As we approach Halloween, it’s time to share a scary story.

As we approach Halloween, it’s time to share a scary story.

The “Reverse Morris Trust” is something a majority of Americans have never heard of before, but if you are a Verizon customer and happen to live in one of 13 states where Verizon is just itching to abandon you, it’s time to learn more about this twister in the tax laws. A debt-laden phone company may haunt your future. Another is already haunting millions of New Englanders.

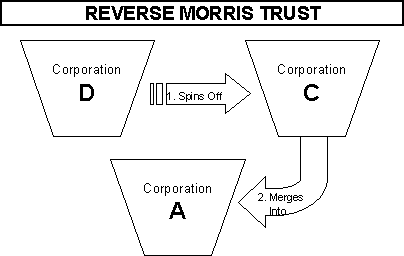

When Verizon throws telephone customers overboard to companies like FairPoint (and Frontier Communications if that deal is approved by state regulators), the company has found a great way to cash out, saddle the buyer in massive amounts of debt, and walk away without paying one cent in taxes. How?

The Reverse Morris Trust.

To be fair, Verizon is not the first company to use this tax loophole to structure mergers, acquisitions, and spinoffs. Before 1997, the use of the original Morris Trust provision was commonplace. A company would split itself into two pieces, one of which would be swapped for stock in an unrelated company. Then those shares would be redistributed, effectively transferring ownership. The tax savings were enormous. A $3 billion dollar sale would normally net the taxman nearly $1 billion in capital gains taxes. But when using the magic of the Morris Trust, the taxman got $0.00.

In 1997, Congress realized how much tax money they were losing from this loophole. They enacted Internal Revenue Code Sec. 355(e), which made these transactions taxable. Or did they?

With billions in savings now potentially gone, businesses started looking for a way around Sec. 355(e) and found one in the Reverse Morris Trust.

Follow this:

Companies involved in a Reverse Morris Trust deal don’t buy and sell from each other directly. Instead, the seller sets up a new corporation, usually referred to in company financial reports as “Spinco” and conducts the transaction through that entity.

Spinco issues stock (and why not), which is owned by a majority of the shareholders of the parent company cooking up the sale.

When Verizon cast off its New England customers into the fetid waters of FairPoint, it structured the sale as a Reverse Morris Trust. Verizon “spun off” Bell Atlantic Communications, NYNEX Long Distance, and Verizon New England assets serving Maine, New Hampshire and Vermont into Northern New England Spinco, a new corporation it created just for the deal. It needed to find a buyer smaller than itself to take advantage of the tax-free magic of the Reverse Morris Trust. It found FairPoint Communications, a tiny independent phone company based in North Carolina, dwarfed by the three New England states’ Verizon customers. Imagine living alone in a one bedroom apartment and then letting The Brady Bunch move in with you.

Spinco, by design, has an addiction to piling on debt. It’s like giving a shopaholic a wallet full of credit cards all issued by Verizon. Spinco lards itself with as much debt as it possibly can. When it’s finally teetering under the weight of as much as $1.7 billion in debt, Verizon effectively sends a bill saying “we want our money — pay us back our $1.7 billion in full.” Of course, Verizon doesn’t expect to receive the check. Instead, it demands Spinco pay a “dividend” in the form of an IOU for the entire amount.

Spinco now has a problem. Its balance sheet looks terrible. Would you buy a company that has a $1.7 billion liability on its balance sheet? FairPoint would, but of course, they knew this was part of the plan all along.

FairPoint now seeks to merge with this Spinco company that has more debt than some third world countries. State regulators announce they have to examine this deal to make sure a company like FairPoint, now proposing to take on Spinco’s debt, will be able to run the company, make investments in its upkeep and expansion, and still pay back the Bank of Verizon, or whoever else ends up owning the IOU.

FairPoint now seeks to merge with this Spinco company that has more debt than some third world countries. State regulators announce they have to examine this deal to make sure a company like FairPoint, now proposing to take on Spinco’s debt, will be able to run the company, make investments in its upkeep and expansion, and still pay back the Bank of Verizon, or whoever else ends up owning the IOU.

Regulators (foolishly) go ahead and approve the deal, and the newly merged Spinco and FairPoint issue stock to Verizon shareholders, the original owners of Spinco. Verizon also gets cash and securities. Technically, Verizon shareholders now own 60% of FairPoint. Of course, nobody says every shareholder gets an equal vote. In the end, FairPoint runs and manages the entire operation, or tries to, saddled with what is now $2.5 billion in debt and on the brink of bankruptcy.

