In an effort to keep up with Comcast, Cox Communications has quietly expanded its internet overcharging scheme to customers in Arkansas, Connecticut, Kansas, Omaha, Neb, and Sun Valley, Ida. (perhaps the only community that can afford Cox’s threatened overlimit fees). Cox’s customers have noticed and told DSL Reports about the forthcoming highway robbery.

In an effort to keep up with Comcast, Cox Communications has quietly expanded its internet overcharging scheme to customers in Arkansas, Connecticut, Kansas, Omaha, Neb, and Sun Valley, Ida. (perhaps the only community that can afford Cox’s threatened overlimit fees). Cox’s customers have noticed and told DSL Reports about the forthcoming highway robbery.

These unlucky customers join those in Cleveland, Oh., Florida and Georgia who have already been enduring Cox’s usage cap and penalty fee system.

Cox hasn’t shown any interest in listening to customers who do not appreciate usage allowances and have repeatedly told the company they want unlimited access, especially considering how much they already pay Cox for service.

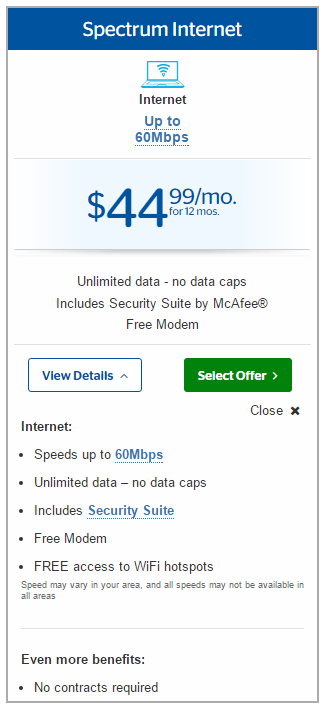

“It’s a total ripoff and customers have no option to keep unlimited, unless they move to the next city over where Charter/Spectrum offers internet access without any data caps,” notes Cleveland resident Shelly Adams.

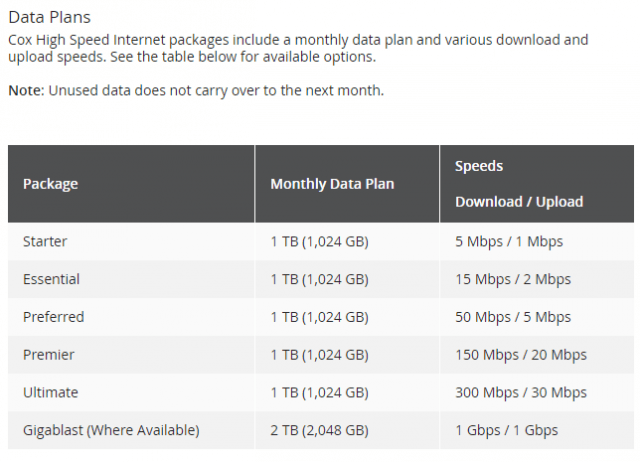

Cox has followed Comcast by boosting most usage allowances given to customers to 1TB, an amount many believe was set high enough to avoid threatened regulatory scrutiny of stingy data caps by the FCC under the former Obama Administration.

As with every provider that has ever conjured up an internet overcharging scheme, no matter what the allowance is, the company always claims it is generous and impacts almost nobody. Cox claims 99% of their customers will never hit the cap, which always begs the question, if it affects so few customers why spend time, money and energy creating a data cap, usage measurement tools, and billing scheme for only a handful of customers? Is that Cox’s idea of innovation?

Usage caps for one and all.

In fact, Comcast has claimed the same thing, but their math came into question when more than 13,000 Comcast customers managed to stumble their way to the FCC’s complaints bureau in one year and write a formal protest about Comcast’s own overlimit fee scheme. We are certain there are many more customers with overlimit fees on their bills than that, and guess only a small fraction took the time to write a complaint and submit it.

As Stop the Cap! has said for almost a decade, beware of cable company “generosity” because it usually comes with fine print.

“Cox High Speed Internet packages include 1 TB (1,024 GB) of data to provide you with plenty of freedom to stream, surf, download, and share,” the company writes on its support website (its much rarer Gigablast gigabit plan includes 2TB). For now, if you use Cox Wi-Fi or CableWiFi hotspots, usage on those networks does not count toward your data plan.

Cox reserves itself some extra freedoms, such as automatically charging customers who exceed their allowance a $10 overlimit penalty for each 50GB of usage they incur until the next billing cycle begins. Cox’s generosity ends with the unused portion of your allowance, which Cox keeps for itself, not allowing customers to roll over unused data to the following month.

In an effort to get customers to accept the scheme, Cox calls it a “data plan,” similar to what wireless customers might pay, and says other companies have data caps too. But none of this justifies the practice.

You’re over our arbitrary usage limit!

