New York’s Department of Public Service (DPS) has granted Charter Communications an unprecedented additional 18-day extension to file its threatened appeal of the Commission’s decision to boot the cable company from the state and its six-month exit plan.

“Charter and DPS Staff state in their request for a limited 18-day extension of time that discussions are ongoing, that Charter and DPS Staff have established a framework for how a settlement agreement might be structured, and that any final agreement would necessarily address: issues relating to the inclusion of certain categories of addresses and whether they are valid ‘passings’ under the Merger Approval Order; penalty actions and amounts under dispute in Supreme Court; and a schedule for compliance (including enforcement mechanisms) going forward,” the order granting the extension reads.

Despite last week’s filing from Charter’s attorneys excoriating the Public Service Commission for its decision to remove Spectrum from the state, the DPS claimed this week that because of Charter’s “continued obligations to comply with the Public Service Law and regulations, good cause exists […] to allow for further discussions while both sides reserve their respective legal rights.”

But some consumer groups, including Stop the Cap!, are wondering exactly when patience will run thin at the Commission.

“When the latest deadline arrives in January 2019, it will be nearly six months since the Commission voted to strip approval of Charter’s merger with Time Warner Cable,” said Phillip M. Dampier, founder of Stop the Cap! “While we can appreciate the benefits of negotiation and dialogue, these conversations are taking place behind closed doors with no public input and no formal ability for groups like ours to intervene and offer our own views.”

Stop the Cap! has advocated that Charter Communications be allowed to remain in business in New York, but only with their agreement to meet some additional terms and conditions:

- Further extend Spectrum service to additional customers in rural New York scheduled to receive satellite internet service;

- Increase entry-level broadband speed to at least 200 Mbps immediately and further extend availability of Everyday Low Price Internet service ($14.99/mo);

- Settle the ongoing labor dispute with striking Spectrum workers in downstate New York.

“At present, it appears the DPS/PSC is only negotiating to get Spectrum back in compliance with the original terms of the Merger Order they have been ignoring, which is hardly a concession,” Dampier said. “Charter’s arrogance and blatant disrespect for the terms of the merger deal and its flippant adherence to those terms should cost the company more than just a monetary fine lost in the state’s coffers. Visible benefits to New York consumers must be part of the equation.”

The state seems mostly focused on keeping Charter in compliance with the agreement while the lawyers talk.

“As the Commission noted in prior extensions, however, this limited extension should not be viewed as an indefinite grant of time for discussions to continue between DPS Staff and the Company,” DPS officials wrote. “Many Upstate New Yorkers living in Charter’s franchise areas are understandably frustrated by the lack of modern communications infrastructure. The Compliance and Revocation Orders were designed to deal with very serious consumer issues presented by Charter’s conduct related to the company’s network expansion. As such, the processes envisioned therein must continue in the absence of an agreement.”

The current extension resets the deadlines to file an appeal to Dec. 14, 2018 and the six-month exit plan to Jan. 11, 2019. Both are just the latest in a series of extensions.

Important Dates:

- July 27, 2018: The PSC votes to rescind approval of the Charter/Time Warner Cable merger in New York, effectively disallowing the company to continue to do business in the state.

- August 17, 2018: Charter files a 60-day extension request, which is granted on Aug. 20.

- September 7, 2018: Charter files a 30-day extension request, which is granted on Sept. 10.

- October 9, 2018: Charter files a 60-day extension request. The DPS grants a 45-day extension instead on Oct. 10.

- November 21, 2018: Department of Public Service (DPS) Staff and Charter filed a joint letter stating that they had not yet been able to reach a fully executed settlement agreement, but that they had established a framework for how a settlement agreement might be structured and that discussions remain ongoing. A limited 18-day extension is granted.

- December 14, 2018: Deadline for Charter to file its appeal with the Commission.

- January 11, 2019: Deadline for Charter to file a six-month exit plan showing the Commission how the company intends to orderly transfer its Spectrum cable operation to another provider.

Subscribe

Subscribe

Charter Communications ‘productive negotiations’ with New York’s Public Service Commission have deteriorated.

Charter Communications ‘productive negotiations’ with New York’s Public Service Commission have deteriorated. Charter argues the Commission has no right to insist on much of anything, because much of its business operation is unregulated and attempts to interfere with it would cause the company “clear and substantial irreparable harm,” and violate the company’s constitutional rights.

Charter argues the Commission has no right to insist on much of anything, because much of its business operation is unregulated and attempts to interfere with it would cause the company “clear and substantial irreparable harm,” and violate the company’s constitutional rights. Charter claims the Commission changed the terms of the Merger Order after it was approved. In Charter’s view, the company’s expansion effort to reach unserved parts of New York State should include New York City, one of the most wired metropolitan areas in the United States. That the Commission took offense to Charter’s interpretation of the Merger Order should not mean the company should face the ultimate consequence — being asked to leave the state.

Charter claims the Commission changed the terms of the Merger Order after it was approved. In Charter’s view, the company’s expansion effort to reach unserved parts of New York State should include New York City, one of the most wired metropolitan areas in the United States. That the Commission took offense to Charter’s interpretation of the Merger Order should not mean the company should face the ultimate consequence — being asked to leave the state. Charter expects the PSC to rule on its motion within a week of filing it, demanding a stay before the start of business on Monday, Nov. 26. If the company does not get what it wants, it will seek a stay from the Supreme Court in Albany County instead.

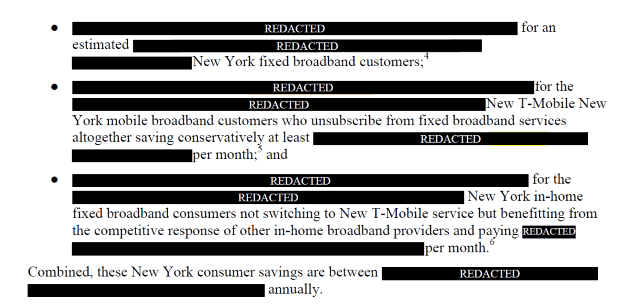

Charter expects the PSC to rule on its motion within a week of filing it, demanding a stay before the start of business on Monday, Nov. 26. If the company does not get what it wants, it will seek a stay from the Supreme Court in Albany County instead. A dispute is emerging in New York between Sprint and T-Mobile and the Communications Workers of America (CWA) and pro-consumer group the Public Utility Law Project (PULP) over the wireless companies’ attempt to argue for their merger deal in a partly secretive filing not open to review by the public.

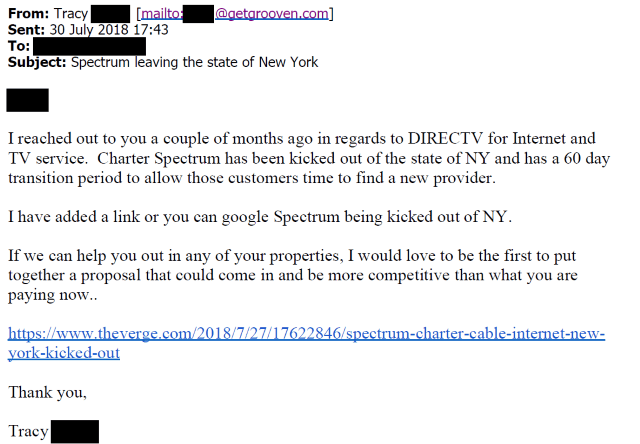

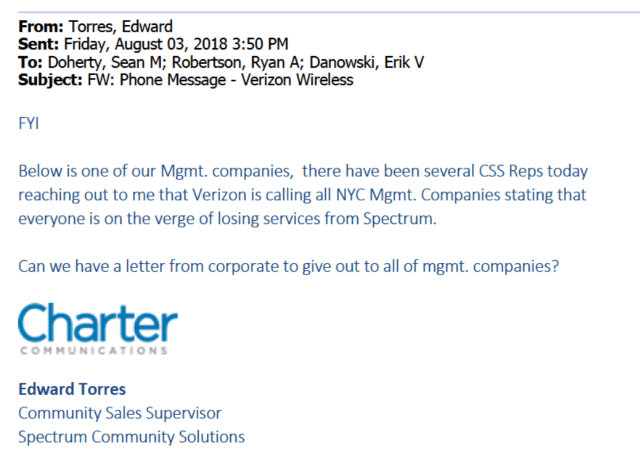

A dispute is emerging in New York between Sprint and T-Mobile and the Communications Workers of America (CWA) and pro-consumer group the Public Utility Law Project (PULP) over the wireless companies’ attempt to argue for their merger deal in a partly secretive filing not open to review by the public.

The merger of the two wireless companies requires state and federal approval. Alaska, Colorado, Delaware, Georgia, Louisiana, Maryland, Minnesota, Nevada, Texas, Utah, West Virginia and the District of Columbia have already essentially “rubber-stamped” approval of the merger deal with little comment. Pennsylvania regulators submitted a series of questions that the two companies answered earlier this week.

The merger of the two wireless companies requires state and federal approval. Alaska, Colorado, Delaware, Georgia, Louisiana, Maryland, Minnesota, Nevada, Texas, Utah, West Virginia and the District of Columbia have already essentially “rubber-stamped” approval of the merger deal with little comment. Pennsylvania regulators submitted a series of questions that the two companies answered earlier this week.

“It took a service technician coming out to make it clear to us there was no way we would ever get faster speed because there was too much copper wiring between their office and our homes,” Brown said. “The technician felt for us, and about half of his service calls were disappointing customers like us.”

“It took a service technician coming out to make it clear to us there was no way we would ever get faster speed because there was too much copper wiring between their office and our homes,” Brown said. “The technician felt for us, and about half of his service calls were disappointing customers like us.” “We are paying for internet speed that we aren’t receiving,” Ruth complained. “It is so slow that we have a hard time getting a short 50 second video to load. Forget watching a YouTube video, it’s not going to happen.”

“We are paying for internet speed that we aren’t receiving,” Ruth complained. “It is so slow that we have a hard time getting a short 50 second video to load. Forget watching a YouTube video, it’s not going to happen.” Wall Street balks at the dollar amounts it would take for Windstream to fully update its network to offer broadband speeds that were common for cable subscribers a decade ago. That kind of network investment would likely drive down the share price, impact shareholder dividends or stock buyback plans, and increase debt. Instead, many phone companies are hoping the federal government will come to the rescue and subsidize rural network improvements through the FCC’s Connect America Fund or government grants. But many of those grants won’t deliver service improvements to existing customers. Instead it will allow rural phone companies to bring broadband to customers who never had it before.

Wall Street balks at the dollar amounts it would take for Windstream to fully update its network to offer broadband speeds that were common for cable subscribers a decade ago. That kind of network investment would likely drive down the share price, impact shareholder dividends or stock buyback plans, and increase debt. Instead, many phone companies are hoping the federal government will come to the rescue and subsidize rural network improvements through the FCC’s Connect America Fund or government grants. But many of those grants won’t deliver service improvements to existing customers. Instead it will allow rural phone companies to bring broadband to customers who never had it before.