How much did taxpayers lose from all of this? Considering the spending machine in Washington is going to get the money from somewhere (us), they are going to be looking at you and I for the estimated $700 million Verizon never had to pay in capital gains taxes.

Make your check payable to “U.S. Government” and make sure it’s in the mail by Halloween.

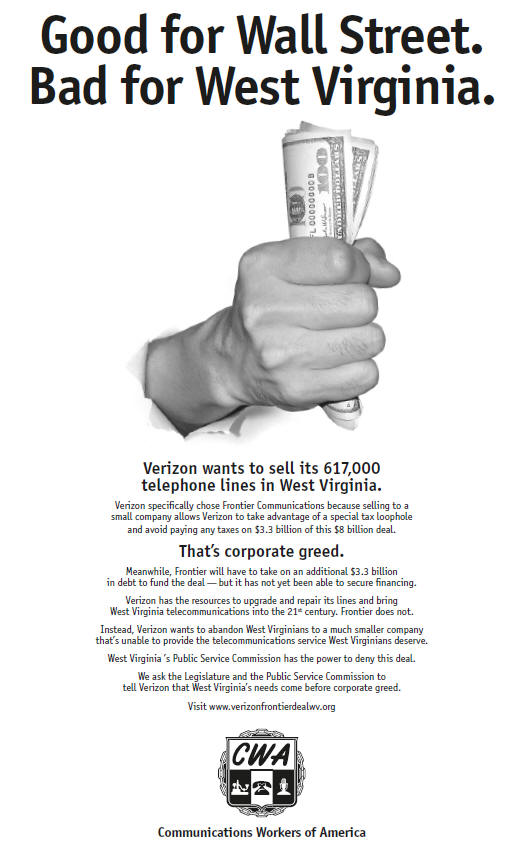

Yes, this scary story is true, and has a sequel: Frontier and Verizon plan to structure their magic deal using the same technique.

Boo! (Now add another zero on the dollar amount of your check.)

If this new deal is approved, Verizon walks away with $3.3 billion in tax-free cash. Verizon shareholders (lucky them) get to be owners of just under 70% of Frontier Communications, soon to be saddled with its own Spinco debt which will run well into the billions. Knowing this, they dump their stock in Frontier in droves as soon as the deal completes. Why hang around for another financial Titanic to sink like a rock around their portfolio?

If this new deal is approved, Verizon walks away with $3.3 billion in tax-free cash. Verizon shareholders (lucky them) get to be owners of just under 70% of Frontier Communications, soon to be saddled with its own Spinco debt which will run well into the billions. Knowing this, they dump their stock in Frontier in droves as soon as the deal completes. Why hang around for another financial Titanic to sink like a rock around their portfolio?

Verizon customers get to join the Frontier Family, and those of us who are already members get to see whether Frontier can survive the minimum monthly payment on that debt.

Or maybe not.

A large contingent of the New England Congressional delegation has written a letter to Rep. Charlie Rangel (D-NY), who chairs the Ways and Means Committee responsible for overseeing tax policy in Congress, asking that a stake be driven through the heart of the loopholes in the Reverse Morris Trust.

Reps. Michael Michaud, Chellie Pingree, Peter Welch, Paul Hodes, and Carol Shea-Porter all signed the letter asking Rangel to reform the Reverse Morris Trust (they abbreviate it “RMT”) and take it away from companies like Verizon looking for a tax-free windfall:

We projected that the transaction [FairPoint-Verizon] would have disastrous consequences in our states. Unfortunately, our concerns were well founded with widespread consumer dissatisfaction evident across the region.

Recently, we have learned that other states across the country face similar threats to service and employment as Verizon, once again, seeks to avoid taxes through the use of the RMT in its proposed transaction with Frontier Communications.

[…]

Now is the time to restrict the utility and benefits of the RMT to protect the public interest.

West Virginians, in particular, have expressed increasing concern about their state following a similar path northern New England took. Frontier would assume control over all of Verizon’s operations across the state of West Virginia.

“I hope this vital request, now based on past history, isn’t ignored again,” said Elaine Harris, International Representative with the Communications Workers of America. “West Virginia is being given the opportunity to avoid some of the pitfalls of the FairPoint disaster and it would be a real shame if we simply follow the same path and our communications operations end up in bankruptcy.”

Expect the usual Washington lobbyists to fight to preserve the loophole. Remember, in the world of Halloween telecommunications finance, tax free trick or treat candy is for closers.

Subscribe

Subscribe