Windstream Communications lost between $3.2-5.1 million in lost profits because of a 2019 false advertising campaign run by Charter Communications in areas where the two companies compete for internet customers, claimed an expert witness in a court hearing to determine the damages Charter must pay.

Windstream Communications lost between $3.2-5.1 million in lost profits because of a 2019 false advertising campaign run by Charter Communications in areas where the two companies compete for internet customers, claimed an expert witness in a court hearing to determine the damages Charter must pay.

In December, U.S. Bankruptcy Judge Robert Drain issued a summary judgment finding Charter responsible for sending out misleading advertising fliers that violated the federal Lanham Act and false advertising laws in place in some states.

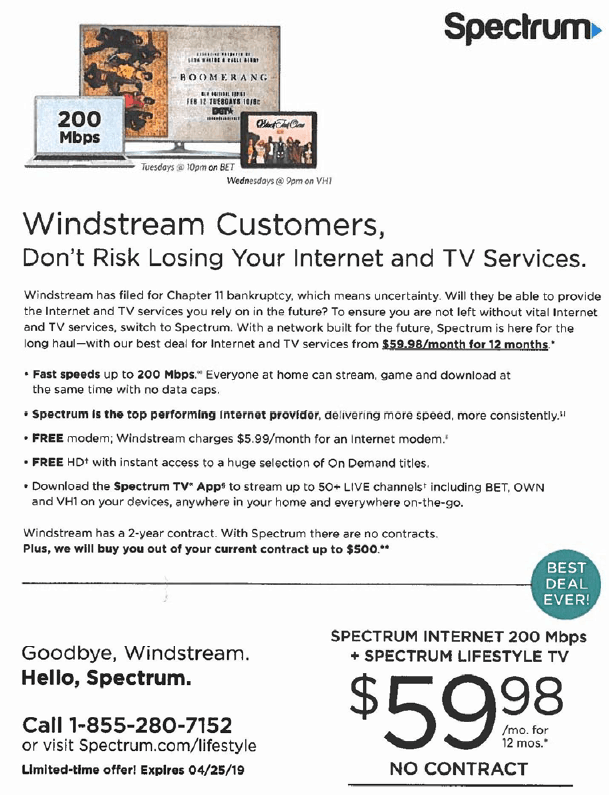

“Shortly after Windstream filed for Chapter 11 protection, Charter commenced a false and misleading advertising campaign designed to cause irreparable injury and damage to Windstream’s reputation and business,” the original lawsuit filed with the U.S. Bankruptcy Court for the Southern District of New York stated. “Charter targeted Windstream customers in Alabama, Georgia, Kentucky, Ohio, Nebraska, and North Carolina, which are several of Windstream’s top performing states.”

“On the envelopes for the advertisement, Charter intentionally utilized Windstream’s trademark and signature color pattern to mislead Windstream customers into believing that the advertisement came directly from Windstream. Indeed, Charter’s advertisement stated that it was ‘Important Information Enclosed for Windstream Customers.’”

The offending Charter flier seems to suggest Windstream is going out of business.

A later investigation found Charter sent at least 800,000 mailers to customers in service areas where Windstream competes with Spectrum.

Jeffrey Auman, executive vice president of sales and marketing at Windstream Communications, told the court last week the false ads directly harmed Windstream’s reputation with its customers, with some left believing the phone company was ceasing operations because of its bankruptcy filing. Auman argued it was fair for Charter to pay damages covering Windstream’s legal expenses to file the lawsuit and cover its advertising and promotional expenses incurred to rebut the ads and retain customers.

A company-provided expert witness testified Windstream lost customers and between $3.2 and $5.1 million in lost profits. Spectrum’s ad campaign also created long term negative “fear, uncertainty, and doubt” about Windstream’s health and ability to service customers. The witness claimed Spectrum’s fliers ended a “growth streak” for the phone company and has caused new customer projections to fall behind.

“It was a big deal with us,” Aubrey testified. “Word of mouth in these small communities means a lot.”

Windstream told Judge Drain the company has spent more than $4.3 million on service credits, promotional retention discounts, and cost-free upgrades to keep customers happy.

Charter has countered Windstream’s customer losses come from its inferior technology, which makes Windstream’s speeds slower and less competitive. Spectrum has upgraded internet customers in the midwest and parts of the southern U.S. to up to 200 Mbps for its Standard internet plan, which is much faster than what Windstream offers many of its DSL internet customers.

Subscribe

Subscribe Some Comcast customers are receiving notifications their service may be briefly interrupted as a result of ongoing network enhancements:

Some Comcast customers are receiving notifications their service may be briefly interrupted as a result of ongoing network enhancements: Comcast is currently preparing its network for full duplex DOCSIS 4.0 service by adopting “node plus zero” network architecture, which in plainer terms means removing signal amplifiers from existing lines and replacing a significant percentage of its copper coaxial cable infrastructure with fiber optics. The fiber network upgrades are reportedly bringing more consistent and faster internet speed on a more reliable network as soon as the switch is complete. Most customers won’t see fiber cables replacing the current cable line coming into their homes, however. The upgrade is mostly taking place on utility poles and, in some places, underground as Comcast replaces copper wiring with optical fiber cables.

Comcast is currently preparing its network for full duplex DOCSIS 4.0 service by adopting “node plus zero” network architecture, which in plainer terms means removing signal amplifiers from existing lines and replacing a significant percentage of its copper coaxial cable infrastructure with fiber optics. The fiber network upgrades are reportedly bringing more consistent and faster internet speed on a more reliable network as soon as the switch is complete. Most customers won’t see fiber cables replacing the current cable line coming into their homes, however. The upgrade is mostly taking place on utility poles and, in some places, underground as Comcast replaces copper wiring with optical fiber cables.

Stankey’s predecessor, Randall Stephenson, will exit as AT&T’s CEO in July. He leaves a much larger conglomerate than what he started with. AT&T has diversified from its telephone and wireless portfolio with several major acquisitions, including DirecTV — the satellite TV service, and Time Warner (Entertainment), a Hollywood studio and entertainment giant. The result is a company loaded with debt and a revolt by activist investors that question the wisdom of creating the 2010s version of AOL-Time Warner.

Stankey’s predecessor, Randall Stephenson, will exit as AT&T’s CEO in July. He leaves a much larger conglomerate than what he started with. AT&T has diversified from its telephone and wireless portfolio with several major acquisitions, including DirecTV — the satellite TV service, and Time Warner (Entertainment), a Hollywood studio and entertainment giant. The result is a company loaded with debt and a revolt by activist investors that question the wisdom of creating the 2010s version of AOL-Time Warner. Comcast today announced it will extend its COVID-19 crisis commitments until the end of June, including a continued suspension of its 1 TB data cap.

Comcast today announced it will extend its COVID-19 crisis commitments until the end of June, including a continued suspension of its 1 TB data cap. With an estimated 90,000 New Yorkers stranded without broadband service, a proposal from Charter Communications to block funding for future projects is coming under fire from a bipartisan group of rural legislators.

With an estimated 90,000 New Yorkers stranded without broadband service, a proposal from Charter Communications to block funding for future projects is coming under fire from a bipartisan group of rural legislators.