The Federal Communications Commission has quietly approved the acquisition of Alaska’s largest cable operator by John Malone’s Liberty Interactive with no deal conditions or consumer protections, despite fears the merger will lead to monopoly abuse.

The Federal Communications Commission has quietly approved the acquisition of Alaska’s largest cable operator by John Malone’s Liberty Interactive with no deal conditions or consumer protections, despite fears the merger will lead to monopoly abuse.

The purchase of Alaska’s General Communications Inc. (GCI) in an all-stock deal valued at $1.12 billion was announced in April 2017. GCI currently offers cable TV and broadband service to 108,000 customers across Alaska, and runs a wireless company.

“We conclude that granting the applications serves the public interest,” the FCC wrote. “After thoroughly reviewing the proposed transaction and the record in this proceeding, we conclude that applicants are fully qualified to transfer control of the licenses and authorizations […] and that the transaction is unlikely to result in public interest harms.”

Various groups and Alaska’s largest phone company petitioned the FCC to deny the merger, claiming GCI’s existing predatory and discriminatory business practices would “continue and worsen upon consummation of the deal.”

Malone

Those objecting to the merger claimed GCI already has monopoly control over broadband-capable middle-mile facilities in “many locations in rural Alaska” and that GCI has refused to allow other service providers wholesale access to that network on “reasonable” terms. They also claimed GCI received substantial taxpayer funds to offer service in Alaska, but in turn charges monopoly rates to schools, libraries, and rural health care providers, as well as residential customers.

Essentially quoting from Liberty’s arguments countering the accusations, the FCC completely dismissed opponents’ claims, noting that Liberty does not provide service in Alaska, meaning there are no horizontal competitive effects that would allow GCI Liberty to control access to more facilities than it does now. On the contrary, the FCC ruled, the merger with a larger company meant the acquisition was good for Alaska.

“Rather than eliminating a potential competitor from the marketplace or combining adjacent entities in a manner that increases their ability to resist third-party competition, […] [this] transaction results in GCI becoming part of a diversified parent entity that will provide more resources for its existing Alaska operations.”

The FCC also rejected claims GCI engages in monopolistic, anti-competitive behavior, ruling that past claims of charging above-market prices are “not a basis for denying the proposed transaction because the allegations are non transaction-specific.”

“Although ACS [Alaska’s largest telephone company] claims that the transaction will exacerbate the behavior it finds objectionable, we see no reason to assume that GCI will have greater ability or incentive to discriminate against rivals in Alaska simply because it has access to more financial resources,” the FCC ruled. “To the contrary, the Commission has generally found that a transaction that could result in a licensee having access to greater resources from a larger company promotes competition, potentially resulting in greater innovation and reduced prices for consumers.”

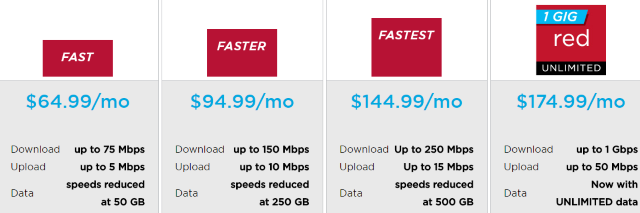

GCI’s current internet plans are considered more expensive and usage capped than other providers.

In almost every instance, the FCC order approving the merger was in full and complete agreement with the arguments raised by Liberty Interactive in favor of the deal. This also allowed the FCC to reject in full any deal conditions that would have resulted in open access to GCI’s network on fair terms and a requirement to charge public institutions the same rates GCI charges its own employees and internal businesses.

The FCC also accepted at face value Liberty’s arguments that as a larger, more diversified company, it can invest in and operate GCI more reliably than its existing owners can.

“We find that this is likely to provide some benefit to consumers,” the FCC ruled. But the agency also noted that because Liberty executives did not specify that the deal will result in specific, additional deal commitments, “the amount of anticipated service improvements that are likely to result from the […] transaction are difficult to quantify.”

The Justice Department and the Federal Trade Commission earlier approved the merger deal. Most analysts expect the new company, GCI Liberty, exists only to allow Malone to structure the merger with little or no owed tax. Most anticipate that after the merger is complete, the company will be eventually turned over to Charter Communications, where it will operate under the Spectrum brand.

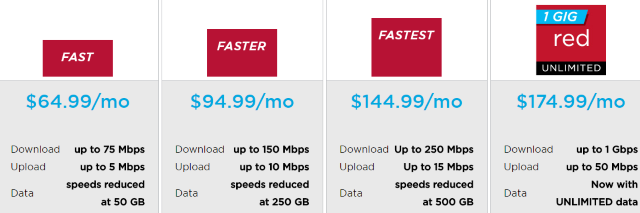

Comcast is raising broadband speeds across its expansive Central Division, which covers customers in Alabama, Arkansas, Florida, Georgia, Indiana, Illinois, Kentucky, Louisiana, Michigan, Mississippi, South Carolina, and Tennessee.

Comcast is raising broadband speeds across its expansive Central Division, which covers customers in Alabama, Arkansas, Florida, Georgia, Indiana, Illinois, Kentucky, Louisiana, Michigan, Mississippi, South Carolina, and Tennessee.

Subscribe

Subscribe Viacom and Charter Communications today announced a multi-year renewal of a carriage agreement that will bring back Viacom’s cable networks to almost all Spectrum cable television customers.

Viacom and Charter Communications today announced a multi-year renewal of a carriage agreement that will bring back Viacom’s cable networks to almost all Spectrum cable television customers. Charter indicated its agreement allows Spectrum to keep other Viacom-owned networks not mentioned above on its Silver or Gold tiers. The agreement also grants Charter customers access to Viacom networks’ on-demand programming through set-top boxes or mobile apps.

Charter indicated its agreement allows Spectrum to keep other Viacom-owned networks not mentioned above on its Silver or Gold tiers. The agreement also grants Charter customers access to Viacom networks’ on-demand programming through set-top boxes or mobile apps. The Federal Communications Commission has quietly

The Federal Communications Commission has quietly

WASHINGTON (Reuters) – U.S. antitrust regulators believe that AT&T Inc’s proposed acquisition of Time Warner Inc would raise costs for rival entertainment distributors and stifle innovation, a Department of Justice official told Reuters on Thursday.

WASHINGTON (Reuters) – U.S. antitrust regulators believe that AT&T Inc’s proposed acquisition of Time Warner Inc would raise costs for rival entertainment distributors and stifle innovation, a Department of Justice official told Reuters on Thursday.