Frontier Communications has won approval to assume control of telephone lines serving 310,000 Oregonians.

The Oregon Public Utilities Commission Friday unanimously approved the transfer of service from Verizon to Frontier as part of a 14-state transaction.

“First and foremost we want to ensure that customers are not harmed by this transaction. That’s why we are requiring more than 50 conditions, all aimed at making sure customers are not harmed by this sale,” Chairman Lee Beyer said. “In addition, we are requiring Frontier Communications to spend $25 million on expanding high-speed internet access to its Oregon customers by July 2013.”

In return for approval, Frontier agreed to PUC demands for customer service protections:

- A commitment that Frontier spend at least $25 million to expand high-speed broadband in Oregon by July 2013;

- No changes in “commission-regulated” retail service plans for at least three years;

- Costs of the transition must not be paid by customers in the form of rate increases;

- 90-day window to change long distance carrier without any fees;

- An independent audit, paid for by Verizon, to ensure Frontier can handle service for those customers affected by the deal;

- An opt-out provision letting Oregon’s FiOS subscribers terminate their contracts without penalty if Frontier reduces Internet speeds or drops any of its television channels.

What is missing from Oregon’s agreement?

What is missing from Oregon’s agreement?

- A prohibition of Internet Overcharging schemes like Frontier’s 5 gigabyte “acceptable use” policy that potentially limits customer’s broadband use. Expanded broadband that customers can only use for basic web browsing and e-mail, without fear of exceeding the limit, indefinitely punishes rural Oregonians with no broadband alternatives;

- A specific definition of what constitutes “broadband” speeds. Frontier can continue to deliver the 1-3 Mbps it routinely provides to its less urban service areas. While better than nothing, Oregon regulators could have used the deal as leverage to win 21st century broadband speeds from Frontier, not yesterday’s ‘barely broadband;’

- Fines and penalties that will punish a provider that does not invest appropriately in high service standards to provide quality service, and a trigger to permit automatic cancellation of operating certificates should Frontier go bankrupt.

Too many of these deals offer upsides for Wall Street and little benefit to consumers, especially those dependent on their landline phone company for basic communications services. By forcing requirements that prove costly for a provider to renege on, investors will understand their gains will only happen when they are assured Frontier is doing right by their customers, as well as their shareholders.

Oregon is the sixth state to approve the sale.

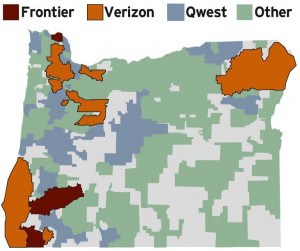

Frontier currently serves only 12,000 customers in the state, mostly in southwest Oregon, including the communities of Azalea, Canyonville, Cave Junction, Days Creek, Glendale, Myrtle Creek, O’Brien, Riddle, Selma, and Wolf Creek.

The company’s new customers will come mostly from Washington County, east Multnomah County, and from several pockets of customers in the northwestern part of the state. Oregon’s largest telephone provider is Qwest Communications, but the state has numerous smaller independent providers as well.

Subscribe

Subscribe