Suddenlink: Subscribers Walloped With Big Rate Increases and “Free” Speed Upgrades (With Usage Caps)

Suddenlink customers are unhappy with the cable company’s usage caps that go with “free speed upgrades.”

Suddenlink subscribers promised “free” speed upgrades are calling them Suddenlink’s Trojan Horse because they are accompanied by dramatically higher cable programming surcharges and usage caps.

St. Augustine, Tex. subscribers got a smaller bite in the mail than some other communities:

Effective with the March 2015 billing cycle, Suddenlink customers will experience no change to the price of telephone service and no change to the price of Basic TV service. There will also be no change to the price of Expanded Basic TV service; however, a $3.00 sports programming surcharge will be added to the bills of customers subscribing to this service to cover a portion of the skyrocketing cost of dedicated sports channels and general entertainment networks with sports programming. The broadcast station surcharge will increase $2.88 per month to cover the escalating fees charged by broadcast TV station owners. Optional tiers of digital TV channels will increase $1.25 per month per tier. High-speed Internet services will increase $3.00 per month.

Over in Chandler, Tex., fees went even higher, with one customer reporting his broadcast station surcharge now exceeded $8 a month. Another customer counting up all the extra fees added to his bill found them coming close to an extra $25 a month.

But the state that gets the worst from broadband providers remains West Virginia, where Suddenlink faces only token DSL competition from Frontier Communications. Suddenlink retention representatives dealing with customers threatening to cancel service in West Virginia are well aware customers have nowhere else to go and don’t break a sweat trying to rescue business.

“We are a business and our goal is to make a profit,” one retention representative told a Suddenlink customer dropping service in favor of DirecTV.

Customers tell Stop the Cap! they were first excited Suddenlink was dramatically boosting Internet speeds — good news for the small and medium-sized cities Suddenlink favors over larger cable operators. The bad news is Suddenlink is bringing back strict enforcement of usage caps, temporarily suspended when its usage measurement tool was proven inaccurate.

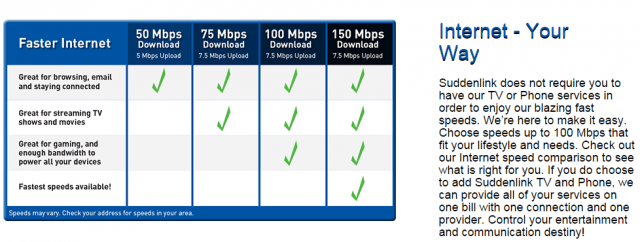

Suddenlink has been upgrading its cable systems since 2014 and has gradually rolled out new speeds. Most customers can now choose speed tiers of 50, 75, 100, or 150Mbps, but some larger systems are getting more robust upgrades:

- Current speed 15Mbps increases to 50Mbps (250GB usage cap)

- Current speed 30Mbps increases to 50Mbps (250GB usage cap)

- Current speed 50Mbps increases to 75Mbps (350GB usage cap)

- Current speed 100Mbps increases to 300Mbps (500GB usage cap)

Suddenlink’s sales website makes no reference to the company’s broadband usage caps.

Suddenlink is also enforcing usage caps again, which most customers only learn about after signing up for service. Suddenlink makes no references to usage allowances on their sales or general support pages and information is difficult to find unless a customer uses a search engine to find specific information.

Suddenlink’s explanation for its usage caps is among the most cryptic we have ever seen from an ISP:

Consistent with our Acceptable Use Policy and Residential Services Agreement, Suddenlink has applied monthly usage allowances to residential Internet accounts in most of its service areas. To determine if there is a monthly allowance associated with your account – and what that allowance is – please set up or log in to an existing online account. See the related instructions under question #8.

While existing residential customers will quickly learn their usage allowance and find a usage measurement tool on Suddenlink’s website, that is not much help to a new or prospective customer. The overlimit fee, also difficult to find, is $10 for each allotment of 50GB.

Some customers have found a way around the usage cap by signing up for Suddenlink’s business broadband service, typically 50/8Mbps for around $75 a month. Business accounts are exempt from Suddenlink’s caps.

Subscribe

Subscribe Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover.

Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover. Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that.

Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that. Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell.

Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell. Verizon FiOS is the fastest nationwide broadband service available.

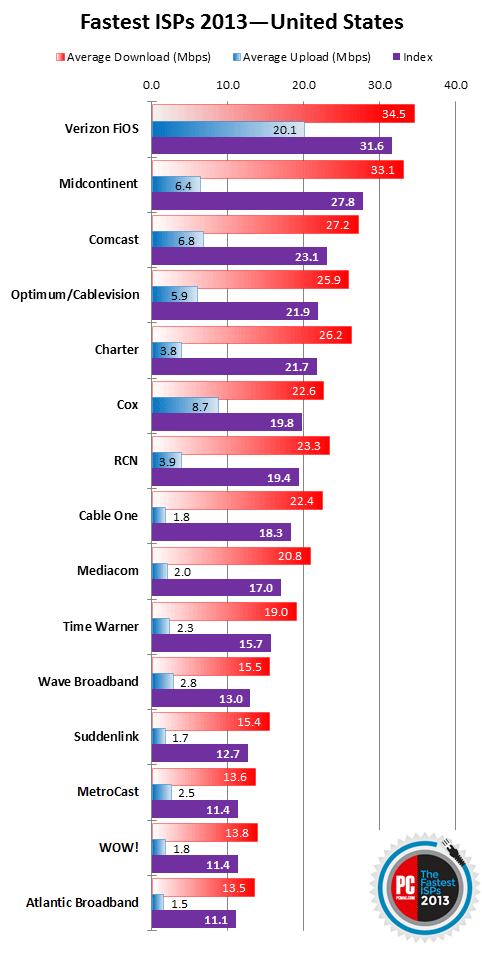

Verizon FiOS is the fastest nationwide broadband service available.