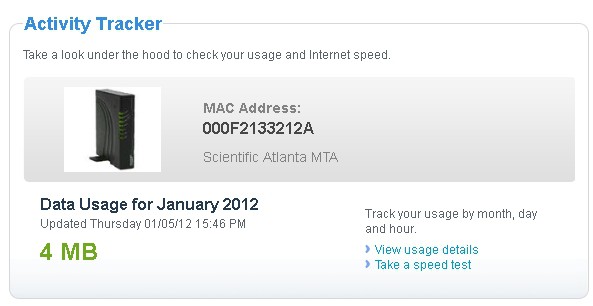

New York City area residents browsing through the My Services section of the Time Warner Cable website had an unwelcome introduction to the company’s new Usage Meter, located under the My Internet tab.

Time Warner has been gradually rolling out the “activity tracker” to all of its service areas, ostensibly for its Internet discount plan Internet Essentials, which offers a $5 discount to customers who keep their monthly usage under 5GB per month.

Although the company insists customers will not lose access to unlimited service (but does not indicate what customers could eventually end up paying for it), the usage meter is not well-received, particularly by customers who found it completely inaccurate.

One customer reported their Time Warner meter showed 161MB of usage… in July, with no usage since.

A Fairview, N.J. Broadband Reports reader was even more concerned to discover the cable company counted 4GB of usage between Oct. 28 and Oct. 31. That was a remarkable feat, according to the customer, because his service was knocked out during that time by Hurricane Sandy. Perhaps the hurricane wanted to stream some old episodes of Jersey Shore to contemplate its “before and after” strategy.

Time Warner’s meter, like that of every other cable or phone company provider, is not subject to independent review or audit by a neutral third party or government oversight. Some companies claim to have third-party verification through outside companies, but critics contend those outside entities have a direct financial interest reporting results that are positive to the company that paid for the review.

Subscribe

Subscribe