Verizon’s FiOS expansion is still as dead as Francisco Franco.

Verizon is prepared to watch up to 30% of their copper landline customers drift away because the company is adamant about no further expansion of its FiOS fiber to the home network.

Fran Shammo, chief financial officer at Verizon, told attendees of the Jefferies Global Technology, Media & Telecom Conference that Verizon will complete the buildout of its fiber network to a total of about 19 million homes, and that is it.

“Look, we will continue to fulfill our FiOS license franchise agreements,” Frammo said. “[We will] cover about 70% of our legacy footprint. So 30%, we are not going to cover. That is where we are still going to have copper.”

That is bad news for Verizon customers stuck with the company’s copper network because Verizon isn’t planning any further significant investments in it.

“We will continue to harvest that copper network and those customers and keep them as long as we can,” Frammo said. “But we will not be building FiOS out for those areas.”

In fact, Frammo admitted ongoing cost-cutting at Verizon’s landline division is allowing the company to shift more money and resources to its more profitable wireless network.

Verizon CEO Lowell McAdam doesn’t want to spend money on non-FiOS areas when more can be made from its wireless network.

“It is also taking cost structure out,” Frammo said. “As I mentioned, the migration of copper to fiber has been very big for us. Our Lean Six Sigma projects have really significantly helped us in our capital investment in the wireline which is why I can put more money into the wireless side of the business.”

Verizon has shifted an increasing proportion of its capital investments towards its wireless division year after year, while cutting ongoing investment in wireline. Ratepayers are not benefiting from this arrangement, and critics contend Verizon landline customers are effectively subsidizing Verizon’s wireless networks.

Verizon will still complete the FiOS buildouts it committed to earlier, particularly in New York City, but it is increasingly unlikely Verizon will ever start another wave of fiber upgrades.

In fact, Michael McCormack, the Jefferies’ Wall Street analyst questioning Shammo at the conference foreshadowed what is more likely to happen to Verizon’s legacy copper customers.

“We have talked extensively in the past about the non-FiOS areas and I guess in my second reincarnation as a banker, I will try to help you get rid of those assets,” said McCormack.

Subscribe

Subscribe

Smit also promised major broadband speed upgrades and other improvements for Time Warner Cable customers, but nobody mentioned Comcast’s gradual reintroduction of usage caps on residential broadband accounts.

Smit also promised major broadband speed upgrades and other improvements for Time Warner Cable customers, but nobody mentioned Comcast’s gradual reintroduction of usage caps on residential broadband accounts. Wireless operators are playing up fears that without comprehensive reassignment of wireless spectrum to their businesses, a massive data crunch will slow wireless networks to a crawl.

Wireless operators are playing up fears that without comprehensive reassignment of wireless spectrum to their businesses, a massive data crunch will slow wireless networks to a crawl.

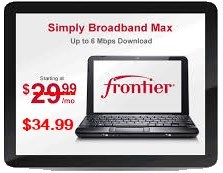

As of May 1st, Frontier Communications has raised the price of its standalone DSL service $5 a month, primarily because its competitors have also raised prices.

As of May 1st, Frontier Communications has raised the price of its standalone DSL service $5 a month, primarily because its competitors have also raised prices. Despite the speed increases, cable competitors still made their presence known. Most cable companies sell faster service than Frontier offers and on the low-end, Time Warner Cable’s 2Mbps $15 broadband package, marketed to current DSL customers, was acknowledged to have an impact by Wilderotter, but not enough to bring a significant change in competitive intensity.

Despite the speed increases, cable competitors still made their presence known. Most cable companies sell faster service than Frontier offers and on the low-end, Time Warner Cable’s 2Mbps $15 broadband package, marketed to current DSL customers, was acknowledged to have an impact by Wilderotter, but not enough to bring a significant change in competitive intensity. Companies in the Pacific Coastal region of California are concerned about losing wholesale access to Time Warner Cable’s business fiber network if the cable company is acquired by Comcast.

Companies in the Pacific Coastal region of California are concerned about losing wholesale access to Time Warner Cable’s business fiber network if the cable company is acquired by Comcast. Currently, third-party access to cable broadband technology is provided on a voluntary basis by cable operators. Regulated telephone companies like Verizon and AT&T that serve California are required to offer open access to competitors, at least on their copper line networks.

Currently, third-party access to cable broadband technology is provided on a voluntary basis by cable operators. Regulated telephone companies like Verizon and AT&T that serve California are required to offer open access to competitors, at least on their copper line networks.