James

New York Attorney General Letitia James and California Attorney General Xavier Becerra today filed an unusual multi-state lawsuit, along with eight other State Attorneys General to halt the proposed merger of telecom giants T-Mobile and Sprint, deciding not to wait for a decision from the Department of Justice, which is also reviewing the merger. The complaint, filed in the federal Southern District of New York court in coordination with Colorado, Connecticut, the District of Columbia, Maryland, Michigan, Mississippi, Virginia, and Wisconsin alleges that the merger of two of the four largest national mobile network operators would deprive consumers of the benefits of competition and drive up prices for cellphone services.

“When it comes to corporate power, bigger isn’t always better,” said Attorney General Letitia James. “The T-Mobile and Sprint merger would not only cause irreparable harm to mobile subscribers nationwide by cutting access to affordable, reliable wireless service for millions of Americans, but would particularly affect lower-income and minority communities here in New York and in urban areas across the country. That’s why we are going to court to stop this merger and protect our consumers, because this is exactly the sort of consumer-harming, job-killing megamerger our antitrust laws were designed to prevent.”

“Although T-Mobile and Sprint may be promising faster, better, and cheaper service with this merger, the evidence weighs against it,” said Attorney General Xavier Becerra. “This merger would hurt the most vulnerable Californians and result in a compressed market with fewer choices and higher prices. Today, along with New York and eight other partner states, we’ve filed a lawsuit to block this merger and protect the residents of our state.”

The states departed from traditional courtesies in the case, deciding to launch a pre-emptive legal challenge to the transaction without providing Justice Department officials advance notice of their decision to sue. That decision may have come after FCC Chairman Ajit Pai gave his full support for the merger, with indications the Republican majority on the FCC would also vote in favor of approving the deal. Staffers in the Antitrust Division of the Justice Department object to the merger, and are recommending it be rejected. But the Justice Department’s unpredictability, and its poor track record trying to block the AT&T-Time Warner (Entertainment) merger in court may have pushed the state attorneys general to also act on their own.

T-Mobile USA and Sprint are the third and fourth largest mobile wireless networks in the U.S., and are the lower-cost carriers among the “Big Four” — with market leaders Verizon Wireless and AT&T controlling the larest share of the wireless market. Intense competition, spurred in particular by T-Mobile and Sprint, has delivered declining prices, increased coverage, and better quality for all mobile phone subscribers. According to the Labor Department, the average cost of mobile service has fallen by roughly 28 percent over the last decade, while mobile data consumption has grown rapidly. The merger, however, would put an end to that fierce competition, argue the attorneys general, which has delivered a great number of benefits to consumers.

States with large urban poor communities are particularly sensitive to the merger, because both T-Mobile and Sprint focus their coverage on urban areas. With the average U.S. household spending $1,100 annually on wireless phone service, even small rate increases can dramatically increase service suspensions or disconnections due to late or non-payment.

States with large urban poor communities are particularly sensitive to the merger, because both T-Mobile and Sprint focus their coverage on urban areas. With the average U.S. household spending $1,100 annually on wireless phone service, even small rate increases can dramatically increase service suspensions or disconnections due to late or non-payment.

“Low-and moderate-income (LMI) New Yorkers put a greater share of their household income toward their phone bill, and when you are looking at a budget that is already stretched thin, every dollar counts,” said Mae Grote, CEO of the Financial Clinic. “Cellphones now not only give us the ability to communicate with friends and family, here and abroad, but are increasingly the way we engage with many critical services. Our customers use cellphone apps to access public information, send and receive money, manage their SNAP benefits, look for a job, and even communicate with their doctors, and maintaining competition in the market for this critical service ensures LMI consumers have the same access to quality, affordable service as the more financially secure. The Clinic is proud to advocate on behalf of the communities we serve to protect their inclusion in the modern economy.”

The attorneys general investigation laid bare many of the alleged merger benefits offered by T-Mobile and Sprint to win approval of the merger. The group found many of the claimed benefits were completely unverifiable and were likely to be delivered years into the future, if ever. But within weeks of approving such a merger, the companies would have an immediate incentive to raise prices and reduce service quality. Sprint’s network, in particular, was scheduled to be largely mothballed as a result of the merger, even though Sprint provides coverage in some areas that T-Mobile does not. Although the two companies could identify several self-serving deal efficiencies that would reduce their costs and staffing needs, there is no evidence the merger would deliver consumers lower prices and were outweighed by the merger’s immediate harm to competition and consumers.

Additionally, the merger would harm thousands of hard-working mobile wireless independent dealers in New York and across the nation. The ten states are concerned that further consolidation at the carrier level would lead to a substantial loss of retail jobs, as well as lower pay for these workers in the near future.

