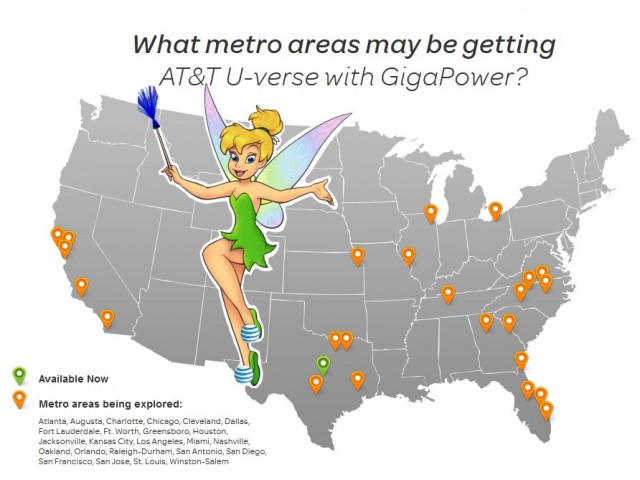

AT&T’s Magic Fiber Fairy brings fiber to you, if you approve AT&T’s business agenda.

If it wins approval from regulators to buy satellite TV provider DirecTV, AT&T says it will have enough money to afford to expand its gigabit fiber network Gigapower U-verse to an extra two million homes.

That bit of non-sequitur was the highlight of AT&T’s regulatory filing with the Securities and Exchange Commission. AT&T claims money for the fiber expansion will come from anticipated savings from programming volume discounts AT&T will get combining DirecTV’s 20.3 million customers with AT&T’s 5.7 million U-verse TV subscribers.

AT&T expects cost synergies to exceed $1.6 billion annual run-rate by three years after closing. These savings will begin in the first year after closing, ramp up over four years and grow with the addition of video subscribers thereafter. It is anticipated that at least 40% of these total synergies will be realized by year two after closing. These synergies are conservative and derived from items such as programming cost reductions, operational efficiencies and reductions in redundant broadcast infrastructure. Programming cost reductions are the most significant part of the expected cost synergies. At this time, AT&T’s U-verse content costs represent approximately 60% of its subscriber video revenues. With the scale this transaction provides, we estimate AT&T’s U-verse content costs after the completion of the transaction will be reduced by approximately 20% or more as compared with our forecasted standalone content costs.

AT&T believes that despite perennially increasing programming costs, especially for popular over-the-air and cable networks, the 20 percent of anticipated savings will give AT&T enough money to vastly expand its fiber network.

“The economics of this transaction will allow the combined company to upgrade two million additional locations to high-speed broadband with Gigapower FTTP (fiber to the premise) and expand our high-speed broadband footprint to an additional 13 million locations where AT&T will be able to offer a pay TV and high-speed broadband bundle,” AT&T wrote.

On AT&T’s budget, the company can send you this really nice star ceiling kit, but it won’t pay for gigabit broadband.

Before announcing its intent to buy DirecTV, AT&T already promised to expand Gigapower U-verse to up to 100 cities, while telling investors it anticipated flat spending on network improvements. On Tuesday, AT&T went further and dramatically cut investments in its wireline network to a level that raised concerns for the financial security of several of its vendors, including those supplying fiber optic cable and equipment.

AT&T predicted savings from the merger will amount to $1.6 billion a year, but not until three years after the merger closes. There are questions whether this amount is enough to fund the kind of fiber expansion AT&T promises.

In 2012, AT&T committed to expanding U-verse to 8.5 million more customer locations at a cost of $6 billion. That investment paid for AT&T’s less-costly fiber to the neighborhood service. Based on AT&T’s figures, the cost to deploy fiber into each neighborhood, while still utilizing existing copper wiring to bring service into each home, was $705 per home or business.

AT&T Gigapower U-verse requires AT&T to spend considerably more to extend fiber service directly to each premises it intends to serve. Google is spending approximately $4,000 to reach each home with fiber optics in Kansas City. But AT&T’s math suggests it only has to spend about $800 per home (based on the $1.6 billion savings figure it expects to begin receiving in 2017) for decommissioning the remaining copper and extending U-verse fiber for each of two million customer homes passed. What does AT&T know that Google does not?

But wait. AT&T is also committing to use that $1.6 billion to expand traditional fiber to the neighborhood U-verse to 13 million additional homes as well. That means AT&T has a budget that limits it to $106 per home for a combined 15 million new locations passed. That amount is enough for a fiber optic star ceiling kit or a really nice fiber strand light fixture, but it isn’t nearly enough to bring gigabit broadband to AT&T customers.

One thing is certain: AT&T will not be passing on any cost savings to customers in the form of lower bills. AT&T’s proposed investment is a blatant appeal to regulators with promises of broadband expansion the company has already made and shows few signs of actually delivering.

Subscribe

Subscribe

AT&T’s claim it wants to expand gigabit fiber to the home service to as many as 100 cities nationwide requires closer inspection on news this week it has slashed spending on its wireline business.

AT&T’s claim it wants to expand gigabit fiber to the home service to as many as 100 cities nationwide requires closer inspection on news this week it has slashed spending on its wireline business. CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

A residential burglar alarm in the city of Houston

A residential burglar alarm in the city of Houston