AT&T pays a lot of money — millions annually — to make sure its business agenda does not run into political or legislative roadblocks in Washington, D.C. With dozens of members of Congress effectively on AT&T’s campaign contribution payroll and the company’s unparalleled skill at convincing non-profit organizations to advocate for its interests, worrying about the government’s antitrust views on its proposed buyout of Deutsche Telekom’s T-Mobile was the least of its troubles.

AT&T pays a lot of money — millions annually — to make sure its business agenda does not run into political or legislative roadblocks in Washington, D.C. With dozens of members of Congress effectively on AT&T’s campaign contribution payroll and the company’s unparalleled skill at convincing non-profit organizations to advocate for its interests, worrying about the government’s antitrust views on its proposed buyout of Deutsche Telekom’s T-Mobile was the least of its troubles.

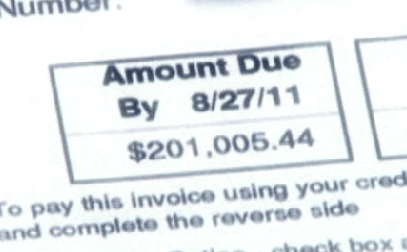

“It’s a done deal,” several analysts predicted shortly after the deal was announced, especially after AT&T demonstrated its confidence level in the merger was as high as the enormous $6 billion dollar breakup concession payable to Telekom if it ever fell apart.

Then the government dared to put its two cents in, in the form of a “are you kidding me?”-lawsuit courtesy of the U.S. Department of Justice. It seems, in the words of some Beltway cynics, the Obama Administration can manage to see a clear cut case of anti-competitive behavior when given enough time.

Since the lawsuit was announced on Aug. 31, it has been “all-hands-on-deck” for the company’s government relations division, packed full of the company’s top lobbyists. While company lawyers desperately attempt to block what it sees as “pile on” objections and lawsuits from worried competitors, Sprint-Nextel in particular, AT&T lobbyists are trying to compromise away the Justice Department case with proposals of concessions and giveaways to make approval more palatable.

Further north, as fall turns into winter in New York’s financial district, Wall Street analysts are cold on the troubled deal themselves.

The Financial Times reports most analysts think there is now less than a 50-50 chance the merger will be completed unless the two companies agree to disgorge themselves of market share, territories, and increasing “shareholder value” that will come from eventual rate increases a wireless duopoly would inevitably bring.

Some are even less sanguine, predicting AT&T has only a 20 percent shot, and only if it sells off considerable chunks of valuable spectrum to competitors other than Verizon Wireless.

AT&T is retuning its “message” for the times, downplaying the original, ludicrous notion that urban-focused T-Mobile would be the keystone of a new era in 4G wireless service for rural America. There is a reason T-Mobile isn’t the first choice for small town America’s cell phone buyers.

Instead, AT&T is now positioning the merger deal as a lifeboat for its troubled competitor. AT&T suggests the number four carrier is in immediate peril — hemorrhaging customers, caught without a coherent 4G strategy, and an exodus of interest by its increasingly neglectful parent — Deutsche Telekom.

“Over the past two years, T-Mobile USA has been losing customers despite explosive demand for mobile broadband,” AT&T said in a statement this week. “T-Mobile USA has no clear path to 4G LTE, the industry’s next generation network, and its German parent, Deutsche Telekom, has said it would not continue to make significant investments in the United States.”

With AT&T predicting the demise of its smaller would-be cousin, consumers may not be in the mood to sign a two-year contract with a company that could soon be rechristened AT&T, especially those leaving AT&T for T-Mobile.

But don’t tell T-Mobile’s marketing department it’s a phone company on life support. T-Mobile has beefed up its advertising and continues to irritate its larger competitors, particularly AT&T, with very aggressive pricing on its prepaid plans.

T-Mobile recently unveiled two disruptive $30 4G prepaid plans that offer either 1500 shared minutes/text messages and 30MB of data usage -or- 100 voice minutes combined with unlimited texting and up to 5GB of mobile data before the speed throttle kicks in. Those prices are too low for AT&T and Verizon to ignore, especially when offered on a 4G network.

So far, the Justice Department shows no signs of backing down from their resolute opposition to the deal, minor concessions or not. Shareholders may not appreciate giving the government too much of what it wants in order to win approval. Washington lawmakers are split — virtually every Republican favors the merger, Democrats are less absolute, with most opposed. Among those in favor, by how much is often a measure of what kind of campaign money AT&T has thrown their way.

AT&T absolutely denies they have a “Plan B” in case the merger eventually fails. But the Times doubts that, reporting as time drags on, an alternative deal might emerge. Some of the possibilities:

- T-Mobile USA could merge its spectrum with Dish Network, the satellite TV company, to launch a new 4G mobile operator in the USA;

- Combine forces (and spectrum) in a deal with leading U.S. cable companies like Cox, Comcast, and Time Warner Cable to launch a new cable-branded mobile operator;

- Sell or merge operations with MetroPCS, Leap Wireless’ Cricket, or one of several regional cell companies.

Perennial cable booster Craig Moffett from Sanford Bernstein predictably favors the cable solution, which would let companies offer a quad or quint-play of cable TV, wireless mobile broadband, wired broadband, phone, and cell phone service all on one bill. It would also get the FCC off the backs of cable operators Time Warner and Comcast, who both control a total of 20MHz of favored wireless spectrum they have left unused since acquiring it at auction. The Commission is increasingly irritated at companies who own unused spectrum at a time when the agency is trying to find additional frequencies for wireless providers.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Bloomberg ATTs 96000 Job Claim in T-Mobile Deal Questioned 11-8-11.flv[/flv]

Bloomberg News questions AT&T’s claim its merger deal with T-Mobile will create 96,000 new jobs. [Nov. 8] (3 minutes)

Subscribe

Subscribe