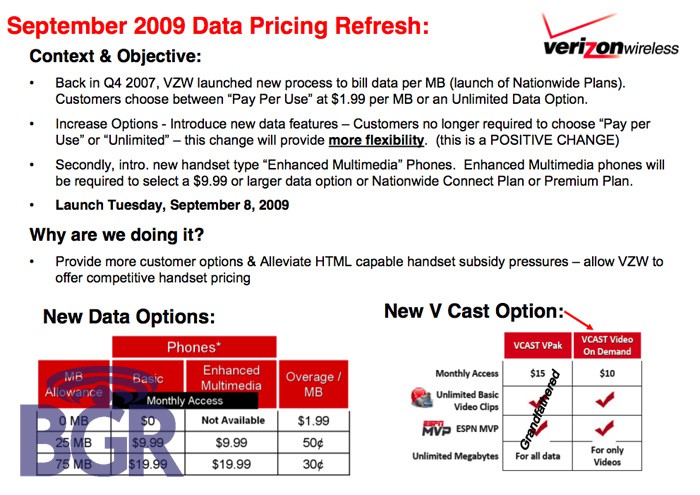

Verizon Wireless has a problem with customers who look for the cheapest possible plans for their most capable phones. Those days are over, as the company introduces ‘mandatory’ data plans for customers using what they define as “enhanced multimedia phones.”

Going forward, phones that meet these four qualifications will be defined as such:

Enhanced Multimedia Phone

- “Enhanced” HTML Browser

- REV A

- Launched on of after September 8, 2009

- QWERTY keyboard

The first phone to achieve this distinction is the Samsung Rogue, due for release on September 9th.

Customers who try to purchase this, or other phones that “qualify” for this status will be required to choose either a service plan that already bundles “unlimited data” (defined as 5GB per month), or choose from one of these mandatory add-on plans:

A-la-carte data – No usage allowance — $1.99/megabyte

25 megabytes per month — $9.99/month

75 megabytes per month — $19.99/month

The one option not available to customers is a block on all data services, to prevent any billing at any of these prices.

<

p style=”text-align: center;”>

What will also no longer be an option is the $15 VCAST Vpak add-on, providing streaming video and includes unlimited data. Customers signing up for VCAST Vpak before September 8th will be grandfathered in and be able to keep this add-on. After September 8th, customers will find a $10 VCAST Video on Demand package on offer instead. It provides unlimited video access, but no data allowance. Customers will have to buy one of the add-on plans mentioned above.

Verizon Wireless’ internal marketing slides, leaked to The Boy Genius Report, speak to Verizon’s motivation for making these changes — money. One slide notes that “over 60% of new activations would require a data plan next year” if the customer wanted access to both data and video on their new phone. Additionally, the change “alleviates HTML capable handset subsidy pressures,” which essentially means they will be able to sell a more advances handset for less money, knowing they’ll make up the difference with a mandatory data plan charged over the life of a two year contract.

<

p style=”text-align: center;”>

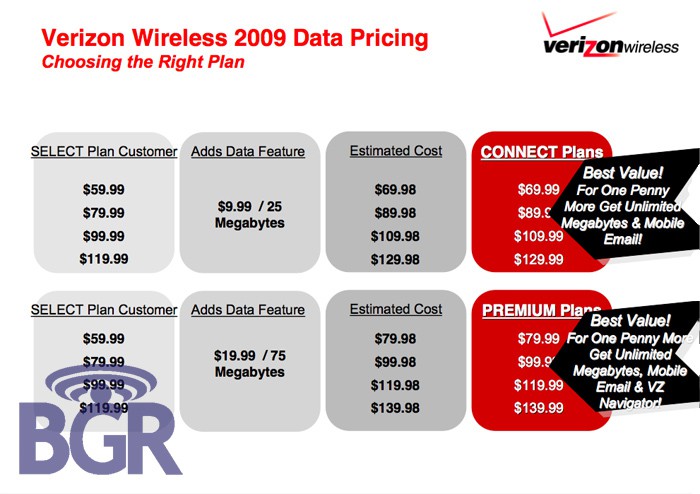

Verizon defends the changes by noting prior to the mandatory data plans, customers who used their browser-capable phones had to either pay the $1.99/megabyte a-la-carte rate, choose a premium unlimited data plan, or get VCAST Vpak. The company feels the 25 and 75 megabyte options may work for customers with light usage, but enough that would bring their data usage over five megabytes per month ($10 on the a-la-carte option).

Realistically, this is another example of a data provider providing consumption billing options at ever-greater pricing. With the loss of the VCAST Vpak option, consumers are now pushed into more expensive options, and will likely be heavily marketed bundled services that include data, just to avoid the pricey mandatory 25/75 megabyte add-ons.

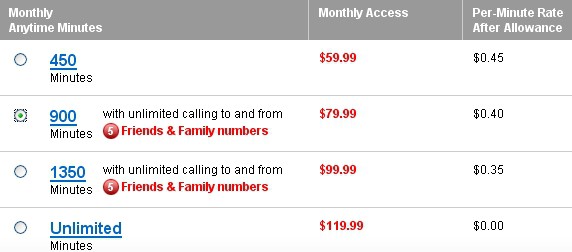

Customers should anticipate marketing of bundled plans and little, if any, mention of the “a-la-carte” option that does not add a monthly fee to the customer’s bill. Indeed, the slides obtained from BGR don’t show the a-la-carte option at all on the “Choosing the best plan” slide. Instead, it pushes customers to the unlimited data option “for just one penny more” for customers choosing the popular second level Verizon Wireless Select plan (with the data plan add-on), which includes 900 talk minutes.

<

p style=”text-align: center;”>

Some Verizon Wireless customers relive better days, as they remain grandfathered on truly unlimited data plans chosen before the era of usage caps. It’s just additional evidence that when usage capped broadband hits the scene, it’s only a matter of time before prices increase, and the usage cap allowances decrease.

Subscribe

Subscribe