Verizon’s FiOS expansion is still, still, still, still, and still dead.

Despite the passage of favorable legislation deregulating the state’s largest telecom companies, Verizon has thumbed its nose at New Jersey’s efforts to convince the company to expand its fiber-to-the-home service.

“Verizon does not plan to expand its FiOS service footprint,” wrote Tanya Davis, a Verizon franchise service manager for FiOS in New Jersey and New York. “The company remains focused on continuing to meet its franchise obligations, and delivering competitive services, and enhanced consumer choices, where the services are available.”

More than a decade after passing the 2006 Cable TV Act in New Jersey, designed to convince telecom companies to compete more vigorously with each other, Verizon remains uninterested in further expanding its fiber network in New Jersey and beyond.

After successfully lobbying the state to adopt a statewide cable TV franchise policy, making life easier for Verizon by not requiring the company to negotiate a contract with each town serviced, Verizon suddenly stopped caring after announcing a pullback in further FiOS expansion in 2010. The change in heart appears to have started at the top. Then CEO Ivan Seidenberg, who approved FiOS, retired and was replaced by Lowell McAdam, who preferred Verizon invest mostly in its wireless networks.

Vergano

As a result, New Jersey has a telecom industry-friendly deregulatory policy in place with nothing to show for it.

“People want to see competition,” Wayne Mayor Christopher Vergano told the North Jersey Record, citing complaints his office has received about Altice USA’s Optimum service. “Over the years, they’ve seen their cable bills increase. We’re trying to give residents options.”

Wayne’s Township Council passed a resolution asking state lawmakers to review the 2006 Cable TV Act to find a way to coerce Verizon to do more fiber upgrades in the state. In 2006, then Gov. John Corzine got Verizon to commit to wiring 70 towns across New Jersey, and Wayne was not one of them.

Verizon agreed to expand its fiber network to all county seats, as well as areas with a population density in excess of 7,111 residents per square mile.

New Jersey’s Board of Public Utilities (BPU) is still allowed to report on Verizon’s progress, but little else, thanks to deregulation. A BPU report stated deployment of FiOS slowed to a crawl between 2010-2013, when only three new towns were reached with fiber upgrades. What little interest Verizon still had in FiOS expansion ended after 2012’s Superstorm Sandy, after which Verizon ended expansion in urban areas of New Jersey as well.

“It’s solely Verizon’s discretion to add municipalities to its system-wide franchise,” a BPU spokesman told the newspaper.

Prior to deregulation, utility boards and regulators could compel companies to offer service instead of shrugging their shoulders and telling state lawmakers ‘it’s all up to Verizon.’

Subscribe

Subscribe

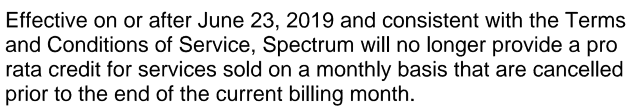

The financial benefit to Charter Spectrum is substantial, because customers will be forced to pay for a full month of service even if they cancel during the first week of a new billing cycle. The cable industry has been gradually shifting away from issuing partial month credits after other telecom companies, notably Windstream and wireless operators, moved to “full month billing – no refunds for partial month” billing.

The financial benefit to Charter Spectrum is substantial, because customers will be forced to pay for a full month of service even if they cancel during the first week of a new billing cycle. The cable industry has been gradually shifting away from issuing partial month credits after other telecom companies, notably Windstream and wireless operators, moved to “full month billing – no refunds for partial month” billing. Your time is up. It may have been one, two, or if you are especially lucky — three years since you signed up for Charter Spectrum service. But your temporary reprieve from the high price of cable is over.

Your time is up. It may have been one, two, or if you are especially lucky — three years since you signed up for Charter Spectrum service. But your temporary reprieve from the high price of cable is over. Frontier Communications

Frontier Communications  Although continued traffic growth would seem to indicate companies like AT&T and Verizon will need to continue major spending initiatives to keep up with demand, technological advancements and upgrade programs have made networks more efficient than ever, allowing AT&T and Verizon to report cost declines as much as 40% annually.

Although continued traffic growth would seem to indicate companies like AT&T and Verizon will need to continue major spending initiatives to keep up with demand, technological advancements and upgrade programs have made networks more efficient than ever, allowing AT&T and Verizon to report cost declines as much as 40% annually.