The corporate-funded American Legislative Exchange Council (ALEC) took a hit in the Georgia legislature last week as the clock ran out on several initiatives backed by its members and supporters on behalf of the group’s corporate clients.

The corporate-funded American Legislative Exchange Council (ALEC) took a hit in the Georgia legislature last week as the clock ran out on several initiatives backed by its members and supporters on behalf of the group’s corporate clients.

While H.B. 282, a municipal broadband ban introduced by Rep. Mark Hamilton (R-Cumming) was soundly defeated in an unusual, bipartisan 94-70 vote, two other measures supported by Hamilton never came up for votes, including one that would have placed restrictions on city employees speaking out against corporate-ghostwritten bills like the public broadband ban he introduced.

Hamilton is no stranger at ALEC. He received $3,527.80 in ALEC “scholarships” in 2008 alone, according to the Center for Media and Democracy. Those payments covered certain travel expenses, wining and dining, and entertainment for state lawmakers (and often their families) bought and paid for by ALEC’s corporate members which include large telecom companies. After 2008, ALEC no longer had to disclose their scholarships and neither do many politicians who receive them.

In the last cycle, Hamilton cashed checks well into the thousands of dollars from AT&T, Charter Communications, Comcast and Verizon. That doesn’t include $1,000 from the Georgia Cable TV Association.

Rep. Don Parsons, another bill supporter, happens to be an active member of the ALEC Telecommunications and Information Technology Task Force. He has received $5,735.48 during his first three years in that role.

Rep. Don Parsons, another bill supporter, happens to be an active member of the ALEC Telecommunications and Information Technology Task Force. He has received $5,735.48 during his first three years in that role.

ALEC’s principle role is to get corporate-backed legislative ideas written into state laws. The group maintains a large database of pre-approved legislation ready-made for introduction in any statehouse. Simply change a few words here and there and suddenly it isn’t AT&T, Verizon, Time Warner Cable or Comcast introducing the bills they helped draft, it is Reps. Hamilton and Parsons.

In 2013, these two representatives went over the top for their corporate friends at ALEC.

Mark Hamilton’s H.B. 228: The “Keep Your Mouth Shut Else or Else” Act

Hamilton

Among the most overreaching bills introduced in the 2013 session was Rep. Hamilton’s H.B. 228 – an untitled bill that would prohibit local government employees from using government computers, fax machines or email to promote or oppose legislation by the General Assembly. It would also prohibit employees from contacting members of the General Assembly or the governor to discuss the impact of pending legislation on local governments, unless the employee is registered as a lobbyist or information is requested directly by a member of the General Assembly.

The greatest wish-come-true of ALEC is introducing legislation supported by unshackled corporate interests while muzzling local governments from objecting to the legislation.

In the community broadband battle, large cable and phone companies have limitless budgets to spend opposing public broadband with scare mailers, push polling, newspaper, radio and even television ads. Local officials fighting to defend their interests in better broadband do not. Hamilton’s bill would have taken this imbalance even further, making it a crime for any agencies, authorities, bureaus, departments, offices, and commissions of the state or any political subdivision of the state to provide members of the General Assembly with information about their broadband problems. Communities could not correct misinformation, explain a bill’s unintended consequences, or request changes to the bill.

“HB 228 is utterly ridiculous,” said Conyers City Manager Tony Lucas. “When did a local government, contacting one of our representatives or our governor, become professional lobbying? It’s respective governments conducting business for or on behalf of our citizens.”

Don Parsons’ H.B. 176: AT&T’s “Put Your Cell Tower Wherever You Want” Act

Rep. Parsons had trouble coming up with a good name for his latest legislative gift to AT&T. Originally entitled the “Advanced Broadband Colocation Act,” that title was eventually scrapped because it was not snappy enough. In its place, the “Mobile Broadband Infrastructure Leads to Development (BILD) Act” was suddenly born.

Parsons

But after reading both it and a substitute amendment, we call it the “Put It Anywhere Act,” because the bill’s real intent is to largely strip away cell tower location authority from Georgia’s local governments.

Parsons does not host an AT&T cell tower in his backyard in Marietta, but other Georgian homeowners might had the bill passed.

H.B. 176 allowed cell towers to be placed anywhere a wireless company wanted with very limited local input. Companies were under no obligation to prove that the new towers were needed. Local governments could no longer veto their choices, much less limit additions to existing towers or suggest more suitable alternative locations. Parsons’ bill even removed authority from local governments to insist that companies remove abandoned towers before constructing new ones.