Becerra

“CWA applauds the Attorneys General and especially General Letitia James’ leadership in taking decisive action today to prevent T-Mobile and Sprint from gaining anti-competitive power at the expense of workers, customers, and communities,” added Chris Shelton, president of the Communications Workers of America (CWA). “Reducing the number of national wireless carriers from four to three would mean higher prices for consumers, job loss for retail wireless workers, and downward pressure on all wireless workers’ wages. The states’ action today is a welcome development for American workers and consumers, and a reminder that regulators must take labor market concerns seriously when evaluating mergers.”

Before filing suit, the states gave significant consideration to T-Mobile and Sprint’s claims of increased coverage in rural areas. However, T-Mobile has yet to provide plans to build any new cell sites in areas that would not otherwise be served by either T-Mobile or Sprint. As stated in the complaint, the U.S. previously won the “race to LTE” as a direct result of vigorous competition among wireless carriers. Finally, continued competition, not concentration, is most likely to spur rapid development of a nationwide 5G network and other innovations.

“This merger is bad for competition, and it is bad for consumers, especially those living in or traveling through rural areas, who will experience fewer choices, price increases, and substandard service,” stated Carri Bennet, general counsel for the Rural Wireless Association. “We are pleased that the New York Attorney General, along with nine states have filed their lawsuit to block the merger. The process at the FCC has not been transparent and the FCC appears to be blindly accepting New T-Mobile’s words as truth.”

The complaint was filed under seal, because it contains unredacted confidential information, in United States District Court for the Southern District of New York. A redacted copy of the lawsuit is likely to be made available later.

T-Mobile currently has more than 79 million subscribers, and is a majority-owned subsidiary of Germany’s Deutsche Telekom AG. Sprint Corp. currently has more than 54 million subscribers, and is a majority-owned subsidiary of Japan’s SoftBank Group Corp.

Despite claims from Republican FCC commissioners that cable companies are boosting investment in their networks as a result of the FCC’s repeal of net neutrality, cable infrastructure suppliers reported first quarter 2019 revenues nosedived 38%, reflecting an “extreme” cutback in cable industry spending not seen in over five years.

Despite claims from Republican FCC commissioners that cable companies are boosting investment in their networks as a result of the FCC’s repeal of net neutrality, cable infrastructure suppliers reported first quarter 2019 revenues nosedived 38%, reflecting an “extreme” cutback in cable industry spending not seen in over five years.

Subscribe

Subscribe

States with large urban poor communities are particularly sensitive to the merger, because both T-Mobile and Sprint focus their coverage on urban areas. With the average U.S. household spending $1,100 annually on wireless phone service, even small rate increases can dramatically increase service suspensions or disconnections due to late or non-payment.

States with large urban poor communities are particularly sensitive to the merger, because both T-Mobile and Sprint focus their coverage on urban areas. With the average U.S. household spending $1,100 annually on wireless phone service, even small rate increases can dramatically increase service suspensions or disconnections due to late or non-payment.

WASHINGTON (Reuters) – The U.S. Supreme Court on Monday agreed to hear cable television operator Comcast Corp’s bid to throw out comedian and producer Byron Allen’s racial bias lawsuit accusing the company of discriminating against black-owned channels.

WASHINGTON (Reuters) – The U.S. Supreme Court on Monday agreed to hear cable television operator Comcast Corp’s bid to throw out comedian and producer Byron Allen’s racial bias lawsuit accusing the company of discriminating against black-owned channels.

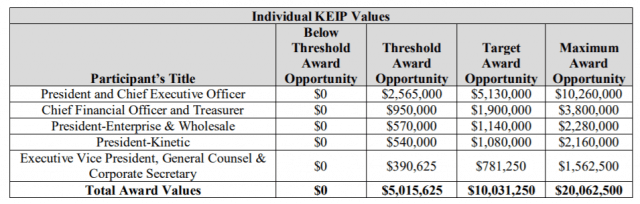

A New York bankruptcy judge cleared the way for Windstream Holdings to pay its top executives up to $24 million in special retention bonuses to convince them to stay at Windstream while the company continues restructuring under Chapter 11 bankruptcy.

A New York bankruptcy judge cleared the way for Windstream Holdings to pay its top executives up to $24 million in special retention bonuses to convince them to stay at Windstream while the company continues restructuring under Chapter 11 bankruptcy.

AT&T claims it is willing to play hardball to force cell tower owners to reduce the cost of leasing space for AT&T’s wireless services. If tower owners won’t lower their prices, AT&T is threatening to find someone else willing to build a new, cheaper tower nearby.

AT&T claims it is willing to play hardball to force cell tower owners to reduce the cost of leasing space for AT&T’s wireless services. If tower owners won’t lower their prices, AT&T is threatening to find someone else willing to build a new, cheaper tower nearby.