THE FRENCH SLASHER: Patrick Drahi’s cost-cutting methods are legendary in Europe. He could soon be bringing his style of cost management to America.

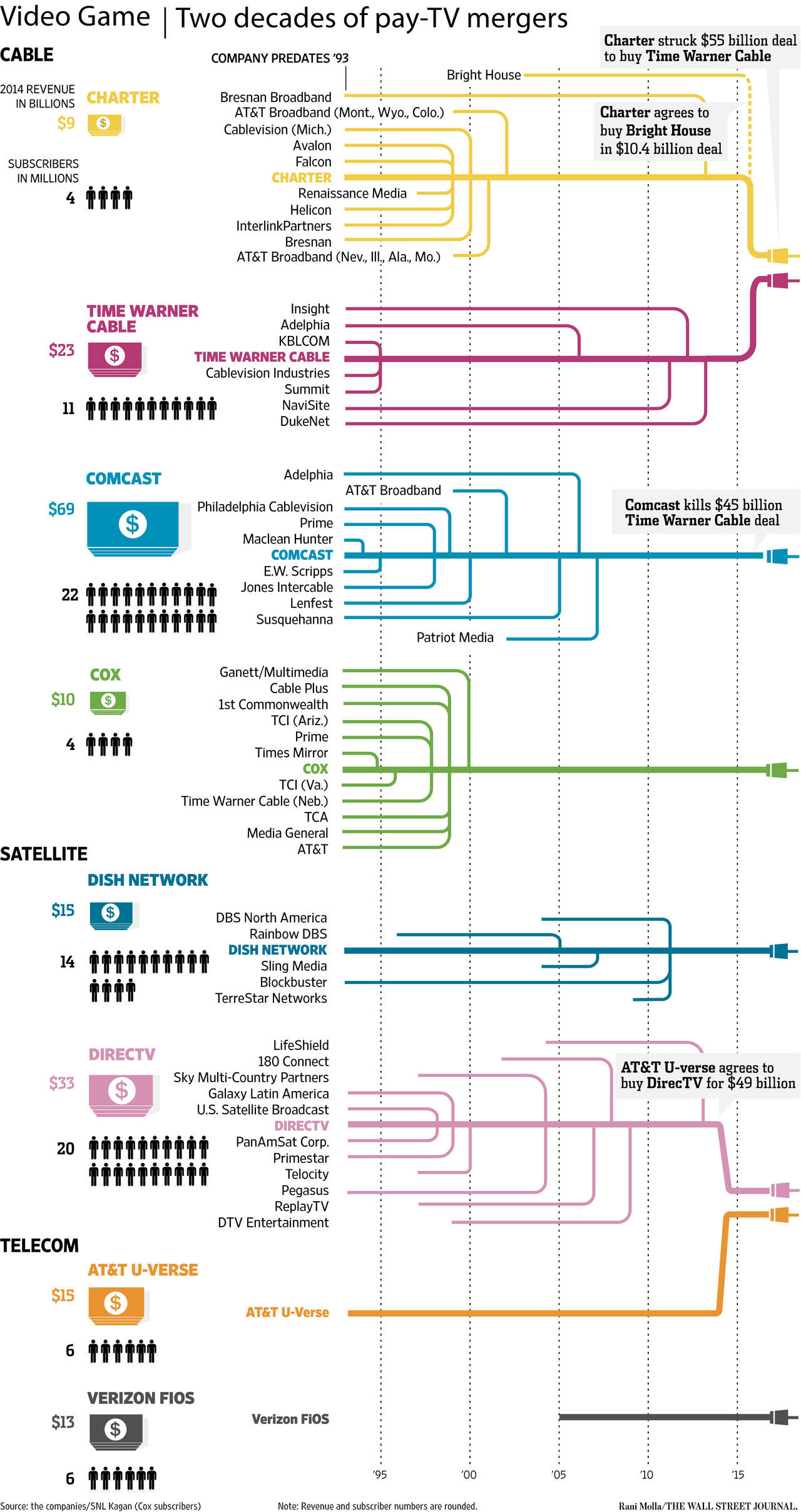

Patrick Drahi and his Luxembourg-based Altice SA appears to be out of the running to buy Time Warner Cable, but are likely to quickly turn their attention to acquiring several of America’s remaining medium-sized cable companies: Cablevision, Cox, and Mediacom.

