The reason why many cable companies are no longer willing to cut deals on cable television with customers looking for a better one is that the profit margin enjoyed by cable operators on television service is shrinking fast.

Researcher Cowen found that smaller cable operators are particularly vulnerable to the high costs of cable programming because they do not get the volume discounts larger operators like Comcast, Charter, DirecTV, and Dish are getting.

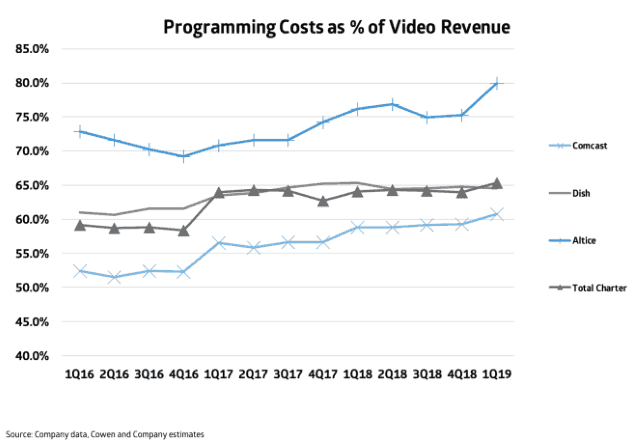

Researcher Cowen found that programming costs are increasing fast at smaller cable companies. (Image: Cowen/Multichannel News)

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station.

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station.

Comcast, the nation’s largest cable operator, unsurprisingly also gets the best programming prices. With volume discounts, Comcast reports its programming costs consume about 60% of revenue. Charter Spectrum and Dish report about 65% of their video revenue is eaten by programming costs. Both are seeing dramatic declines in video subscribers as cord-cutting continues. The more customers a company loses, the less of a discount they will command going forward.

According to Cowen, just three years ago Comcast gave up 53% of video revenue to cover programming costs. With programming rate inflation increasing, many smaller cable companies are considering exiting the cable TV business altogether to focus on more profitable broadband service instead.

Subscribe

Subscribe Discovery Networks has signed a new contract with streaming TV service fuboTV that will bring 13 more channels to its lineups and allow subscribers to access on-demand content from Discovery’s suite of networks.

Discovery Networks has signed a new contract with streaming TV service fuboTV that will bring 13 more channels to its lineups and allow subscribers to access on-demand content from Discovery’s suite of networks. Starry, Inc., a fixed wireless internet provider, this week

Starry, Inc., a fixed wireless internet provider, this week  Dish Network Corporation is in the final stages of talks to acquire assets that include valuable wireless spectrum and Sprint’s Boost Mobile brand for an estimated $6 billion, according to a report quoting anonymous sources

Dish Network Corporation is in the final stages of talks to acquire assets that include valuable wireless spectrum and Sprint’s Boost Mobile brand for an estimated $6 billion, according to a report quoting anonymous sources  Wall Street analyst MoffettNathanson remains skeptical about the T-Mobile/Sprint merger and is even more puzzled by Dish’s reported involvement. The analyst firm released a research note to its clients warning the future of Boost may be bleak:

Wall Street analyst MoffettNathanson remains skeptical about the T-Mobile/Sprint merger and is even more puzzled by Dish’s reported involvement. The analyst firm released a research note to its clients warning the future of Boost may be bleak: Third party contractors hired to install fiber optic infrastructure that will deliver Google Fiber internet service in parts of North Carolina are getting an increasing number of complaints from frustrated residents upset with the pace of the work, the mess it creates, and disruptions caused when crews accidentally damage existing utilities.

Third party contractors hired to install fiber optic infrastructure that will deliver Google Fiber internet service in parts of North Carolina are getting an increasing number of complaints from frustrated residents upset with the pace of the work, the mess it creates, and disruptions caused when crews accidentally damage existing utilities. This summer’s service disruptions are coming at inopportune times, Cary residents complain. Recently, crews mistakenly cut through cables providing power, phone, and cable service, knocking out power for four hours and cutting off air conditioning on a 92 degree day.

This summer’s service disruptions are coming at inopportune times, Cary residents complain. Recently, crews mistakenly cut through cables providing power, phone, and cable service, knocking out power for four hours and cutting off air conditioning on a 92 degree day.