Google is seeking documents from three network television conglomerates that could prove the Mississippi Attorney General’s office conspired with executives of 21st Century Fox, Comcast/NBC, and Viacom to launch a coordinated lobbying campaign against the search engine giant over its business practices.

Google is seeking documents from three network television conglomerates that could prove the Mississippi Attorney General’s office conspired with executives of 21st Century Fox, Comcast/NBC, and Viacom to launch a coordinated lobbying campaign against the search engine giant over its business practices.

A court filing reported by Variety alleges that staffers of Mississippi Attorney General Jim Hood (D) conspired to launch an anti-Google media and lobbying blitz to pressure the company over its search practices, notably the “autocomplete feature” that some believe promotes illegal activities.

Copies of email from Meredith Aldridge, one of Hood’s staff members, addressed to Brian Cohen at the Motion Picture Assn. of America (MPAA) allegedly lays out a proposed media/public relations campaign to plant negative Google stories in newspapers and on television shows with the assistance of executives inside the media companies. The examples included:

Hood

- A custom-written editorial for placement in the Wall Street Journal, owned by News Corp., former owner of 21st Century Fox, suggesting Google stock would lose value if it faced a sustained probe by Attorney General offices across the country;

- An appearance arranged by a Comcast/NBCU government relations executive on the Comcast/NBC-owned Today show that would perpetuate “an attack on Google;”

- A suggestion that a PR firm engineer a regulatory filing with the Securities and Exchange Commission on behalf of a stockholder to complain about Google.

Hood’s office appeared to be ready for a lengthy, all-out assault on Google, at least based on an outline ready for the summer meeting of the National Association of Attorneys General in Boston in 2013. The document suggests Hood was prepared to discuss how Google may have perpetuated the illegal online purchases of counterfeit goods, weapons, and prescription painkillers through its search engine.

Google argues the pattern of behavior from Hood’s office suggests the three media companies are withholding documents connecting “contributions to AG Hood’s cause and the quid quo pro they expected to receive.”

Hood’s case did not go over well in the courtroom of U.S. District Judge Henry Wingate, who ruled there was a “substantial likelihood” Google will prevail on its claim that Hood violated its First Amendment rights.

Subscribe

Subscribe

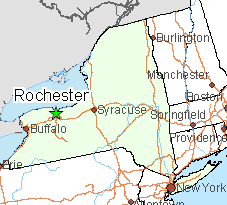

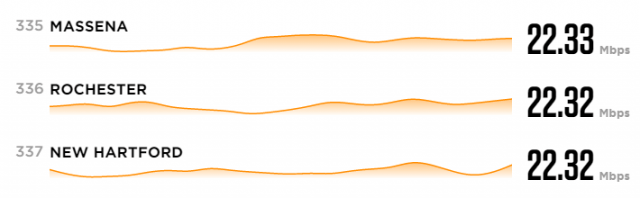

Despite the job shifts, the fact 24,000 workers in the region are already employed in photonics-related jobs may have been a deciding factor in selecting Rochester for the center.

Despite the job shifts, the fact 24,000 workers in the region are already employed in photonics-related jobs may have been a deciding factor in selecting Rochester for the center.

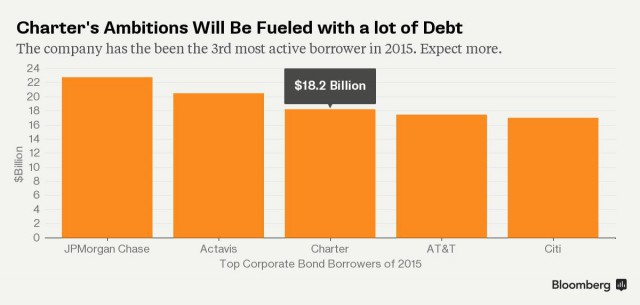

The Marcus-led opposition campaign against Charter gave Comcast just the time it needed to mount a competing bid — all in Comcast stock, then worth around $159 a share. Comcast also offered Marcus an $80 million golden parachute if the deal succeeded.

The Marcus-led opposition campaign against Charter gave Comcast just the time it needed to mount a competing bid — all in Comcast stock, then worth around $159 a share. Comcast also offered Marcus an $80 million golden parachute if the deal succeeded.

NEW YORK (Reuters) – Comcast Corp, the largest U.S. cable operator, posted in-line second-quarter results, as its high-speed Internet and NBC Universal businesses grew amid a drop in pay-TV subscriber departures.

NEW YORK (Reuters) – Comcast Corp, the largest U.S. cable operator, posted in-line second-quarter results, as its high-speed Internet and NBC Universal businesses grew amid a drop in pay-TV subscriber departures. Wall Street keeps a close watch on the number of new video subscribers as pay TV operators fight to keep customers amidst intense competition from streaming video services such as Dish Corp’s Sling TV.

Wall Street keeps a close watch on the number of new video subscribers as pay TV operators fight to keep customers amidst intense competition from streaming video services such as Dish Corp’s Sling TV. The New York State Public Service Commission today

The New York State Public Service Commission today  “The Rochester Business Alliance advocates for an environment that will promote the success of its members and the local economy,” the group writes on its website. “We help our member companies and their employees stay connected to the issues as well as to the people who can make a difference.”

“The Rochester Business Alliance advocates for an environment that will promote the success of its members and the local economy,” the group writes on its website. “We help our member companies and their employees stay connected to the issues as well as to the people who can make a difference.”