Some customers flipping through Verizon FiOS TV’s on-screen guide were shocked to discover movies like “I Banged My Stepdad,” “Pigtail Teens Pounded,” and “Mom, Daughter and Me,” available for on-demand viewing and now the company is defending itself against charges it is a porn peddler.

Some customers flipping through Verizon FiOS TV’s on-screen guide were shocked to discover movies like “I Banged My Stepdad,” “Pigtail Teens Pounded,” and “Mom, Daughter and Me,” available for on-demand viewing and now the company is defending itself against charges it is a porn peddler.

Morality in Media’s 2014 Dirty Dozen List gives prominent placement to Verizon’s adult pay-per-view service, which includes hardcore pornography that implies underage sex and incest.

“Verizon needs to show some corporate responsibility,” Patrick Trueman, president and CEO of Morality in Media told FOX News. “America is suffering a pandemic of harm from pornography and that harm falls particularly hard on children. We are coordinating with the members of our coalition, numbering 146 groups across the U. S., to alert the public to Verizon’s pornography distribution.”

The conservative media watchdog group has drawn some support from those uncomfortable with the nature of some of the titles Verizon is making available for purchase.

Ari Zoldan, CEO of digital communications company Quantum Networks, told FOX “as Americans we believe in freedom of speech, but we also believe in protection of our children’s welfare and well-being first and foremost.”

Verizon defended its programming decisions as a matter of customer choice.

Verizon defended its programming decisions as a matter of customer choice.

“The explosion in choice is a tremendous benefit to consumers, but not all consumers want to have access to all content for themselves and their families all of the time,” Verizon’s associate director for advertising and content standards John P. Artney wrote to Morality in Media. “Not all content is desirable to or appropriate for all consumers, however, and Verizon is proud to provide our customers with myriad tools to control the types of content that they and their families have access to through our service.”

Subscribe

Subscribe

Since the federal government deregulated the cable industry in the 1990s, state and local officials have had little oversight over cable service and pricing, but in many states regulators still have a voice in mergers and other business deals.

Since the federal government deregulated the cable industry in the 1990s, state and local officials have had little oversight over cable service and pricing, but in many states regulators still have a voice in mergers and other business deals. So far, Comcast does not seem concerned about Cuomo’s proposal.

So far, Comcast does not seem concerned about Cuomo’s proposal.

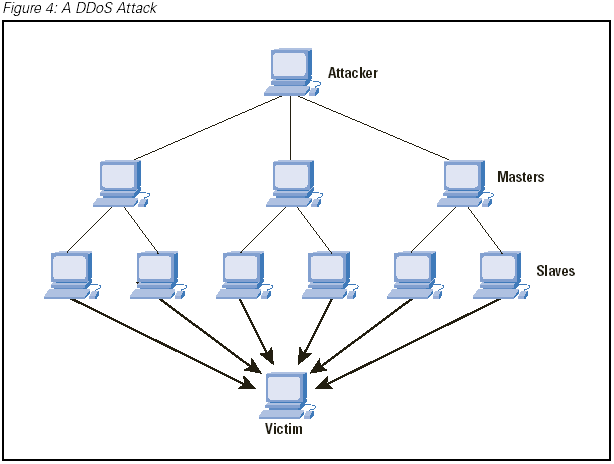

When the attacks began, they not only affected the company’s Internet connection, but also its business phone service.

When the attacks began, they not only affected the company’s Internet connection, but also its business phone service.

Normally when one learns they are losing a job after only a few months in management, it is a time for sober reflection and emotional recovery.

Normally when one learns they are losing a job after only a few months in management, it is a time for sober reflection and emotional recovery. In the all-encompassing merger proposal submitted to the Securities and Exchange Commission, Time Warner Cable noted it sought the advice of several Wall Street investment banks and related institutions. Unsurprisingly, based on the material submitted voluntarily by Time Warner Cable and Comcast, the banks submitted written reports declaring that the merger proposal seemed fair. For that, these advisers were well-compensated. In all, Time Warner Cable and Comcast will pay a combined $135.5 million in fees in return for the positive assessment of the merger’s potential:

In the all-encompassing merger proposal submitted to the Securities and Exchange Commission, Time Warner Cable noted it sought the advice of several Wall Street investment banks and related institutions. Unsurprisingly, based on the material submitted voluntarily by Time Warner Cable and Comcast, the banks submitted written reports declaring that the merger proposal seemed fair. For that, these advisers were well-compensated. In all, Time Warner Cable and Comcast will pay a combined $135.5 million in fees in return for the positive assessment of the merger’s potential: