If this is the best Sprint’s Marcelo Claure can do, Softbank needs to keep shopping for another CEO.

If this is the best Sprint’s Marcelo Claure can do, Softbank needs to keep shopping for another CEO.

Claure’s decision to deep-six the appallingly stupid Framily Plan was a no-brainer. Sprint’s own customer service agents barely understood the multi-level marketing scheme it actually was, and I never saw much value in alienating friends and family by cajoling them to use the atrociously bad Sprint network. Neither did Sprint employees who loudly cheered its upcoming demise.

Even Claure trashed Sprint’s network performance and upgrade program as glacier-slow and highly disruptive to customers who find nearby cell sites here today, gone tomorrow, and maybe back again someday when network upgrades have been finished. Unlike AT&T or Verizon where a cell tower outage might cut a few bars of signal strength, when a Sprint cell tower drops, it’s roaming time. It is not uncommon for residents along Lake Ontario’s shorelines in the United States to find their phones preferring to roam on Canadian networks (especially Rogers) to avoid Sprint.

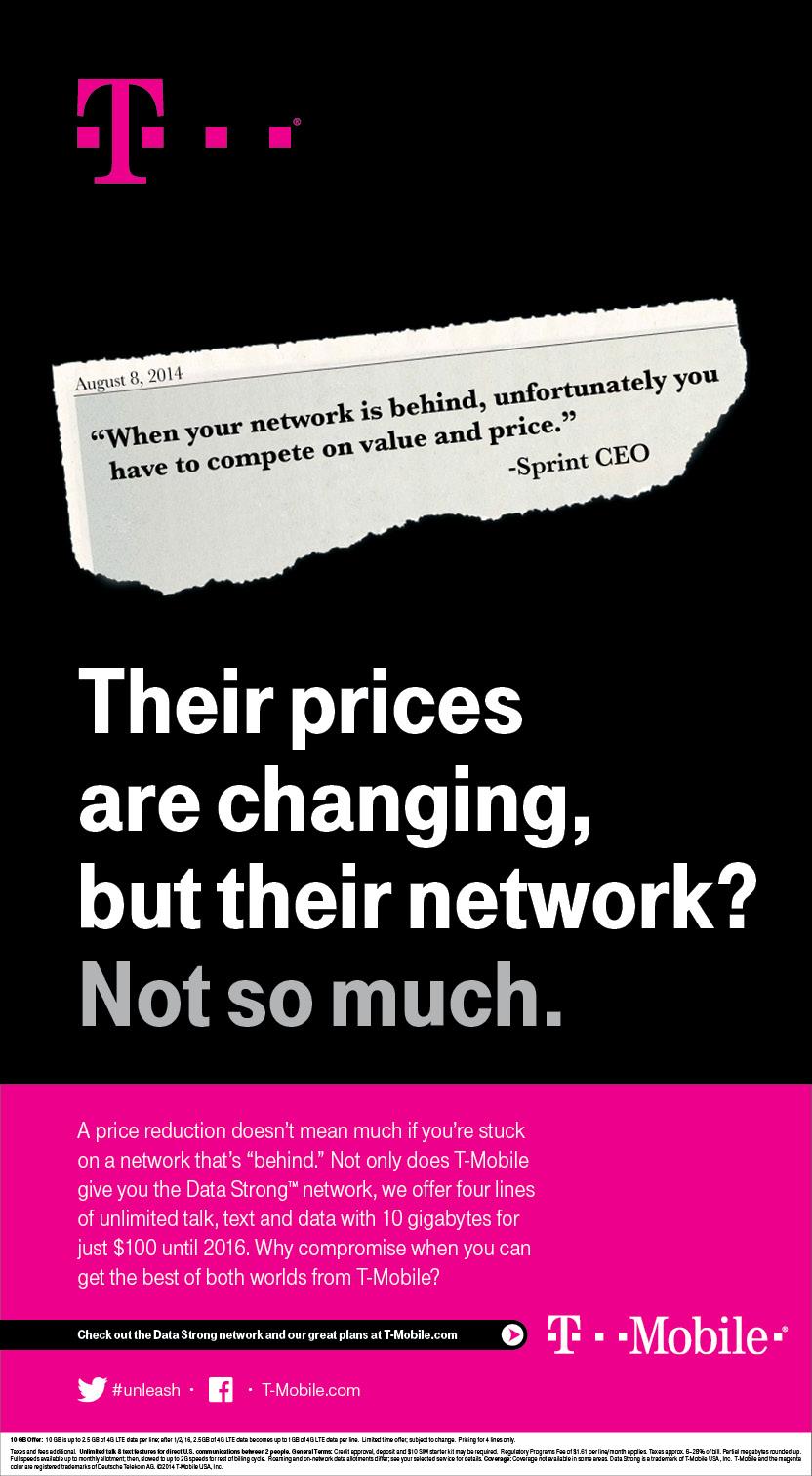

Claure’s commitment to cut prices while cruelly excluding your current customer base from getting any of those savings is a sure-fire way to accelerate their departure… mostly to T-Mobile. John Legere is waiting with open arms.

Sprint doesn’t need to just cut prices, it needs to butcher them, and fast. Sprint’s loyal customers have been promised a lot since the company unveiled its Network Vision upgrade plan during the French Revolution of 1789. The Bastille might still be standing today had Sprint slapped a working 4G LTE antenna on top of it. But alas, let them suffer with Sprint 3G, declared Dan Hesse, on a network so bad that throttled customers in heavy-use prison actually saw their speeds rise. Some customers in western New York simply turn Sprint 3G data off to save the battery.

When Sprint 4G LTE finally did arrive in western New York (illogically first in rural communities like the stiflingly-dull town of Dansville), many barely noticed because Sprint’s backhaul connection between the cell tower and Sprint’s data network often stayed the same — congested and slow.

Although T-Mobile’s coverage is not that different from Sprint, its network upgrades are.

T-Mobile CEO John Legere has confidently pushed Sprint around over its newest plan, but if it does start to eat into T-Mobile’s business, Legere will no doubt respond with some new plans of his own. For current Sprint customers, T-Mobile is definitely the upgrade Sprint has promised for at least five years, and should be considered at contract renewal time. But current Verizon and AT&T customers paying Cadillac pricing should not be expected to switch to Sprint after recalling dropped calls in a store, home or in an emergency on Sprint’s less robust network. They are very unlikely to change carriers no matter what shade of lipstick Sprint applies to its plans.

Claure has the right idea — slash prices and actually deliver on promises of a better network going forward, but those commitments deserve to apply to both existing and new customers. So far Claure has managed to inflict only superficial wounds. The price cuts must go much deeper to attract business from customers of the larger carriers willing to compromise for the right price and upgrades have to be real and delivered immediately.

Sprint still doesn’t understand it cannot charge Honda Accord prices on a Chevy Spark network. Until they do, T-Mobile is likely to continue taking them to school.

Subscribe

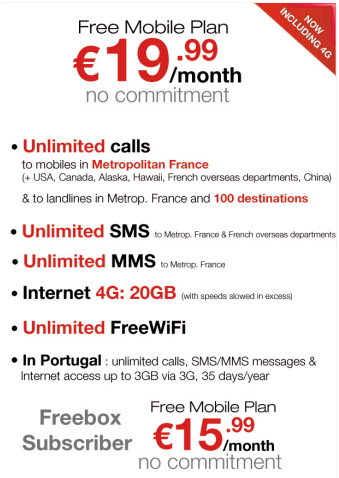

Subscribe The French Revolution in wireless could be spreading across the United States if Paris-based Iliad is successful in its surprise $15 billion bid to acquire T-Mobile USA (right out from under Sprint and Japan-based Softbank). Wall Street hopes it isn’t true.

The French Revolution in wireless could be spreading across the United States if Paris-based Iliad is successful in its surprise $15 billion bid to acquire T-Mobile USA (right out from under Sprint and Japan-based Softbank). Wall Street hopes it isn’t true. Free’s customer care center is run on Ubuntu-based, inexpensive notebook and desktop computers. Free’s wired broadband, television, and phone service is powered by set-top boxes and network devices custom-developed inside Iliad to keep costs down. Its creative spirit has been compared to Google, much to the chagrin of its “business by the book” competitors.

Free’s customer care center is run on Ubuntu-based, inexpensive notebook and desktop computers. Free’s wired broadband, television, and phone service is powered by set-top boxes and network devices custom-developed inside Iliad to keep costs down. Its creative spirit has been compared to Google, much to the chagrin of its “business by the book” competitors.