Parsons went all-out for AT&T. Knowing that resource-strapped local governments often have bigger priorities, he set a deadline on cell tower applications at 90 days for existing towers, five months for new ones. Unless the community rejects a proposal showing good cause, it would be deemed automatically approved.

Amy Henderson, director of communications for the Georgia Municipal Association, scoffed at claims the bill was designed to streamline the cell tower application process.

“Dictatorship is just streamlined government,” she told the Rockdale Citizen. “It doesn’t necessarily mean it’s in the best interest of the public.”

[flv width=”480″ height=”380″]http://www.phillipdampier.com/video/Youtube – Rep Parsons on HB176 3-2-13.flv[/flv]

Rep. Parsons’ rambling YouTube video featuring a laundry list of AT&T talking points about the need for cell companies to throw up cell towers wherever they please because it is good for business (even if it isn’t so good for you or your neighbors). Parsons’ video then launches into a hissyfit directed at the Georgia Municipal Association, unhappy with Parsons’ sweeping transfer of authority away from local communities in favor of AT&T and others. Al Gore never sighed this much. It garnered a whopping 41 views on YouTube to date and in the spirit of open dialogue, Parsons disabled comments on the video. (17 minutes)

Private vs. Public: A Phone-y Debate

At the heart of most of ALEC’s legislative initiatives is a sense that public institutions are somehow hampering private enterprise. Community broadband is considered an especially dangerous threat because incumbent providers claim public broadband represents unfair competition.

At the heart of most of ALEC’s legislative initiatives is a sense that public institutions are somehow hampering private enterprise. Community broadband is considered an especially dangerous threat because incumbent providers claim public broadband represents unfair competition.

But as ALEC itself demonstrates, corporate welfare is alive and well in the statehouses of even the reddest states. The idea that taxpayers should not be footing the bill for things the private sector can do without costing taxpayers a nickel just doesn’t fly with reality.

As Free Press reports, phone and cable companies have been on federal welfare since their inception. A 2011 Institute on Taxation and Economic Policy study shows AT&T and Verizon receiving more than $26 billion in tax subsidies from 2008–2010.

The FCC’s 2012 report on Universal Service Fund subsidies shows nearly $3 billion in federal payments to AT&T, Verizon and Windstream. In 2010, Windstream — a telecommunications company with services across the South — applied for $238 million in federal stimulus grants to improve its service in 16 states. More than 16 million taxpayer dollars went to upgrade the company’s services in Georgia.

“Phone and cable companies would not be recording the soaring profit margins that they do, if there were truly a free market,’” said Free Press Research Director S. Derek Turner. “They have created an unlevel playing field that gives them massive first-mover advantages. The real-dollar benefits of that can’t be quantified.”

Subscribe

Subscribe

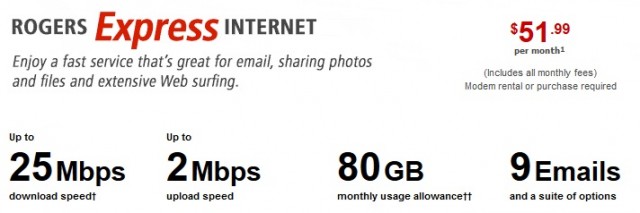

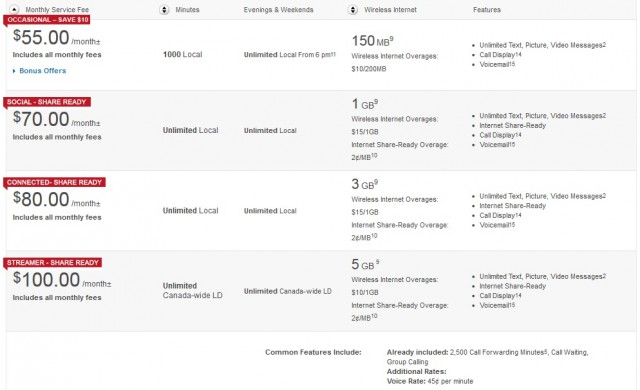

Rogers Communications, Canada’s largest cable operator,

Rogers Communications, Canada’s largest cable operator,

Stephenson’s base salary of $1.55 million was enhanced with a $6.06 million bonus and $12.6 million in additional AT&T shares;

Stephenson’s base salary of $1.55 million was enhanced with a $6.06 million bonus and $12.6 million in additional AT&T shares; More than 18,000 Time Warner Cable customers in upstate New York will receive average refunds of $119 each from the cable company that overcharged them for service since 2007.

More than 18,000 Time Warner Cable customers in upstate New York will receive average refunds of $119 each from the cable company that overcharged them for service since 2007.