AT&T will launch its anticipated DirecTV Now all-streaming cable television alternative next month at an unprecedented price of $35 a month for more than 100 channels, viewable for free without counting against your AT&T smartphone or tablet usage allowance.

AT&T will launch its anticipated DirecTV Now all-streaming cable television alternative next month at an unprecedented price of $35 a month for more than 100 channels, viewable for free without counting against your AT&T smartphone or tablet usage allowance.

Targeting cord-cutters, the new service will not require a satellite dish or expensive equipment — just a reasonably fast internet connection.

AT&T CEO Randall Stephenson used the announcement at a Wall Street Journal-sponsored event to claim the new service was an example of how AT&T won’t increase prices as a result of its proposed merger with Time Warner, Inc.

“That’s not a medium for raising prices,” Stephenson said, referring to AT&T’s new service. “Anybody who characterizes this as a means to raise prices is ignoring the basic premise of what we’re trying to do here.”

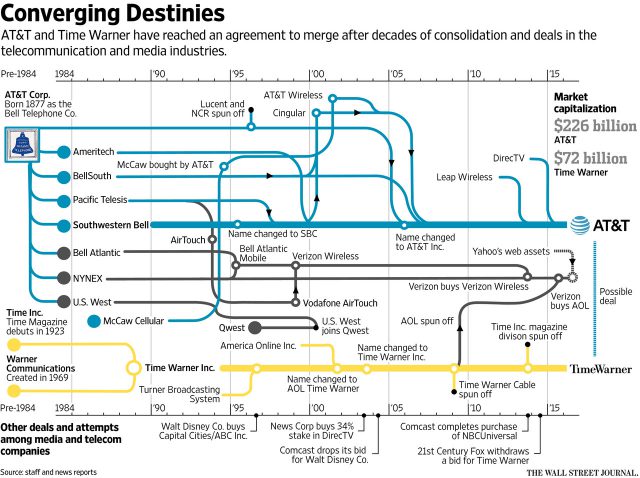

AT&T and Time Warner’s respective CEOs appeared together at the event as part of a week-long press blitz to promote their $85.4 billion merger deal, which is getting considerable blowback from politicians, consumer groups, and Wall Street.

Stephenson and Time Warner CEO Jeff Bewkes claim they are re-inventing the cable television business model and forcing innovation.

“If there was ever an environment that was begging for innovation, it was this environment,” Stephenson said. Bewkes added: “We would say and we’ve been saying it since 1995, every channel in the country should look like HBO or Netflix—there’s no reason we can’t.”

AT&T defends its $35 price point, which is half the price many cable companies charge for cable television, claiming it can afford to charge those prices by doing away with service calls, equipment, satellites, and infrastructure that traditional cable operators have to cover. DirecTV Now will rely on smartphone and desktop apps, and presumably third-party set-top boxes like Roku and Apple TV to provide its lineup.

AT&T hasn’t announced an official channel list for the service, but AT&T has been in serious negotiations with most of the major content conglomerates, so the lineup is likely to cover all the major cable networks, presumably local stations, and include an on-demand library. Customers may not get some of the secondary cable networks most cable systems bury on three or four digit channel numbers in Channel Siberia, but few viewers are expected to miss channels that attract fewer than 50,000 viewers nationwide.

Stephenson promised that future programming cost increases would be offset by developing “new ad models” that will cover most of the price increases.

One impediment to AT&T and Time Warner’s grand plan is the pervasive issue of data caps and usage-based billing, which could prove a lethal deterrent to customers ditching traditional cable TV in favor of online alternatives. AT&T itself imposes data caps on its DSL service, and has an unenforced cap on U-verse. Comcast continues to charge overlimit fees for customers exceeding 1TB of usage per month and smaller cable operators often include even smaller usage allowances.

Customers are highly skeptical of DirecTV Now because AT&T is involved. David Hill shared his prediction:

Undoubtedly you will get a $35 rate… for 6 months. Then because you have been a good, paying customer, they will raise it to $75 a month. But of course, new customers, can still get the $35 deal plus a $400 Amazon gift card.

When you call customer support (if you can actually get through to a living person) and ask for the same $35 rate the new guys get, why you will be told that you cannot get that rate because, well, you already ARE a customer. So eat dirt.

Then when you work your way via the endless menu items to cancel the service about 2 weeks later and for years after you will be flooded with endless postcards and letters BEGGING you to come back. You were a GREAT customer and WE want YOU BACK. Right now!

Is this a stupid marketing policy or not? In my MBA classes we were somehow mislead into believing exiting customers were your top A, number one priority. Yet these internet companies cannot be bothered with keeping you. Jerks, plain and simple.

AT&T CEO Randall Stephenson said the company’s deal with Time Warner will result in a new TV service that will offer more than 100 premium channels for $35 per month. He sat down with Time Warner’s Jeff Bewkes and WSJ’s Rebecca Blumenstein at the WSJDLive conference in Laguna Beach, Calif. (5:05)

Subscribe

Subscribe

Charter Communications has announced price changes and new fees for existing Time Warner Cable customers that will take effect Dec. 15, 2016:

Charter Communications has announced price changes and new fees for existing Time Warner Cable customers that will take effect Dec. 15, 2016: It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner