Another day, another angle on Internet Overcharging, this time from the team of Dr. Kevin A. Hassett & Dr. Robert J. Shapiro. These two economists at the Georgetown Center for Business and Public Policy have produced a very narrow report that takes a new angle on why Internet Overcharging schemes like consumption billing represent the answer to universal broadband adoption. The study claims that the era of the “exaflood” is nearing, and private broadband providers are being called on to spend $100-300 billion dollars to meet the needs of the top 20% of “high bandwidth users” using most of the bandwidth.

The report asks, should the costs be divided equally between every customer, which they posit will increase broadband pricing across the board, or should 80% of those costs be paid by the 20% they claim consumes the most? Their fingers are pressed firmly on the side of the scale marked “heavy users pay more,” theorizing that alone will increase broadband adoption.

What makes Towards Universal Broadband: Flexible Broadband Pricing and the Digital Divide different from the usual refrain that consumption billing is the “fairest way” to price broadband service is the presumed added benefit that such pricing will benefit rural communities, minorities and the poor. Namely, that unless we move to such a system, rural consumers and low-income Americans will never purchase broadband service because of price sensitivity. Increase pricing for everyone, they suggest, and the United States will not achieve the president’s ambition for universal broadband adoption.

The report is an industry dream come true. Expect the usual suspects to wave it around in the air as “proof” of the need to overcharge you for broadband.

But before the Money Party gets started, let’s critically evaluate whether this report represents the solution we’ve been waiting for, or a nice excuse to simply increase prices and promise upgrades later.

It quickly becomes obvious the report is myopic from start to finish, presuming facts not in evidence, or that come from self-interested parties, and relies only on a single solution — price increases. The only debate is over which customers pay more: all of them or just the “heavy users.”

Smart readers already know in the end, everyone pays more no matter what.

And Now the Rest of the Story

Of course, the differing rates of broadband adoption across racial, geographic and income classes are strongly interrelated. A large portion of the disparity in uptake rates by race and geography, for example, are driven by differences in household income. Studies have indicated that uptake rates also are strongly correlated with education and the need for high speed Internet in the workplace.

Our difficult economic times have reversed these trends over the past two years, and the broadband access gap between African‐Americans and white Americans widened in both 2008 and 2009. Broadband adoption among African‐Americans rose only slightly in 2008 and 2009 following several years of much more substantial increases. Meanwhile, broadband adoption by white households continued to rise steadily. As a result, the broadband‐access gap between the races was wider in 2009 than it had been in 2005. A significant rural‐urban gap in broadband uptake rates also has persisted, as rural Americans increased their broadband access at about the same pace as those who live in cities and suburbs.

Respondents to the Pew survey report that their average bills for broadband service fell from $39 to $34.50 between 2004 and 2008. Interestingly, adoption continued to rise in 2009 despite a jump in prices back to the 2004 level. To some extent, the 2009 price levels may reflect the willingness of a growing number of Americans to pay more for premium services that provide even higher speeds. The average monthly cost of basic service stood at $37.10 in 2009, while premium subscribers paid an average of $44.60, according to the Pew Survey. Additionally, economic studies have concluded that households that have adopted broadband Internet are far less price sensitive or “price elastic” than prospective adopters.

These findings are supported by recent experience, which suggests that adoption would have been even higher in 2009 if the price increases had not occurred. Pew reports, for example, that almost one in ten Americans either cancelled or cut back Internet service for financial reasons between April 2008 and April 2009. These cutbacks were greatest at the bottom of the income scale, with 17 percent of households earning $20,000 or less reporting that they reduced or gave up service during 2008.

Most of the Pew data in this section is verifiable, but really only tells a small part of a much greater story. The broadband adoption rate continues to grow, but users are price sensitive, especially as income levels decline. It’s common sense to assume that the higher a cost for a product or service, the lower the adoption rate among income challenged consumers. Of course, at no point do the authors ever contemplate broadband provider complicity in the current pricing structure for broadband. They merely accept the status quo duopoly that most consumers face in broadband pricing, which is now on the increase as providers face revenue challenges in the video and telephone marketplace. The racial component of their argument is hardly explored, so we have no idea whether it is an issue of income, household location, social factors, or some other hurdle we don’t know about.

Also totally unexplored is the question of broadband availability in rural communities. In those areas, broadband adoption starts with having a service to adopt in the first place, followed by the value of a service at the slow speeds for high prices typically on offer.

My biggest criticism of this report is its tunnel-vision-like approach to defining the problem and crafting a single solution for it. The report hints at something very pertinent to this debate, but then completely ignores it going forward.

“To some extent, the 2009 price levels may reflect the willingness of a growing number of Americans to pay more for premium services that provide even higher speeds.”

One might think a report based on how to obtain the revenue necessary to build broadband networks of the future might want to explore the potential revenue earned from premium services delivering higher speeds, particularly considering those enhanced services are often adopted by those that use their connections to a much greater degree than average consumers. Indeed, since the report will later suggest that 20% of the customers who consume the most data should pay 80% of the costs for upgrades, it’s more important than ever to consider whether these customers already present a financial solution to their self-described dilemma. Would higher usage consumers gratefully accept higher pricing for faster tiers of service? Would speed-based tiering represent a better, more positive solution for consumers and the industry in lieu of consumption based pricing for every broadband consumer. The authors don’t bother to find out.

The report also seems to downplay the fact that 100% of consumers may never want broadband service in their home, and that doesn’t necessarily represent a problem. Customers that have it, the report notes, are more committed to keeping it than those who don’t have it are about getting it in the first place. I’m not certain that actually represents a problem, particularly if it means pickpocketing loyal customers in an effort to capture potential new customers that simply don’t want the service at any price.

Hassett and Shapiro are either unaware, or ignore, the fact many providers already heavily market to non-broadband customers, offering promotional pricing and discounts, as well as “economy” tiers providing cheaper, albeit slower, broadband service. These economy tiers are still significantly faster than dial-up, and provide enough of an enhanced online experience to bring budget-minded consumers on board, if only to discard their current dial-up service provider.

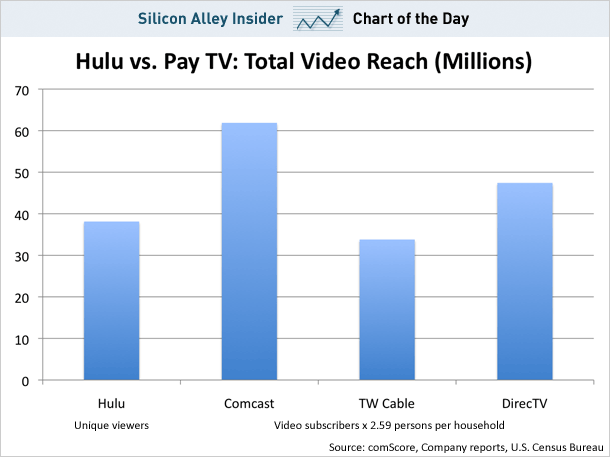

Customers who spend significant amounts of time online already demonstrate their loyalty to the product — it’s one of the few success stories in the current economy for cable and telephone companies who are seeing slowed growth or declines from their other product lines.

To Capture New Customers, You Should Be Able to Experiment on Your Loyal Customers

As policymakers consider the future of broadband policy, they must try to determine whether the historic pattern of technology diffusion will replicate itself with broadband or whether the re‐widening of the Internet access gap is a harbinger of new challenges. Specifically, they must ask themselves what would happen to adoption trends if Internet service providers change their consumer pricing models to accommodate additional costs arising from expanded demand for bandwidth. This paper is intended to provide insights into those questions by examining the impact of various pricing approaches and pricing allocations among consumers.

Policymakers might also want to consider whether the current model for providing broadband, which is a monopoly or duopoly for most consumers, is the best thing for this country. They might also want to take a look outside of their theory bubbles and review what happened in Canada where their experiment came to life. Not only did pricing changes anger existing customers, it ultimately provided little, if any savings for consumers. Indeed, when the usage caps arrived and consumption billing arrived, so did price increases and speed throttles. Policymakers need not dwell too much on their theories and numbers provided by this report, when a quick trip to Toronto or Montreal can provide real world evidence that these schemes don’t provide real savings to consumers, just higher pricing and more restrictive service, and a continued decline in Canada’s broadband rankings.

None of this is explored in this report, of course.

When Self-Interested Parties & Astroturfers Provide the Facts & Figures…

An inescapable and critical flaw in this report is the repeated reliance on data from known astroturfers, funded by the broadband industry to represent their interests, along with self-interested parties like equipment manufacturers whose sales will, in part, depend on making a case for a need to buy their “solutions” to the “problems” they define. At no time do the authors ever consider whether the data they are relying on is credible, much less provide readers with some disclaimers about source self-interest.

Cisco Systems, for example, has forecast that Internet traffic will quintuple from 2008 to 2013, driven largely by video and what it calls “visual networking.”

Cisco is well known for their reports predicting connectivity calamity… unless you manage it by purchasing Cisco products, of course. This report cites Hyperconnectivity and the Approaching Zettabyte Era, something we criticized back in June for not exactly being an independent, dispassionate piece.

In one, widely‐cited report, EDUCAUSE, a higher‐education technology group estimated that providing “big‐broadband” to every home and business, with sufficient bandwidth to meet demand, would cost an additional $100 billion over the next three to five years and even larger investments in capacity going forward.

Apparently the authors stopped reading EDUCAUSE’s report after capturing the dollar data they cited, because unlike Hassett and Shapiro’s very narrow focus on justifying broadband pricing ripoffs, EDUCAUSE’s A Blueprint for Big Broadband, by John Windhausen Jr., calls out the failures prevalent among broadband providers in the United States. Windhausen suggests consumption billing trials are a symptom of a broadband provider not making appropriate investments in their network, instead relying on temporary fixes like usage caps to try and reduce demand on their broadband platforms. He specifically mentioned Time Warner Cable’s experiment in April as an example.

Windhausen advocates for a range of solutions to the capacity crunch that don’t involve ripping off consumers by charging them ever-increasing prices for service, or consumption billing.

Solutions do include:

- Leadership, Vision, and Goals – America should lead the world in broadband speed and availability, with 100Mbps being the target by 2012.

- Organization – Establish a Broadband Council that includes consumers (remember us?), business leaders, and public officials to implement and oversee broadband policy.

- Tax Incentives – Reward the private sector for taking risks on the most advanced technological solutions (fiber in particular) to overcome Wall Street resistance.

- A New Universal Broadband Fund – Direct subsidies to rural and other difficult markets to ensure broadband equality.

- Openness – Net Neutrality protections enforced by law.

- State and Municipal Broadband and Rights-of-Way – An end to industry-driven legal prohibitions on state/municipal broadband service.

- Consumer Education – Efforts to educate consumers about the benefits and managing risks from the online world.

- Broadband Technology Research – America should be a leader in discovering and managing new breakthrough’s in broadband technology.

Or just impose consumption billing on consumers, as Dr. Kevin A. Hassett & Dr. Robert J. Shapiro advocate, and providers will magically lower prices for consumers and create and build the next generation of broadband networks with the money they earn.

Hassett and Shapiro need to get out more and review the documentation assembled over the course of two weeks in April when Time Warner Cable attempted their experiment, because those promised network upgrades, assuming consumers accepted the consumption billing proposal (and they in loud and large numbers did not), turned out to come without any firm dates, and just weeks later were dismissed by the CEO as unnecessary in the short term, because Time Warner Cable has plenty of capacity on their existing network.

It’s hard to sell an “exaflood” when the broadband provider’s CEO denies there is one at hand.

But Hassett and Shapiro still try:

Another estimate cited by David McClure, the head of the U.S. Internet Industry Association, and John Ernhardt, Senior Manager of Policy Communications for Cisco Systems, projects that the long‐term investments required to keep up with fast‐rising bandwidth demand could cost an additional $300 billion over 20 years. (David McClure, “The Exabyte Internet,” U.S. Internet Industry Association, 1 May 2007)

Teletruth, a watchdog site, identified USIIA as one of several groups that TeleTruth called out for its association with an industry public relations/public policy agenda:

U.S. Internet Industry Association

- “The U.S. Internet Industry Association (USIIA), a 13-year-old trade association that represents “companies engaged in Internet commerce, content and connectivity.” Verizon is the biggest name represented on its board of directors.”

- David P. McClure, President and CEO, U.S. Internet Industry Association, is also an author of the NMRC Muni Wifi report.

- USIIA has been a client of Issue Dynamics.

The USIIA has been pushing the theory of the “exaflood” that remains highly dubious in the eyes of independent researchers who also study broadband traffic. Hassett and Shapiro accept it on face value.

Heavy Users Are Already Hooked & Won’t Mind Paying More Anyway

Absent another source of revenue, such as a system that assesses fees on content providers or high bandwidth users, the costs of these additional investments will generate broad price increases substantially larger than those experienced during the expansion of dialup Internet access.

Heavy bandwidth users are assumed to be relatively price insensitive, so their broadband subscription rates remain unaffected by price increases. We do not have adequate data to assess this assumption, but it is reasonable given the likelihood that habit formation would drive consumers to continue the practices that have driven their high bandwidth usage to date. To the extent that high bandwidth users are more sensitive to higher prices than we have assumed, companies would have to choose between spreading the cost to lower bandwidth users, and increasing prices more for high bandwidth users.

We’re clearly well into the realm of “assuming facts not in evidence” with the authors’ assumptions on the price sensitivity of customers: heavy, medium, or light. When Time Warner Cable attempted their experiment, there was considerable outrage at the premise of consumption billing, because consumers don’t want this pricing, regardless of their usage.

The authors’ arrogant presumption that once consumers are hooked on the service, they’ll continue to pay more (much more under the ‘20% of users pay for 80% of the $100-300 billion dollar upgrades’ formula) comes with no evidence of any kind. In fact, all of the evidence is that consumers will become upset and raise hell with the providers that try it.

Assessing fees on content providers was an industry favorite just a few years ago, and it’s interesting to find this “solution” brought up yet again. It was an astroturfer favorite, and was one of the major points of contention over the Net Neutrality debate, now firing up once again. The industry wants to Re-Educate consumers about consumption billing and is now faced with re-fighting the Net Neutrality debate and this nice report, from the industry’s perspective, appears right on cue.

How About Asking the Industry to Take Some of their Profits and Invest in Their Own Networks

Totally absent from this report is even a cursory review of the current profits earned by broadband providers using the existing flat rate pricing formula. They are well into the billions. Today, despite those profits and the scary “exaflood” rhetoric, many have reduced the amount of money they spend on their broadband networks for needed upgrades. Instead, it appears some of that money is being funneled into public policy lobbying efforts to get consumers to accept much higher pricing for broadband under the guise of “fairness.”

Nowhere are the authors willing to explore industry investment in their networks, much less the implications of a national broadband policy that will play a part in constructing, overseeing, and operating a national broadband platform in the interests of citizens, not simply shareholders.

An obvious path to bigger profits for providers already exists, and consumers enthusiastically support it as being an even fairer solution — charging a premium for higher speed tiers of broadband service. No light user is going to commit to spending $60+ dollars a month on a premium speed package, but many of the larger consumers of broadband data will do so, happily. Those investments can easily pave the way for DOCSIS 3 deployments which benefit every customer on a cable network, from light users not subjected to neighborhood congestion, to average users that can quickly access the content they want, to heavy users that will enjoy the faster online experience they have clamored for, and demonstrate a willingness to pay to achieve.

That’s a broadband success story everyone can agree on.

Unfortunately, it’s also the one that requires providers spend some of those big profits to construct the networks capable of providing premium speed tiers. For them, the path of least resistance is to stall upgrades as long as possible by slapping consumption billing and usage caps on consumers to get them to reduce their usage, even as their own broadband bandwidth costs continue to decline.

Why We Don’t Pick Up What They Are Putting Down

Consumers’ real world experiences mean a lot more than statistical theories (especially when some of those statistics are fed by the self-interested broadband industry). They know cable bills never decrease, only increase, unless you drop services. They know many phone companies aren’t willing to invest in fiber optics to the home and settle for ordinary DSL or hybrid fiber-copper systems that don’t deliver much real “savings” in the end. The authors assume that consumers and policymakers will accept the premise that if you allow them to overcharge a portion of broadband customers, it will miraculously create benevolent pricing for income challenged consumers who will finally adopt broadband because of the public-service-like generosity of the broadband industry to give them a much reduced price.

That’s one theory the authors cannot prove, and don’t even try.

In Canada, the authors’ findings have already been tested, and it was bad news for consumers right down the line. First price increases, then usage caps, then speed throttles, then even more price increases. Even the highest speed premium tiers carry relatively paltry usage caps, diminishing their potential value to Canadian consumers. And this rapacious capture of consumer cash has not exactly provided Canadians with world class broadband. Instead, Canada falls further and further behind in global broadband rankings, evoking outrage from consumers upset that the upgrades they were sold on aren’t exactly in a hurry to arrive, and even when they do, the usage caps, throttles and ever-increasing prices remain.

That’s not broadband I can believe in.

Subscribe

Subscribe