“While it is still possible that Altice counters on TWC, we do not believe that it can match Charter [and backer John Malone’s] funding firepower and will ultimately lose out,” wrote Macquarie Capital’s Kevin Smithen. “In our opinion, Altice is more likely to turn its attention to Cablevision or privately held Cox or Mediacom, in an effort to gain more fixed-line scale in order to compete against Charter and Comcast.”

Last week, cable analysts were surprised when Drahi swooped in to acquire Suddenlink, one of America’s medium-sized cable operators.

“Altice’s decision to buy Suddenlink (at an unsupportably high price) creates even more uncertainty in an industry where virtually every element of the story is now in flux,” said MoffettNathanson analyst Craig Moffett.

Cablevision recently seemed to signal it was willing to talk a merger deal with Time Warner Cable, but that now seems unlikely with the Charter acquisition heading to regulator review. Drahi met last week with Time Warner Cable CEO Robert Marcus about a possible deal with the second largest cable company in the U.S., which seems to indicate he is serious about his plans to enter the U.S. cable market.

“On paper, Cablevision was already overvalued,” Moffett said. “And Altice’s acquisition of Suddenlink, which has no overlap with Verizon FiOS, would suggest that they are quite cognizant of the appeal of a carrier without excessive fiber competition. The spike in Cablevision’s shares only makes that overvaluation worse. Then again, if Altice is willing to overpay for one investment, might they not be willing to overpay for another?”

Drahi has been topic number one for the French telecom press for months after his aggressive acquisition and cost-cutting strategies left a long trail of unpaid vendors and suppliers, as well as employees forced to bring their own toilet tissue to work. Customers have also started leaving his French cable company after service suffered as a result of his investment cuts.

As a new wave of cable consolidation is now on the minds of cable executives, several Wall Street analysts have begun to call on the cable industry to consolidate the wireless space as well, buying out one or more wireless companies like Sprint or T-Mobile to combine wired and wireless broadband.

“Unlike Europe, we continue to believe that the U.S. is not yet a ‘converged’ market for wireless and wireline broadband services but that this trend is inevitable in the U.S. due to increasing need for small cells, fiber backhaul and mobile video content caching closer to the end user. In our view, Altice believes in convergence and so mobile will be a strategic objective in the long-term,” Smithen wrote.

Other Wall Street analyst/helpers have pointed out there are other cable targets ripe for acquisition: WideOpenWest Holding Cos (a/k/a WOW!) and Cable One have a combined 1.92 million video subscribers.

A tiny Madison Avenue investment bank (so small its only web presence is a webpage displaying its logo) that spent one week advising Charter Communications on its merger deal with Time Warner Cable and Altice SA on its acquisition of Suddenlink Communications will earn as much as $65 million in fees if both deals close, according to a report from Bloomberg News.

A tiny Madison Avenue investment bank (so small its only web presence is a webpage displaying its logo) that spent one week advising Charter Communications on its merger deal with Time Warner Cable and Altice SA on its acquisition of Suddenlink Communications will earn as much as $65 million in fees if both deals close, according to a report from Bloomberg News.

Subscribe

Subscribe

Just in time for the summer fireworks, Comcast’s own rate explosion may be arriving in your mailbox. The cable company is boosting rates on cable television and broadband service in several regions, including higher Broadcast TV surcharges and, for some, the introduction of a new compulsory sports programming fee. Comcast customers shared their rate increase letter

Just in time for the summer fireworks, Comcast’s own rate explosion may be arriving in your mailbox. The cable company is boosting rates on cable television and broadband service in several regions, including higher Broadcast TV surcharges and, for some, the introduction of a new compulsory sports programming fee. Comcast customers shared their rate increase letter