The Weather Channel has been removed from DirecTV’s lineup and replaced with WeatherNation, a much-smaller channel based in St. Paul, Minn., because the popular weather network reportedly sought a $0.01 monthly rate increase.

The Weather Channel has been removed from DirecTV’s lineup and replaced with WeatherNation, a much-smaller channel based in St. Paul, Minn., because the popular weather network reportedly sought a $0.01 monthly rate increase.

DirecTV subscribers told Stop the Cap! the channel change happened just after midnight, although WeatherNation was already a part of DirecTV’s lineup.

“This is unprecedented for the Weather Channel,” said David Kenny, CEO of the Weather Channel’s parent company. “In our 32 years, we have never had a significant disruption due to a failure to reach a carriage agreement.”

The Weather Channel has launched a campaign to restore the network that carries the impression DirecTV does not care about the safety of their customers. The Weather Channel executives have stated their severe weather coverage is unparalleled and would leave satellite dish customers in rural areas without important information about dangerous weather.

The Weather Channel has launched a campaign to restore the network that carries the impression DirecTV does not care about the safety of their customers. The Weather Channel executives have stated their severe weather coverage is unparalleled and would leave satellite dish customers in rural areas without important information about dangerous weather.

But Dan York, responsible for DirecTV content, said weather information is available from a variety of sources, especially smartphones, and The Weather Channel has drifted away from its core weather mission, devoting up to 40 percent of its programming to reality TV shows.

The two sides are far apart, even arguing over the amount of the increase The Weather Channel wants for its programming. Executives at The Weather Channel claim their requested increase amounts to $0.01 per month, per subscriber, on top of the $0.13 average cost distributors pay for the weather network. DirecTV says it is substantially more than that and it seeking a 20% rate cut due to declining ratings.

The Weather Channel lacks the clout major corporate conglomerates like NBC Universal, Time Warner Entertainment, or Viacom have when negotiating contract renewals. Instead, it is counting on its loyal audience to bring the fight to the satellite provider.

So far, viewers seem to be responding. An anti-DirecTV website run by The Weather Channel has received more than 700,000 page views and reportedly brought 150,000 complaint calls to DirecTV customer service.

[flv]http://www.phillipdampier.com/video/WSJ The Weather Channel Off DirecTV 1-14-14.flv[/flv]

The Wall Street Journal reports the advent of smartphones has taken a significant toll on The Weather Channel’s viewership, leading DirecTV to ask for a 20% rate cut. (4:17)

Subscribe

Subscribe A U.S. appeals court today ruled the FCC’s Net Neutrality policy requiring all Internet Service Providers to treat Internet traffic equally lacks legal authority.

A U.S. appeals court today ruled the FCC’s Net Neutrality policy requiring all Internet Service Providers to treat Internet traffic equally lacks legal authority. “Even though the commission has general authority to regulate in this arena, it may not impose requirements that contravene express statutory mandates,” Judge David Tatel said.

“Even though the commission has general authority to regulate in this arena, it may not impose requirements that contravene express statutory mandates,” Judge David Tatel said.

As expected for months, Charter Communications, Inc. today formally offered Time Warner Cable shareholders $132.50 per share to assume ownership of the nation’s second largest cable operator in a deal worth more than $61 billion, including debt.

As expected for months, Charter Communications, Inc. today formally offered Time Warner Cable shareholders $132.50 per share to assume ownership of the nation’s second largest cable operator in a deal worth more than $61 billion, including debt.

“Since we made our first proposal, Time Warner Cable has lost another half million video customers,” Rutledge said. “Their customer service continues to decline in every measure. We can improve it. We have a demonstrated track record of improving customer service. It’s a question of credibility.”

“Since we made our first proposal, Time Warner Cable has lost another half million video customers,” Rutledge said. “Their customer service continues to decline in every measure. We can improve it. We have a demonstrated track record of improving customer service. It’s a question of credibility.” After years of inaction, northern Canada will finally see improved telecommunications services that the rest of us have taken for granted for at least a decade.

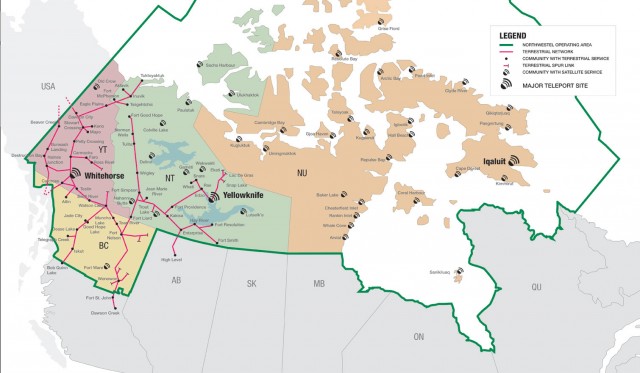

After years of inaction, northern Canada will finally see improved telecommunications services that the rest of us have taken for granted for at least a decade.

The CRTC has been unimpressed with the Bell Canada subsidiary’s performance, noting the quality of service is well behind the rest of Canada. The Commission has placed a four-year price cap on services and has broken up NorthwesTel’s near-monopoly on service by ordering it sell landline, Internet, and other voice services separately, which opens the door for new competitors to emerge. New entrants could either develop their own networks or resell service purchased wholesale from the phone company.

The CRTC has been unimpressed with the Bell Canada subsidiary’s performance, noting the quality of service is well behind the rest of Canada. The Commission has placed a four-year price cap on services and has broken up NorthwesTel’s near-monopoly on service by ordering it sell landline, Internet, and other voice services separately, which opens the door for new competitors to emerge. New entrants could either develop their own networks or resell service purchased wholesale from the phone company. AT&T is offering T-Mobile customers — and only T-Mobile customers — up to $450 to switch their wireless service to AT&T, but is the switch actually worth it? A close inspection of AT&T’s fine print suggests some customers might want to think twice.

AT&T is offering T-Mobile customers — and only T-Mobile customers — up to $450 to switch their wireless service to AT&T, but is the switch actually worth it? A close inspection of AT&T’s fine print suggests some customers might want to think twice.