Carol Jameson simply can’t afford to spend $70 a month for cable television any longer. Although Canada’s economy is doing better than some, Jameson’s husband recently had to endure a pay cut, and the costs of raising their two teenage children are not getting any lower. The London, Ont. Rogers Cable customer ran several kitchen table meetings to discuss what expenses could be cut from the family budget. Her teenage son and daughter targeted the family’s landline telephone — an archaic curiosity of the past for today’s cell-phone-obsessed youth, and cable-TV, which they saw as increasingly irrelevant.

“Just don’t touch the Internet connection,” Carol was advised.

Despite concerns from her sports-addicted husband, Jameson decided to start shopping around, and definitely decided the days of their landline was over. In her neighborhood, “shopping around” meant choosing from Rogers Cable or a satellite TV provider. Bell’s Fibe — fiber to the neighborhood — service was not up and running in her part of London.

“I had settled on a basic satellite package and keeping Rogers’ broadband and called the cable company to share the bad news,” Carol tells Stop the Cap! “But when I tried to cancel, I was transferred to someone who said I could stay and pick and choose only the channels I wanted to watch and pay for.”

Carol was shocked Rogers had a solution for her high cable bill that it never bothered to share until she tried to cancel.

“You can’t find a thing about this deal online or even on the phone with Rogers’ customer service, and who would think to ask after years of getting dozens of channels we never watch,” Jameson says.

Carol was being pitched Rogers’ new “Pick and Pay” service, currently undergoing a five month trial in the London area.

“I was offered the service until March 2012, after which I was advised to call Rogers back and discuss my options after the trial ends, if it ends,” Jameson tells us.

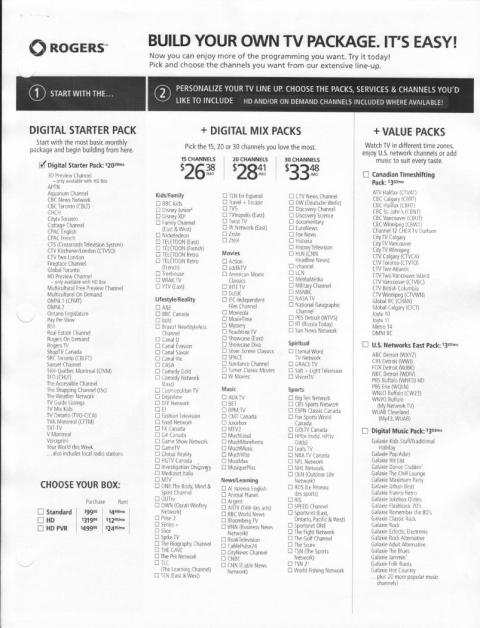

Rogers’ “Pick and Pay” is a modified a-la-carte suite of offerings. It does not allow customers to pick and choose only the channels they wish. It instead asks customers to sign up for a $20 basic cable package containing local broadcasters and certain other channels Canadian telecommunications regulators want all Canadians to have access to, and several channels Rogers wants their customers to have (home shopping, The Fireplace, Aquarium, and Sunset Channels, etc.) Beyond that, customers can choose from mini-packages of Canadian superstations, U.S. broadcast stations, and digital music. Customers then select 15, 20, or 30 channels of their choosing ranging in price from $26.38-$33.48 per month.

“It’s better than $70 a month, but not by too much,” Carol says.

Carol and her husband decided to consider the offer, but found an exact list of channels hard to come by.

“That’s not a problem limited to me,” Carol reports. “The Globe & Mail featured Rogers’ new cable package and the customer in that case had to obtain a photocopied list of channel choices because Rogers didn’t have one online.”

Carol ended up with the 20 channel add-on package and the U.S. network station suite, which runs $28.41 and $3, respectively. That means her cable TV bill dropped to $52 a month, just over $22 a month less.

Rogers' scarce photocopied channel listing for their "Pick and Pay" package, obviously removed from an employee's three-ring binder.

“But here is where Rogers gets you by your pocketbook,” Carol warns. “You have to take Rogers’ phone service with the deal, so now the landline is back, although they charge less than Bell.”

Jameson also notes these prices do not include mandatory extras:

- $4.49 – Digital terminal rental (per TV)

- $2.99 – Digital service fee

- $0.70 – Local Programming Improvement Fund Fee

- + G.S.T. (taxes)

“So much for the savings,” Carol says.

The Globe & Mail speculates the Rogers’ trial is rigged to convince Canadian regulators there is little interest in a-la-carte cable, at least the way Rogers has packaged it (and kept it hidden from public view):

The Globe & Mail speculates the Rogers’ trial is rigged to convince Canadian regulators there is little interest in a-la-carte cable, at least the way Rogers has packaged it (and kept it hidden from public view):

In September, the Canadian Radio-television and Telecommunications Commission said that it had received complaints from consumers about being forced to pay for too many channels they do not watch, and that it expects cable and satellite companies to change that. The CRTC ordered all TV providers to report back by April on what actions they have taken to give subscribers more choice.

But cable and satellite executives have told the CRTC in hearings that there is no consumer demand for cheaper, “skinny basic” packages that offer fewer channels at lower cost than today’s basic TV packages. And some think that Rogers will use the London example to tell the CRTC that there isn’t much demand for the product.

Customers like the Jameson family might end up unwittingly proving Rogers’ point.

“After all of the extras, we rejected the plan and were all ready to switch to satellite and keep the broadband, but at the last minute Rogers offered us new customer pricing on their standard package for a year if we agreed to stay, and we did,” Carol tells us. “A-la-carte cable is exactly what we need, but this isn’t it. Maybe that is why Rogers keeps it a secret.”

Subscribe

Subscribe