500 suddenly most of that revenue isn’t going to pay for the network,” Meyers said.

Ferber expects to deliver new smartphones to U.S. Cellular customers for less than $200 by the holiday season, so customers will find the initial cost for phones lower than ever. But Ferber admits the company’s forthcoming tiered data pricing means increased revenue and “better cost controls” over the life of a customer’s 2-year contract.

“We have also talked about things like tier data pricing on a going forward basis,” Ferber said. “We do believe that has at least two major benefits. The first is to align data revenue with data cost better and the second is to, in combination with the lower cost smartphones, enable more customers to get into a smartphone.”

But Ferber also acknowledges the company’s move to LTE 4G technology will actually cut the company’s costs to deliver that data — great news to investors, but potentially higher cell phone bills for consumers.

“Over the long turn it’ll certainly make the economics much more attractive,” Ferber said.

Other highlights from Monday’s conference call:

- U.S. Cellular will not acquire other providers not within or adjacent to its current operations, but is stockpiling cash for the potential purchase of any T-Mobile territories the federal government requires AT&T to divest as part of any merger agreement. T-Mobile is not a major competitor in most of U.S. Cellular’s more-rural/suburban markets, but if U.S. Cellular does acquire any of these customers, they will have to convert them from T-Mobile’s GSM network to the company’s CDMA network;

- Data roaming from Verizon and Sprint customers traveling through U.S. Cellular’s service areas have brought increased traffic to the company’s data network, and roaming revenue with it;

- System operations expenses of $228 million were up $14 million or 7% year-over-year. This was due primarily to higher usage and roaming expenses as customers use more data services both on and off U.S. Cellular’s network. Through June of this year, total data of network usage increased nearly 400% over the same period last year.

Subscribe

Subscribe