Public interest groups today began an offensive against the cable industry’s attempts to stave off potential online video competition with an industry dominated and controlled online video platform that guarantees consumers won’t cut cable’s cord.

Free Press, Media Access Project, Public Knowledge and Consumers Union are sending letters to the Justice Department and the Federal Trade Commission calling for a probe into the industry’s “TV Everywhere” project, designed to weed out non-cable subscribers from accessing online video programming.

The undertaking, which the industry claims will eventually rival Hulu in size and scope, seeks to provide their broadband customers with on-demand access to as much programming as possible, as long as they subscribe to a corresponding video programming and broadband service package.

Known in the industry as a “pay wall,” the system would assure pay television companies affiliated with the project that they will not lose subscribers from customers cutting the cord to watch programming online for free. Consumer groups call that collusion, and accuse the industry of secretly meeting to outline the TV Everywhere concept and may be violating anti-trust laws in the process.

![]() “The old media giants are working together to kill off innovative online competitors and carve up the market for themselves,” said Marvin Ammori, a law professor at the University of Nebraska and senior adviser to Free Press. Ammori’s report: TV Competition Nowhere: How the Cable Industry Is Colluding to Kill Online TV, is included in the mailing to the federal agencies.

“The old media giants are working together to kill off innovative online competitors and carve up the market for themselves,” said Marvin Ammori, a law professor at the University of Nebraska and senior adviser to Free Press. Ammori’s report: TV Competition Nowhere: How the Cable Industry Is Colluding to Kill Online TV, is included in the mailing to the federal agencies.

Ammori says the industry has a long history of controlling behavior.

“Over the past decade, they have locked down and controlled TV set-top boxes to limit competing programming sources; they have considered imposing fees for high-capacity Internet use in ways that would discourage online TV viewing; and they have pressured programmers to keep their best content off the Internet,” Ammori writes.

In addition, these companies, which already dominate the Internet access market, have threatened to discriminate against certain online applications or have already been caught violating Network Neutrality. Indeed, the FCC issued an order in 2008 against Comcast for blocking technologies used to deliver online TV, noting the anti-competitive effect of this blocking. While it may be economically rational for cable, phone and satellite companies to squash online competitors, the use of anti-competitive tactics is bad for American consumers and the future of a competitive media industry.

The latest method of attack aimed at online TV, however, may be the most threatening — and is also likely illegal. Competition laws aim to ensure that incumbent companies fight to prevail by providing better services and changing with the times, not by using their existing dominant position and agreements to prevent new competitors from emerging.

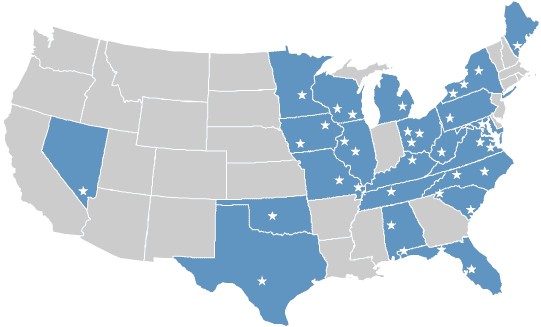

TV Everywhere has a simple business plan, under which TV programmers like TNT, TBS and CBS will not make content available to a user via the Internet unless the user is also a pay TV subscriber through a cable, satellite or phone company. The obvious goal is to ensure that consumers do not cancel their cable TV subscriptions. But this plan also eliminates potential competition among existing distributors. Instead of being offered to all Americans, including those living in Cox, Cablevision and Time Warner Cable regions, Fancast Xfinity is only available in Comcast regions. The other distributors will follow Comcast’s lead, meaning that the incumbent distributors will not compete with one another outside of their “traditional” regions.

In addition, new online-only TV distributors are excluded from TV Everywhere. The “principles” of the plan, which were published by Comcast and Time Warner (a content company distinct from Time Warner Cable), clearly state that TV Everywhere is meant only for cable operators, satellite companies and phone companies. By design, this plan will exclude disruptive new entrants and result in fewer choices and higher prices for consumers.

This business plan, which transposes the existing cable TV model onto the online TV market, can only exist with collusion among competitors. As a result, TV Everywhere appears to violate several serious antitrust laws. Stripped of slick marketing, TV Everywhere consists of agreements among competitors to divide markets, raise prices, exclude new competitors, and tie products. According to published reports and the evident circumstances, TV Everywhere appears to be a textbook example of collusion. Only an immediate investigation by federal antitrust authorities and Congress can prevent incumbents from smothering nascent new competitors while giving consumers sham “benefits” that are a poor substitute for the fruits of real competition.

The benefits of controlling the marketplace of video and online entertainment is a lucrative one, earning players billions in profits each year. Losing control of the business model risks the industry repeating the mistakes of the music industry, which overpriced its product and alienated consumers with annoying digital rights management technology and lawsuits. It also risks a repeat of the newspaper industry which many in the cable industry believe made the critical mistake of giving away all of their content for free.

With online video services like Hulu generating enormous online traffic from its free video programming, the cable industry fears they might already be headed down the road newspapers paved. TV Everywhere is part of a multi-pronged defense plan according to Ammori.

Indeed, what the industry cannot control themselves, Internet Overcharging schemes like usage caps and “consumption billing” can handily manage.

Ammoni notes:

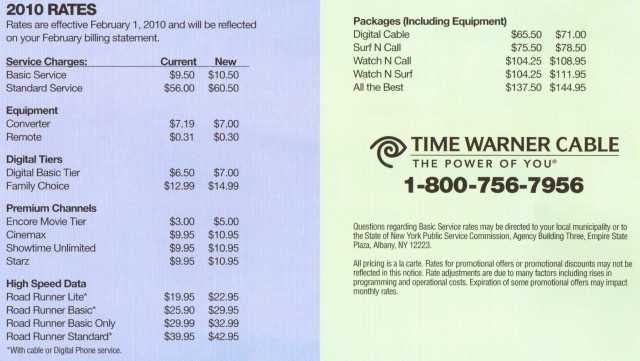

Cable and phone companies have proposed cap-and-metered pricing for Internet service that appears to target online TV. Unlike the current all-you-can-eat monthly fee-plans, cap-and-metered pricing would charge users based on the capacity used. As a result, downloading or streaming large files will be more expensive than smaller files. In March 2009, Time Warner Cable announced metered pricing trials in four cities that would have made watching online TV cost prohibitive.

AT&T is testing a metering plan on its wireline U-verse service with hopes for national expansion. Even under generous allowances for bandwidth, users could not watch high-definition programming for many hours a day.

In response to trials by Time Warner Cable, a House bill was introduced in Congress, and Time Warner Cable dropped its immediate plans under consumer pressure. The company stated the plans would be reintroduced following a “customer education process.”

“Online TV is this nation’s best shot at breaking up the cable TV industry oligopolies and cartels. Permitting online distributors to compete vigorously on the merits for computer screens and TV screens will result in increased user choice, more rapid innovation, lower prices and a more robust digital democracy,” Ammoni concludes.

Subscribe

Subscribe