In another “generous” move, Cox is offering a grace period for two consecutive bill cycles before it slaps overlimit penalties on customer bills for real in Arkansas, Connecticut, Kansas, Omaha, and Sun Valley. The grace period window begins with bills dated on or after Feb. 20, 2017. To make sure you get the message, the company will bill you the overlimit fee it claims almost nobody will ever pay along with a corresponding grace period credit for two months, just to put the scare in you. After May 22, it is time to pay up.

Cox will make sure you can’t claim you “didn’t know” you ran through your allowance by harassing you with data usage messages via Cox browser alert, email, text message, or an automated outbound call when you have used about 85% and 100% of your monthly data plan. You will receive additional alerts when you have reached 125% of your monthly data plan, at which point Cox will throw a party in your honor with thanks for allowing them to run up your bill.

Coincidentally, Cox isn’t testing their scheme in markets rife with competition from providers like Verizon FiOS, where usage is effectively unlimited. In many of Cox’s usage-capped markets, customers have AT&T as their alternative, and they have a 1TB usage allowance as well.

Incoming FCC chairman Ajit Pai is on record opposing any involvement in regulating usage-based pricing schemes, claiming it amounted to government meddling in business. But customers can complain directly to Cox and threaten to cancel service. It may be a good time to renegotiate your cable bill to win discounts that may help cover any overlimit fees that do make it to your bill.

There remains little, if any justification for a company like Cox to peddle data plans with usage allowances to their customers. The company is moving towards gigabit broadband speeds but apparently lacks the resources to manage customers that want a hassle-free unlimited experience? If Cox is being honest about how few customers will ever be affected by the cap, there is no reason the company cannot continue an unlimited plan at current prices.

Cox’s scheme does shine light on the uncompetitive broadband marketplace that continues to afflict this country. As one reader pointed out, customers are constrained by the offerings of whatever provider has set up shop in a city that typically has, at best, one other choice (usually a phone company selling DSL or up to 24Mbps U-verse). A truly competitive market would give customers a wide choice of “data plans” that include unlimited plans customers enjoyed for years and want to keep. But safe in their broadband duopoly, cable companies like Cox have no incentive to treat customers to a better or even fair deal.

The real reason for usage caps and data plans with penalty pricing was exposed by Wall Street analysts like Jonathan Chaplin, a research analyst for New Street Research LLP. Although he was speaking to a cable company executive at the time, his words traveled to our ears as well:

“Our analysis suggests that broadband as a product is underpriced,” Chaplin said.  “Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment).”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment).”

“The companies will undoubtedly have to take pay-TV pricing down to help ‘fund’ the price increase for broadband, but this is a good thing for the business,” Chaplin added. “Post re-pricing, [online video] competition would cease to be a threat and the companies would grow revenue and free cash flow at a far faster rate than they would otherwise.”

Exactly.

Subscribe

Subscribe Former Bright House Networks customers in Florida are unhappy with a $9.99 Wi-Fi Activation Fee that appeared on some customer bills in December.

Former Bright House Networks customers in Florida are unhappy with a $9.99 Wi-Fi Activation Fee that appeared on some customer bills in December. Verizon Communications has opened preliminary talks with officials close to Charter Communications about a possible merger of the two companies, concerning regulators worried the massive combined telecommunications company would have a near-monopoly on residential broadband service in New York and western Massachusetts.

Verizon Communications has opened preliminary talks with officials close to Charter Communications about a possible merger of the two companies, concerning regulators worried the massive combined telecommunications company would have a near-monopoly on residential broadband service in New York and western Massachusetts.

Verizon’s Heavy Dependence on Wireless Was a Mistake

Verizon’s Heavy Dependence on Wireless Was a Mistake Verizon executives have shown little interest in acquiring assets that rely primarily on linear/live television, which is why the company never moved to counter AT&T’s acquisition of DirecTV with an offer for its satellite competitor Dish Networks.

Verizon executives have shown little interest in acquiring assets that rely primarily on linear/live television, which is why the company never moved to counter AT&T’s acquisition of DirecTV with an offer for its satellite competitor Dish Networks.

Bright House Networks customers are also experiencing transition troubles. Residential customers reportedly lost any static IP addresses they signed up for when they converted to a Charter Spectrum residential plan. Static IP addresses are still available for Spectrum commercial plans. More troubling for many is the loss of access to Bright House Network’s secure Wi-Fi network.

Bright House Networks customers are also experiencing transition troubles. Residential customers reportedly lost any static IP addresses they signed up for when they converted to a Charter Spectrum residential plan. Static IP addresses are still available for Spectrum commercial plans. More troubling for many is the loss of access to Bright House Network’s secure Wi-Fi network. In Indianapolis, former Bright House Networks customers

In Indianapolis, former Bright House Networks customers  Former AT&T customers who dumped their former carrier for T-Mobile in return for a free year of DirecTV Now are getting a sweeter deal with a free year of Hulu with Limited Commercials as well.

Former AT&T customers who dumped their former carrier for T-Mobile in return for a free year of DirecTV Now are getting a sweeter deal with a free year of Hulu with Limited Commercials as well.