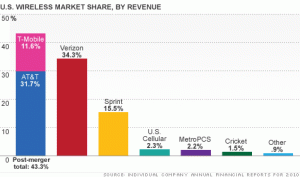

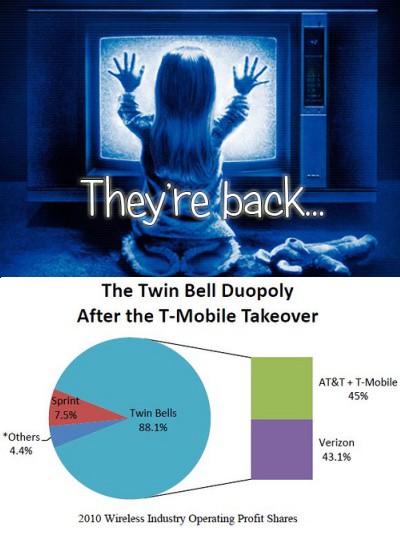

Sprint is preparing to launch its own 4G LTE network early next year in an undetermined number of markets to increase 4G speeds and compete with AT&T and Verizon.

Sprint is preparing to launch its own 4G LTE network early next year in an undetermined number of markets to increase 4G speeds and compete with AT&T and Verizon.

Sprint’s existing 4G service, based on older WiMax technology that powers the Clearwire network, has not kept up with subscriber demands, and many of Sprint’s “4G”-capable markets have speeds more in common with 3G than Verizon’s LTE or AT&T HSPA+ 4G networks. As Clearwire continues to struggle through serious financial problems (the service has not expanded into a new market since 2010), lawsuits, and disgruntled customers, Sprint isn’t waiting around for Clearwire’s own planned upgrade to TD-LTE, which would require at least $600 million in financing to undertake.

Instead, Sprint is deploying the same technology used by Verizon for its LTE network.

CNET reports Sprint will initially use its G-block spectrum (1900MHz) for its LTE network, but the most robust coverage will come in 2013 when Sprint retires the Nextel iDEN network which currently resides in the 800MHz band, more suitable for longer range reception.

Sprint says the 4G LTE upgrade is all part of its Network Vision plan, which upgrades virtually the entire Sprint network at a cost of $4-5 billion. But shareholders aren’t reacting over Sprint’s LTE spending, because it is included in the earlier budget already disclosed to Wall Street.

For consumers, the upgrade will mean the company that first embraced 4G will once again deliver speeds worthy of that label. Sprint customers across the country have reported network speeds have suffered as more customers have piled on Sprint’s and Clearwire’s network. Clearwire will remain a Sprint partner, but that wireless provider will increasingly depend on Sprint’s network, a reversal of Sprint’s current dependence on Clearwire WiMax for their existing 4G service. Clearwire may ultimately be unable to finance its own upgrades.

For consumers, the upgrade will mean the company that first embraced 4G will once again deliver speeds worthy of that label. Sprint customers across the country have reported network speeds have suffered as more customers have piled on Sprint’s and Clearwire’s network. Clearwire will remain a Sprint partner, but that wireless provider will increasingly depend on Sprint’s network, a reversal of Sprint’s current dependence on Clearwire WiMax for their existing 4G service. Clearwire may ultimately be unable to finance its own upgrades.

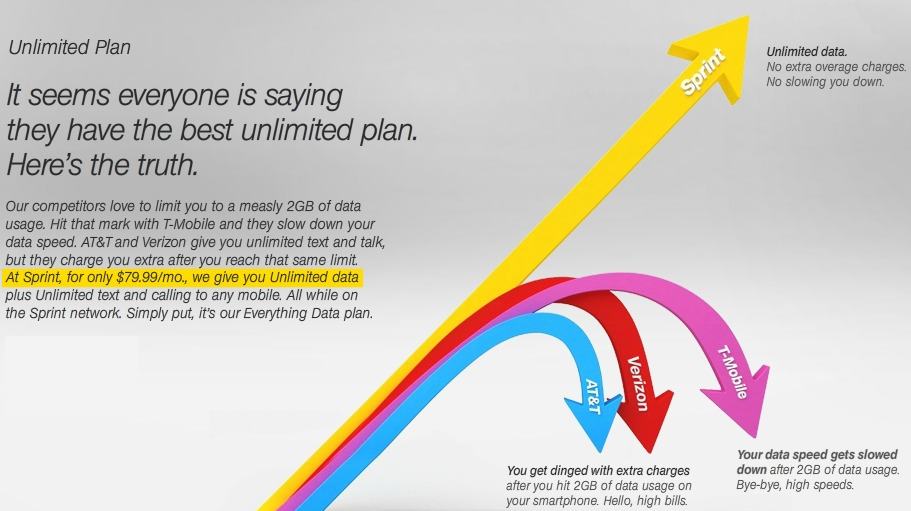

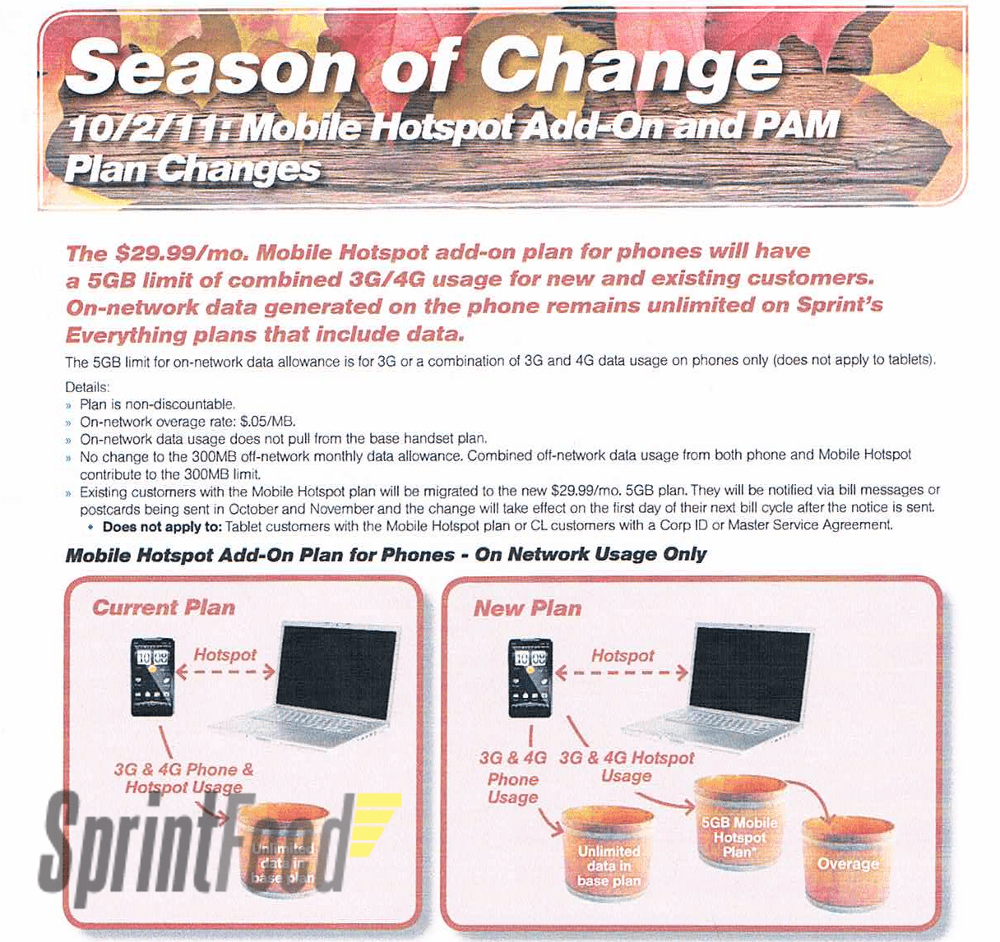

Sprint also announced it will keep its unlimited smartphone data plans, because they attract customers from AT&T and Verizon who do not want limited-use plans. But preserving unlimited data comes at a cost. Sprint has been cutting perks all month:

- Sprint nearly doubled its early termination fee from $200 to $350 effective Sept. 9.

- Sprint slashed its satisfaction guarantee program for new customers from 30 to 14 days on Sept. 16. Sprint’s guarantee allows new customers the opportunity to test Sprint’s network before committing to a two-year contract. The company also now expects to be paid for whatever airtime charges were incurred during the trial.

- Sprint has announced it is ending its Premier Program Dec. 31. Premier gave customers who spend more than $89 a month on an individual cell plan the opportunity to upgrade their phones annually, penalty-free. Members also received free minutes, discounts on accessories, early buying opportunities for the newest phones, and regular plan reviews. Instead, customers will be dropped into the same New for YouSM Upgrade Program lower spenders receive. But Sprint will be changing that program too:

On October 2, the following changes to our New for YouSM Upgrade Program will take effect:

- New lines of service and existing customers who upgrade on or after October 2, 2011 will receive future upgrades after 20 months;

- $75 and $25 upgrade discounts will no longer be available for customers signing up for a 1-year agreement or 2-year agreement after 12 months or signing a 1-year agreement after 22 months.

Additional information for existing customers. As of October 2:

- If you’ve already qualified for a full upgrade, nothing changes. When you sign up for a new 2-year agreement and take your device offer, future upgrades will be available after 20 months;

- If you haven’t qualified for your full upgrade yet, to receive a discount you’ll wait until you qualify for your full upgrade at 22 months.

On Oct. 5, Sprint is expected to introduce the Apple iPhone on its network for the first time. Some analysts predict iPhone will be the catalyst to drive Sprint’s unlimited data plan into the ground, because the phone has a reputation for being a favorite for heavy data users. iPhone 5 will remain dependent on 3G networks for connectivity outside of Wi-Fi, which could drive data usage higher than any other Sprint phone. Should that overwhelm Sprint’s 3G network before its 4G service enjoys a widespread rollout (and Apple introduces a phone that works on 4G), Sprint may find itself limiting data usage as well, as least on its 3G network.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Welcome to 4G from Sprint.flv[/flv]

Sprint’s promotional video promoting its current 4G WiMax network, powered by Clearwire. (3 minutes)

Subscribe

Subscribe